The popular Altcoin Solana has been struggling to maintain its upward momentum since it rose to a $206 cycle high on July 22nd. Over the past week alone, assets have fallen 14%, reflecting a decline in short-term investors’ trust.

However, on-chain data suggests that the coin may witness a short-term recovery, with early indications pointing to emotional changes that could drive rebound in the previous session.

Long-term holders are doubling Solana

Short-term traders are offloading their holdings, while long-term holders (LTH) are re-entering their accumulation mode. This behavioral change is evident in the vibrancy of Solana, which has been steadily decreasing since July 25th.

With each GlassNode, this metric tracks the movement of previously dormant tokens plummeted to a low of 0.76 each week yesterday, confirming a decline in sales between Sol’s LTHS.

Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

Vibration tracks long token movements by calculating the ratio of total coin days accumulated by calculating the ratio of destroyed coin days. When it rises, it suggests that more dormant tokens are being moved or sold, and in many cases it will inform you that you will receive benefits from LTHS.

Convergently, like Sol, when this metric drops, it indicates that these investors are choosing to move their assets off the exchange and hold them.

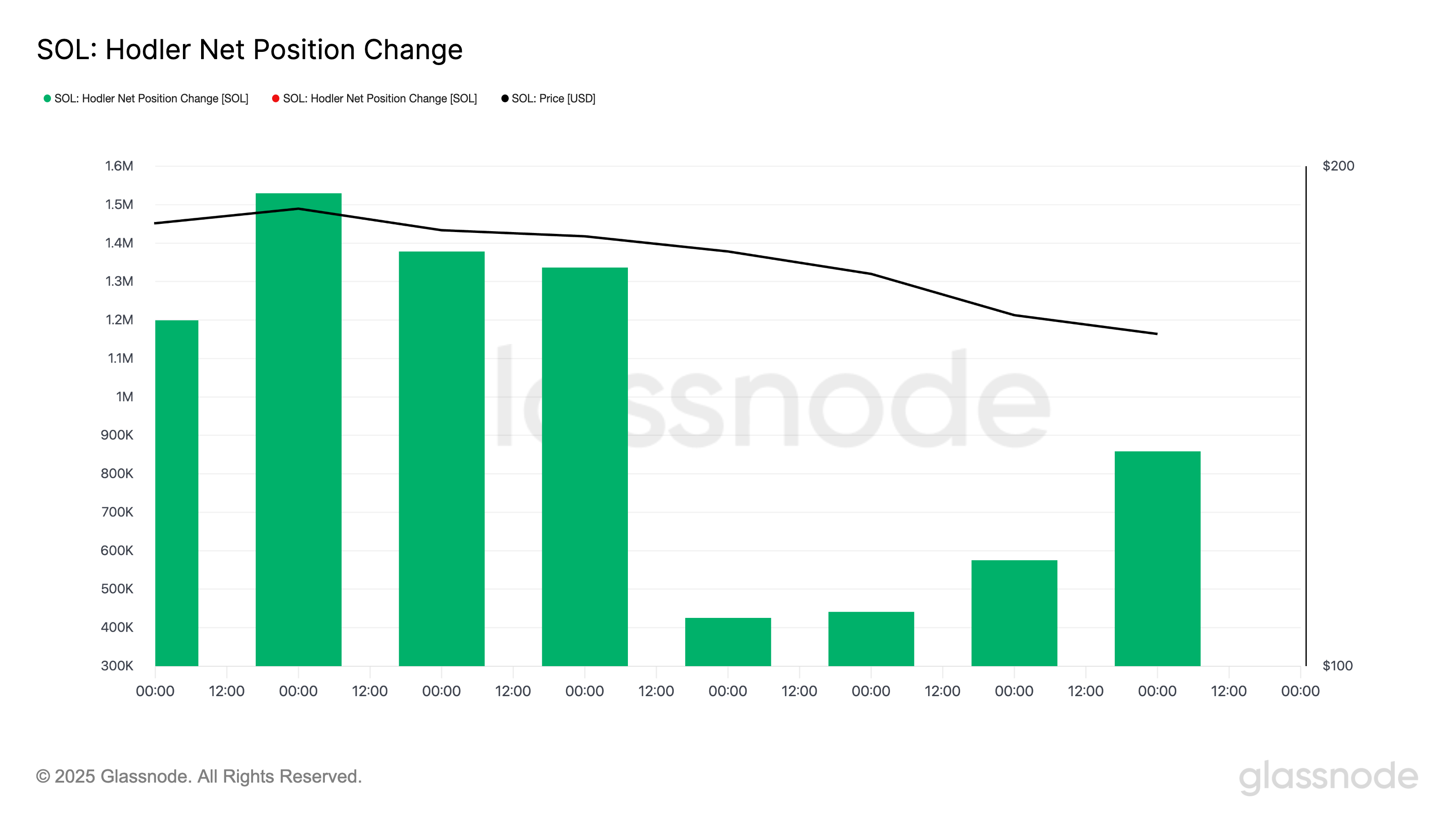

Additionally, since July 30th, Sol’s Hodler Net Position Change has recorded a steady increase. This confirms that more coins are being moved to long term storage despite the insufficient price of the asset.

GlassNode data shows that this metric, which measures 30-day changes in supply held by LTHS, has risen 102% over the past four days. When this metric rises like this, it shows that LTHS is accumulating more coins rather than selling.

Solana Traders are at a loss – the bottom is finally forming?

The sustained decline in SOL’s realized profit/loss ratio supports the bullish outlook mentioned above. On-chain data shows that the metric was closed on August 2 at a 30-day low of 0.15, indicating that many traders leaving their positions continue to be at a loss.

Historically, the market has tended to be stable when most participants fall below the cost base.

Open up how SOL finds a local bottom before bullish catalysts that can cause bullish catalysts that can cause rebounds as fewer holders lose tokens and are willing to offload.

Solana hangs in balance – serious tests supporting $158 face

The Sol trades at $160.55 at press and is held on top of the key support floor at $158.80. As buy-side pressure rises, Sol could begin a bullish reversal and a trend towards $176.33.

However, if sell-off continues and the support floor becomes weaker, the price of Sol could drop to $145.90.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.