Bitcoin Magazine

Why liquidity is more important than ever for Bitcoin

Global liquidity is one of the cornerstone indicators used to assess macroeconomic conditions, and has been used in particular when predicting the price trajectory of Bitcoin. As liquidity increases, so does capital flow into risk-on assets such as Bitcoin. However, in this evolving market situation, more responsive and perhaps even more accurate metrics are emerging.

Global M2

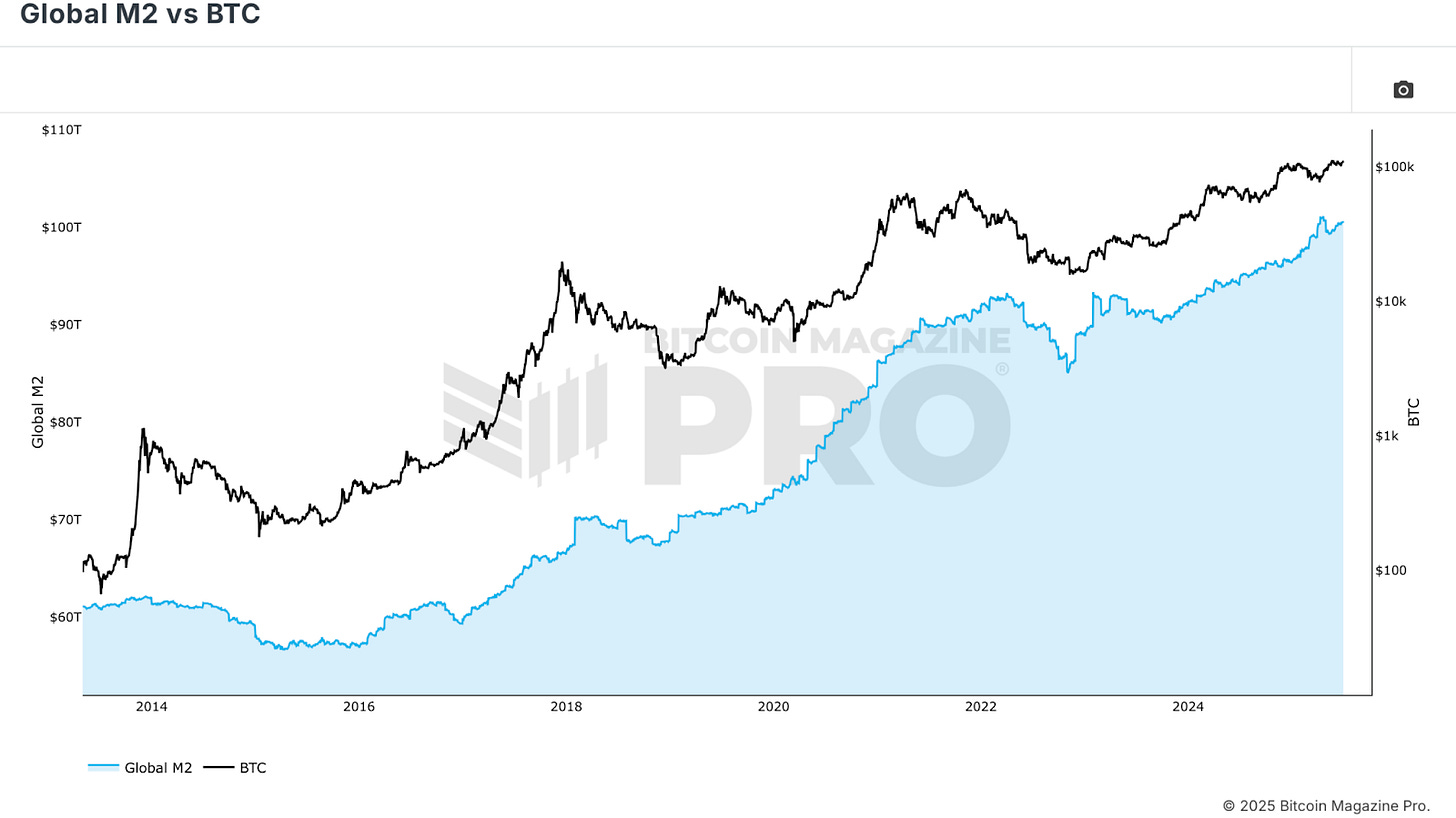

Let’s start with the Global M2 vs BTC chart. This is one of the most shared and analyzed charts in Bitcoin Magazine Pro throughout the current Bull Cycle, and for good reason. The M2 supply includes all the physical currencies and almost money assets in the economy. Globally consolidated across major economies, it draws a clear picture of fiscal stimulus and central bank actions.

Historically, major expansions of the M2, particularly those driven by money printing and financial intervention, have coincided with the explosive Bitcoin rallies. The 2020 Bull Run was an example of a textbook. Trillions of stimuli have flooded the global economy, with Bitcoin exceeding thousands to $60,000. A similar pattern occurred between 2016 and 2017, and conversely, periods such as 2018-2019 and 2022 made M2 contractions consistent along the BTC bare market.

