XRP has grown 5% over the last 24 hours, offering temporary relief from bear pressure that dragged prices downwards last week.

While recent increases reflect broader improvements across the crypto market, on-chain data shows that asset-specific trends could drive XRP rebounds.

XRP Sentiment shifts as futures buy pressure builds

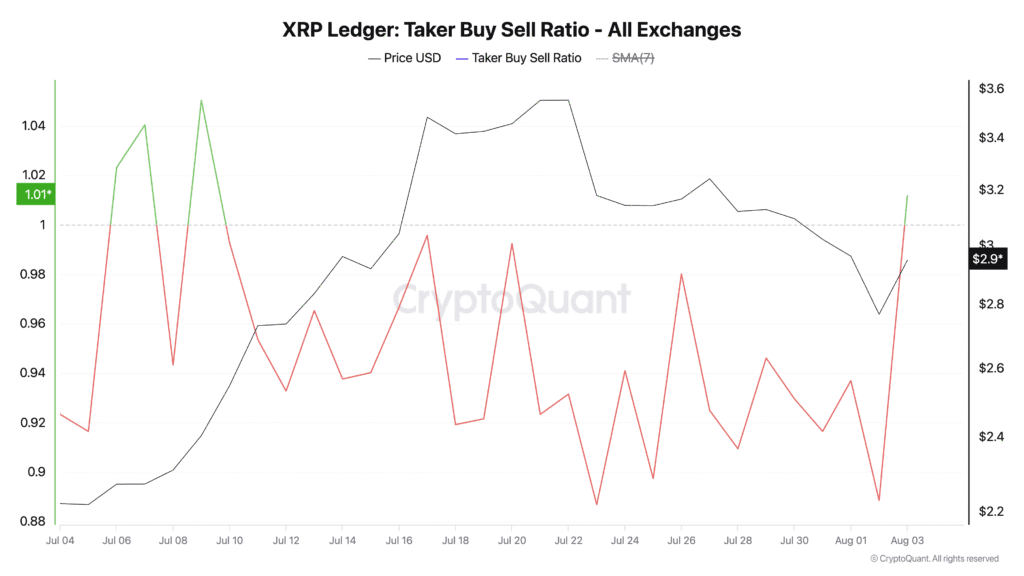

One important metric to point to this shift is the taker buy/sell rate of XRP, which was closed in the green zone yesterday. According to Cryptoquant, this is the first time the metric has closed at a positive value since July 10th, confirming the possibility of a positive change in market sentiment.

About Token TA and Market Updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

Asset taker’s shopping and sales ratio measures the ratio of trading volumes in the futures market. Values above indicate more buying than selling volume, while values below one suggest that more futures traders are selling their holdings.

The increase in XRP’s Taker Buy-to-Sales ratio indicates a slower sales pressure in the futures market. It emphasizes the weakening of bearish emotions among future participants. This is a trend that can further support XRP’s upward movement.

