Zora prices have risen 4% over the past 24 hours, driven by a small rebound in the broader cryptocurrency market.

Despite today’s price lifts, technical and on-chain measurements show that this distribution stage is playing hard, with bearish sentiment still dominating the market.

Zora’s bullish steam fades

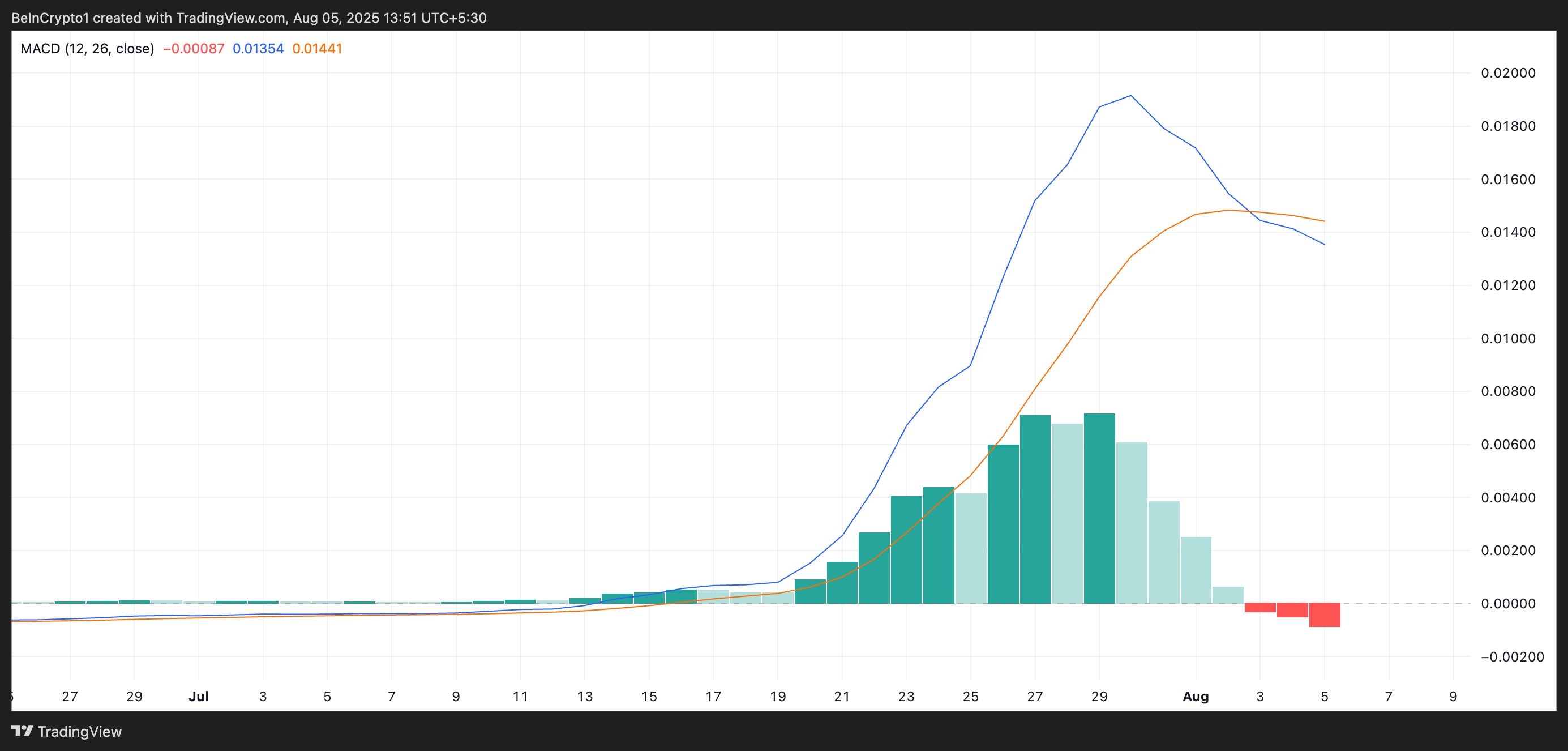

Zora/USD Daily Chart measurements reveal recent negative crossovers of Zora’s moving average convergence divergence (MACD) indicators. This occurs when the MACD line (blue) breaks below the signal line (orange).

About Token TA and Market Updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

Asset MACD indicators identify trends and momentum in price movement. This helps traders find potential purchase or sale signals through a crossover between the MACD line and the signal line.

If the MACD line is above the signal line, it shows bullish momentum, suggesting that the asset’s price could continue to rise.

Meanwhile, when the MACD line is located below the signal line and falls towards the zero mark as is now the case with Zora, it decays the momentum of obesity and the potential shift to bearish control.

Furthermore, there is no difference in the feelings between Zora’s future. This is reflected in the long/short ratio, which sits at a 14-day low of 0.92.

The long/short indicator measures the percentage of long bets on short bets in the asset futures market. A ratio of more than one indicates a longer position than a short position. This shows bullish sentiment as most traders expect their assets to rise.

On the other hand, a long/short ratio below 1 means that more traders are betting on the price of their assets to fall below those who expect it to rise.

So the current long/short ratio of Zola suggests that most traders are increasingly branching out for corrections rather than pushing to new highs.

Zora stalls in resistance – traders brace for sharp movements

At press time, Zora traded for $0.06799, just below the resistance formed at $0.06802. If the bear strengthens control and purchase collapse, the token can witness a pull towards the support floor for $0.05666.

However, if accumulation increases and Zora violates $0.6802, you could extend your profit to $0.08431.

The price of Postzola will rise, but the bear metric suggests the trap of the late buyer.