Stronger correlation

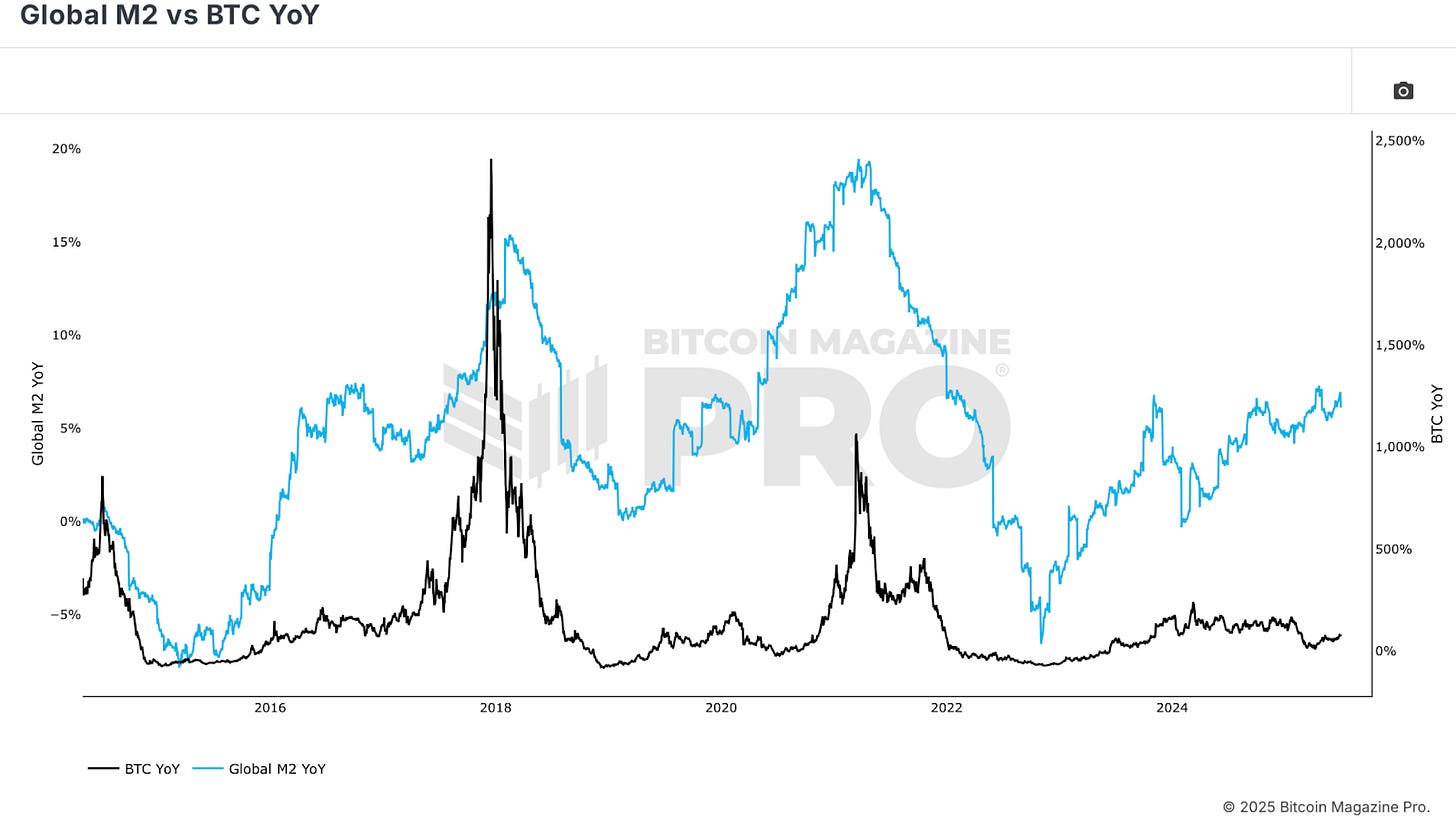

However, while the RAW M2 chart is convincing, viewing the year-over-year global M2 vs BTC provides a more practical view. The basic M2 is almost always supplying upward trend, as the government tends to print money at all times. But the speed of acceleration or deceleration is another story. As the growth rate of M2 increases from the previous year, Bitcoin tends to collect. Bitcoin usually struggles when it drops or becomes negative. This trend underscores the deep connection between widening Fiat liquidity and Bitcoin bullishness, despite the short-term noise.

But attention is being paid. M2 data is slow. It takes time to collect, update and reflect the entire economy. And the impact of increased liquidity will not immediately be on Bitcoin. Initially, new liquidity flows into safer assets such as bonds, gold, and then stocks, and then the height of speculative assets such as BTC. This delay is essential for timing strategies. You can add delays to this data, but the points remain.