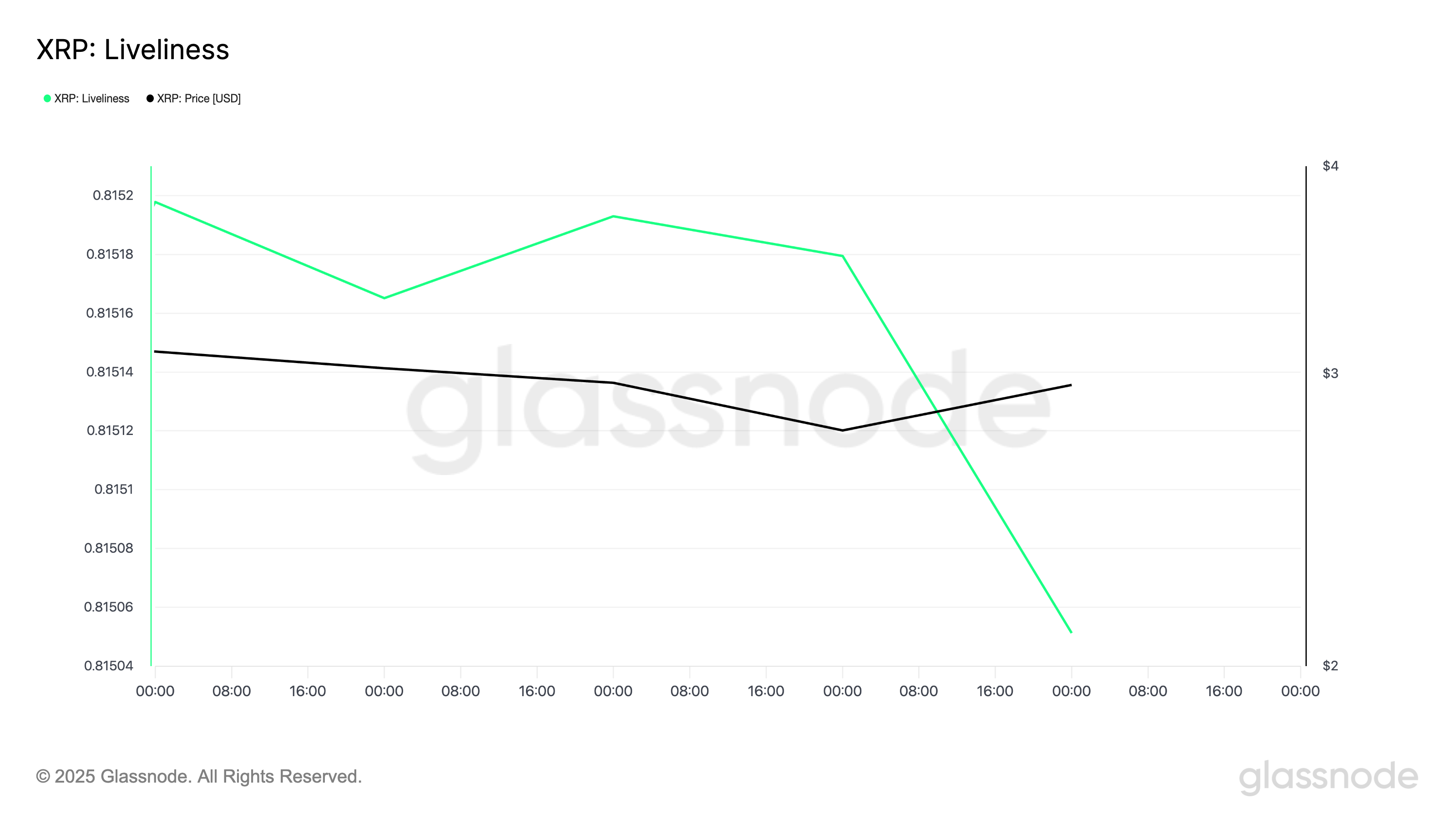

Another notable trend is the steady decline in XRP vibrancy since the beginning of August. According to GlassNode, the metric was closed at 0.8150 on August 3, falling from 0.8152 recorded on August 1.

Vitality tracks the movement of long/dormant tokens. This is done by measuring the ratio of the coin days of an asset to the total accumulated coin days. When the metric climbs, it means that LTHS is moving or selling coins.

On the other hand, if you drop like this, the keychain will return to accumulation mode after the pressurization of the seller, reducing profits.

Does resistance stop the climb or cause a fall to $2.87?

The combination of lower selling and rising futures profits could help XRP stabilize above the $3 price level in the short term. If accumulation is strengthened, Altcoin can extend its profit to $3.22. A successful violation of this barrier could open the door to the rally to $3.33.

Otherwise, the recent downward trend has resumed as Altcoin reversed its reverse profits and saw a low immersion of $2.87.

Post XRP jumps 5%. Is this the beginning of a comeback or a bouncing off a dead cat? It first appeared in Beincrypto.