Hedera (HBAR) shows no signs of slowing down. Tokens are up over 92% each month, showing strong bullish momentum. But the story doesn’t end there.

Whale wallets are stacked, funding rates are stable, and price structures show room for potential breakouts. With multiple legs of support behind this move, the HBAR price could be even more ready.

Whale Wallet Surges Shows Confidence

Whale wallets continue to accumulate. Over the past week, the number of wallets holding more than 1 million HBAR has increased from 67.28% to 71.41%. Also, 10 million+HBAR wallets jumped from 86.29% to 91.62%. That’s been up over 5% in a few days.

About Token TA and Market Updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

Such a concentrated increase in whale holdings usually reflects increased confidence in short-term price behavior. It also suggests that large players are placing themselves before potential continuation rally.

Whale wallet data helps track the percentage of supply that a large wallet holds and measure accumulation pressure.

Fundraising rate spikes show aggressive long

HBAR’s open interest-weighted funding rate reached 0.057% on July 18th. As of July 21, it still sat at 0.01%, which is elevated, suggesting that the long position remains in control.

This surge in funding rates reflects HBAR’s recent price rallies, meaning leverage is in the bull’s favor. In general, rising funding rates indicate aggressive long positioning. It can continue its upward momentum, especially when backed up by a whale accumulation.

The good thing here is that the funding rate has not been overheated (despite being positive) and suggests that leveraged positions do not dominate the derivatives market. This pattern maintains the risk of long apertures for now.

When prices fall, long apertures occur when they are forced to come out with long, stacked positions, causing a cascade of liquidation that accelerates the price decline.

Funding rates reflect leverage costs for leverageding and short positions. A positive rate means that the long is paying for the shorts, suggesting bullish feelings.

HBAR price action suggests in breakout zones

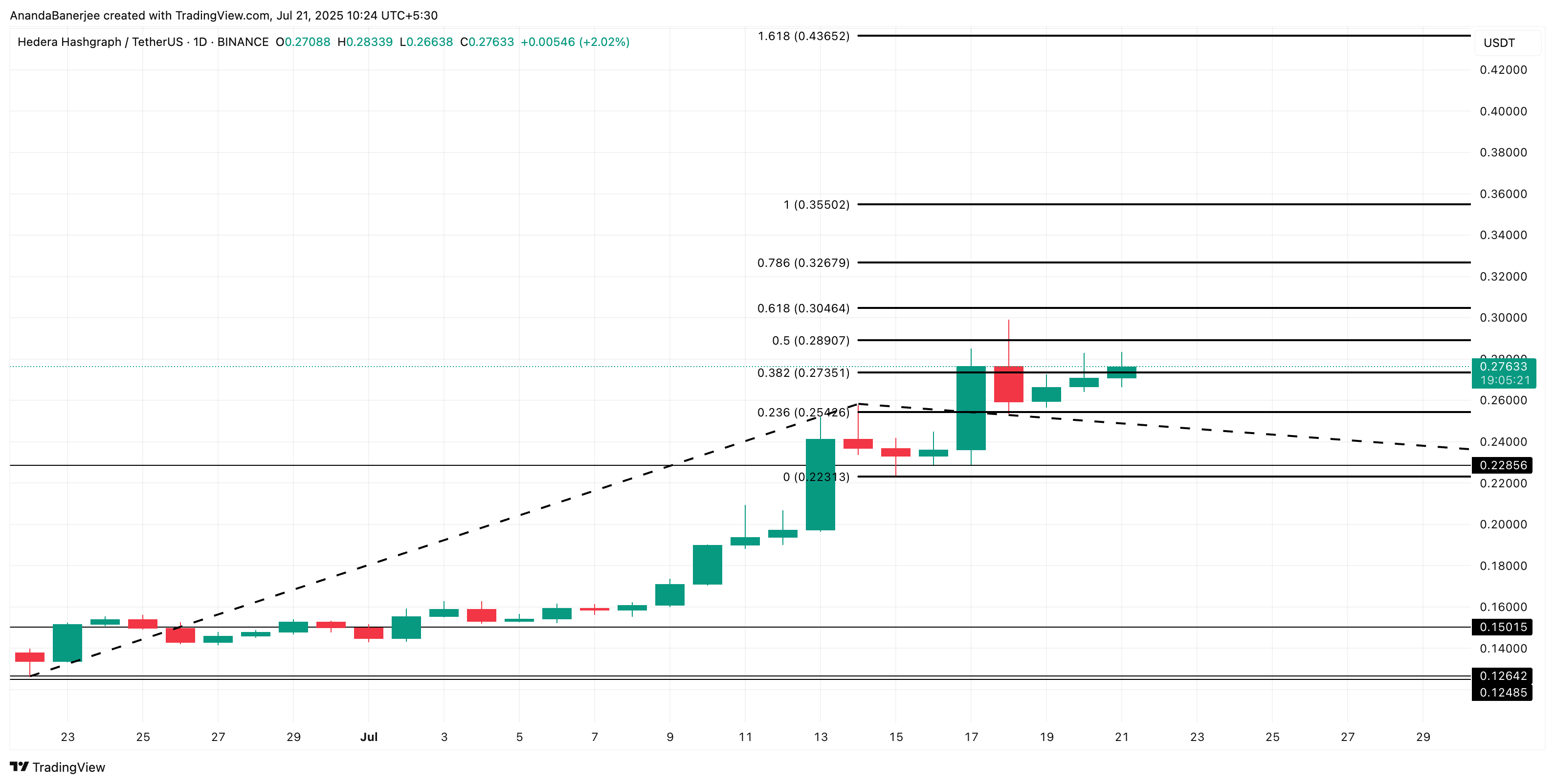

From a technical standpoint, HBAR is currently hovering the 0.382 Fibonacci expansion level at $0.27 after surpassing the 0.236 resistance or $0.25 price level. The region has served as a consolidated zone over the past few sessions, and prices have found consistent support.

If this level holds, the next resistance will be at $0.28 (0.5 FIB) and $0.30 (0.618 FIB), followed by a $0.32 (0.786 FIB) level. A confirmed breakout from FIB levels of 0.382 and 0.5 could open the HBAR price path towards 0.35+.

Fibonacci extension levels are used to identify potential targets or resistance zones by taking advantage of previous impulse movements and subsequent price retardation. In this price list, the $0.22 level will be used as the retracement zone as the current swing is still under development.

As $0.25 serves as one of the most powerful support levels, the dip below that could negate bullish trends for now. Also, if HBAR prices fall below $0.22, the short-term trend may not remain bullish anymore.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.