stablecoins

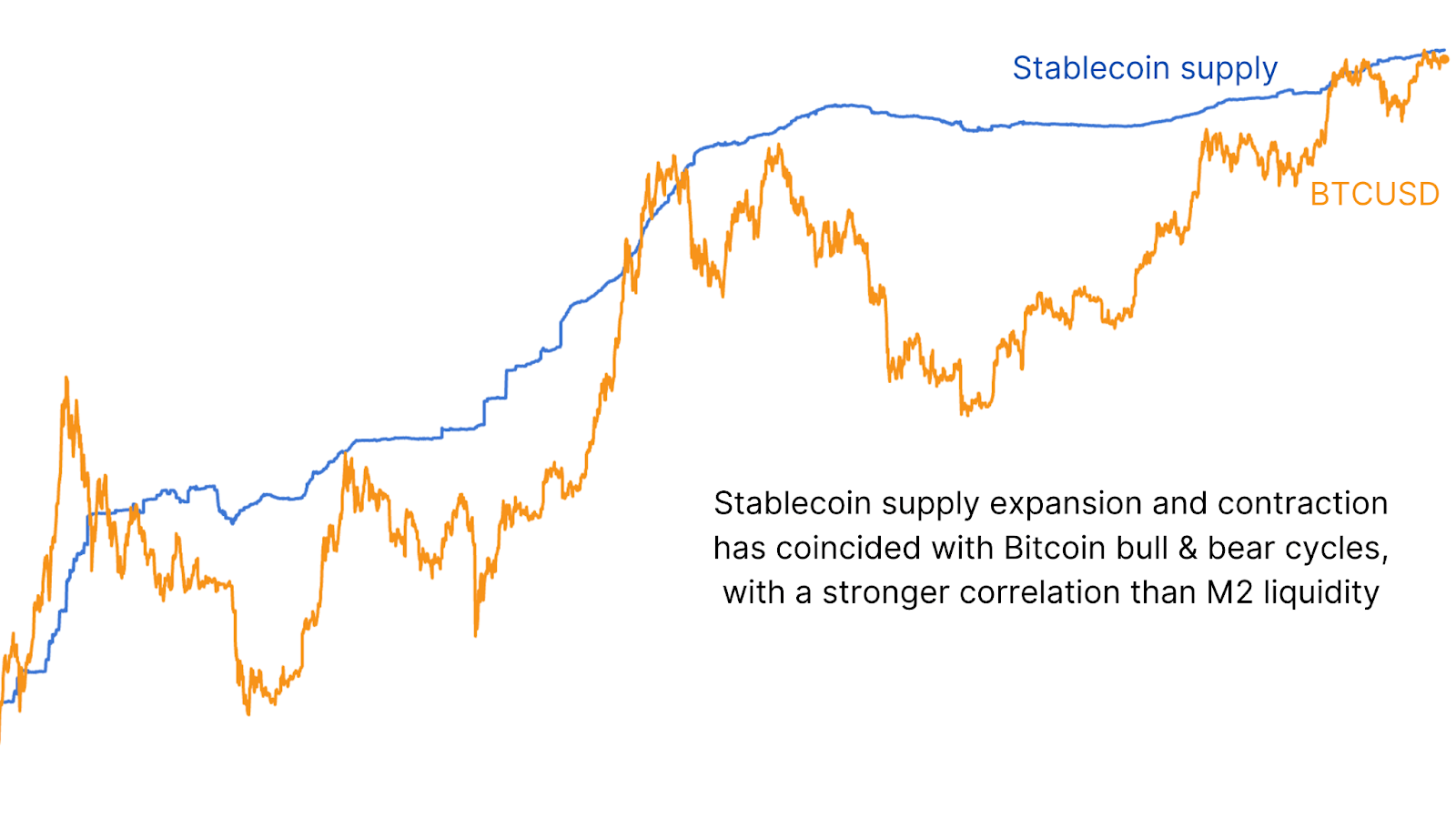

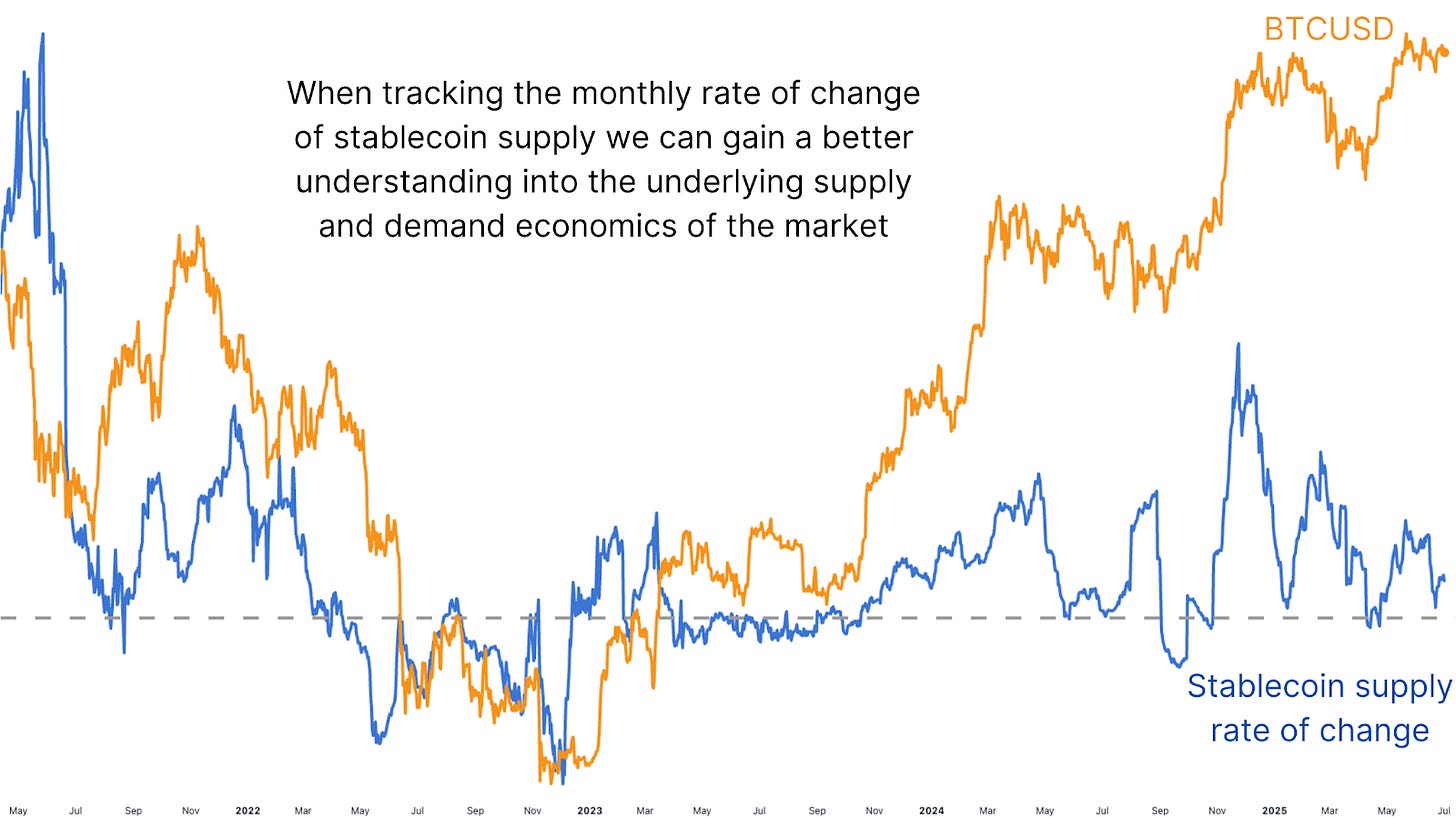

To address this latency, pivot to the liquidity of Stablecoin, a more timely and encryption native metric: Comparing BTC with the supply of major stub coins (USDT, USDC, DAI, etc.) reveals even stronger correlations than M2.

Currently, just tracking the raw value of Stablecoin Supply is worth some degree, but to truly gain an advantage, we look at the rate of change on a rolling basis, especially on a 28-day (monthly) day. This change in supply is a very indication of short-term liquidity trends. When the rate is positive, it often marks the beginning of a new BTC accumulation phase. When it suddenly becomes negative, it coincides with the local top and retracement.

Looking back at the tail end in 2024, Stablecoin’s growth surged, causing BTC to surge from long-term integration to new highs. Similarly, a sudden negative turn of growth in Stablecoin supply took place prior to a major drawdown of 30% earlier this year. These movements were tracked through this metric until that day. More recent rebounds from Stablecoin Supply are beginning to show early signs of potential bounces in BTC prices, suggesting a new influx into the crypto market.

