Bitcoin has been struggling to maintain its upward momentum since reaching a new all-time high of $122,054 on July 14th.

This pullback has reduced the percentage of BTC’s profit supply and has waned investor confidence. As new trading months implement their courses, this trend could signal a more steep price adjustment.

Bitcoin’s profitability is low for 41 days

According to GlassNode, BTC’s profit supply rate fell to a 41-day low of 91.71% on August 1. This metric measures the percentage of the distribution supply of BTC currently held in profit. It measures market sentiment, often peaking during euphoric gatherings and falling as investor confidence wanes.

Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

If this metric falls, the increase in holders will be evenly broken or record losses. These market conditions historically match the period of market consolidation or potential price adjustments.

The recent decline to 91.71% suggests that the broader market is cooling after weeks of rising price action. It reflects a change in emotions. This is because holders rarely maintain their profits comfortably.

This could weaken short-term purchase pressure and risk BTC getting even more immersed in several trading sessions in the coming years.

Bitcoin faces critical tests as futures traders turn bearish

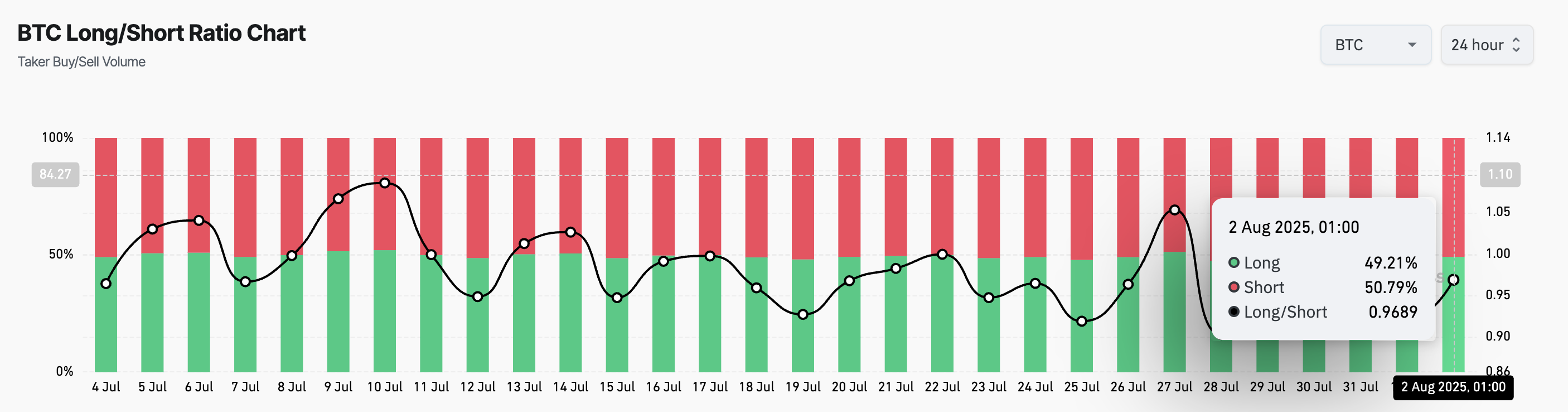

The long/short ratio of BTC is leaning towards bearish territory, confirming that bullish beliefs among leveraged traders may also be in decline. At press, this is 0.96 at less than one.

The long/short indicator measures the percentage of long bets on short bets in the asset futures market. A ratio of more than one indicates a longer position than a short position. This shows bullish sentiment as most traders expect their assets to rise.

On the other hand, a long/short ratio below 1 means that more traders are betting on the price of their assets to fall below those who expect it to rise.

With fewer traders willing to bet on a continuous basis, BTC may find it difficult to regain momentum unless fresh catalysts emerge.

Next move for Bitcoin: breakdown to $111,855 or breakouts above $120,000?

Bitcoin’s daily trading volume has fallen from its peak in July, indicating a decline in market participation. Increased profits could reduce Kingcoin to $111,855.

However, once new demand enters the market, the coin’s price could regain strength and rise to $116,952. This violation of resistance is important before the coin returns to above $120,000.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.