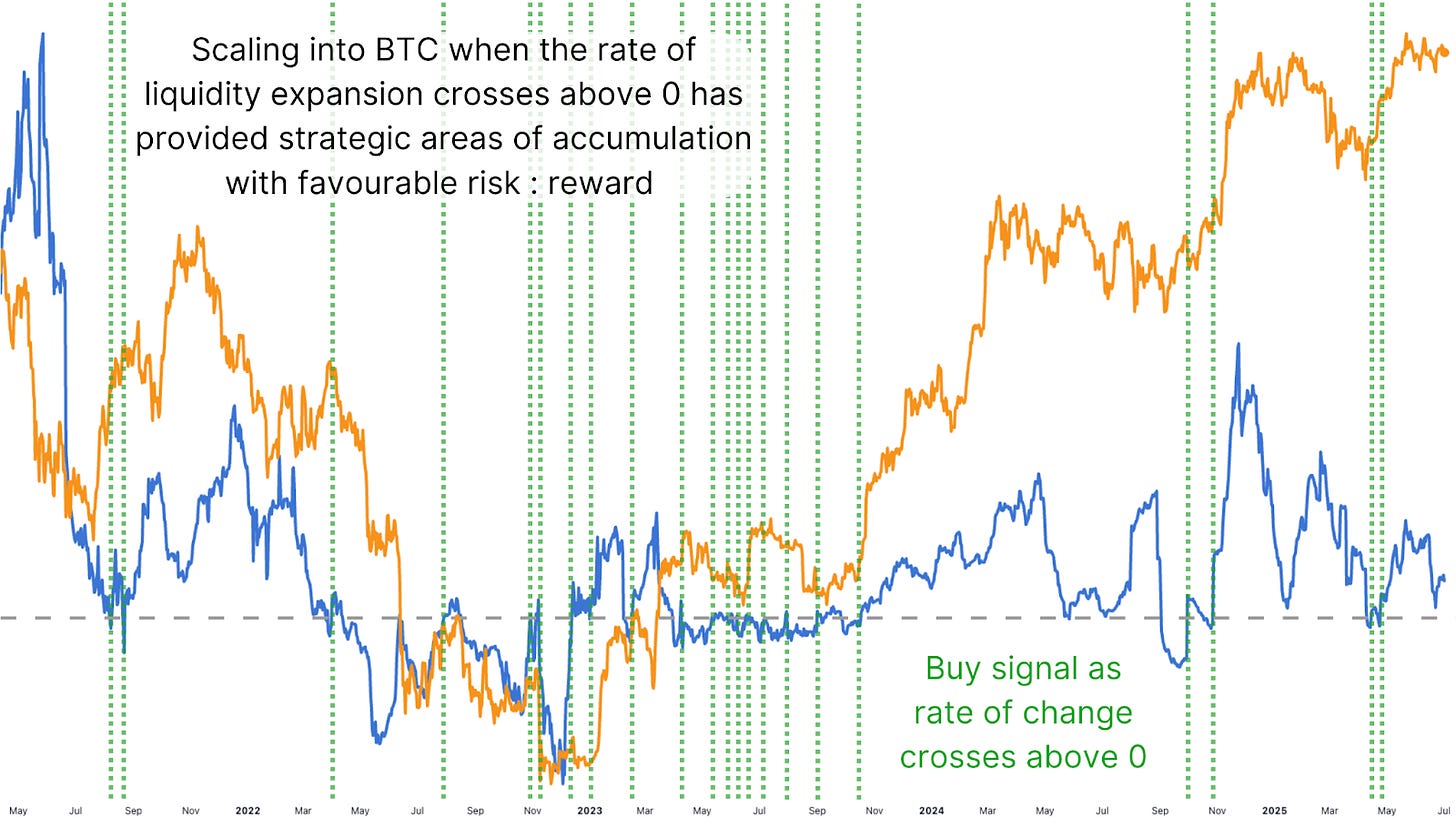

Figure 5: In the past, indicators triggered by liquidity rates above zero were reliable purchase signals.

The values in this data are not new. Crypto veterans remember the Tether Printer account on Twitter dating back to 2017, looking at all USDT mint as a Bitcoin pump signal. The difference is that this can be measured more accurately, in real time, and by adding additional rate of change analysis. What makes this even more powerful is the intracicle and intraday tracking features. Unlike the rarely updated global M2 chart, Stablecoin liquidity data can be used live and in short time frames. Tracking positive changes in this change can provide a great accumulation opportunity.

Conclusion

Global M2 growth is consistent with the long-term Bitcoin trend, but the metrics of stable rate of change provide clarity in the cycle positioning. Deserves a spot in all analyst toolkits. Considering using simple strategies such as looking for crossovers above zero with a 28-day rate of change for accumulation and scaling when extreme spikes occur will work very well and may continue to do so.

Have you noticed the dynamics of Bitcoin’s price in this deep dive? For more expert market insights and analysis, subscribe to Bitcoin Magazine Pro on YouTube!

Have you noticed the dynamics of Bitcoin’s price in this deep dive? For more expert market insights and analysis, subscribe to Bitcoin Magazine Pro on YouTube!

For more in-depth research, technical metrics, real-time market alerts, and access to expert analytics, visit bitcoinmagazinepro.com.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making an investment decision.

This post Why liquidity is more important than ever for Bitcoin is the first to appear in Bitcoin magazine and is written by Matt Crosby.

Source: https://bitcoinmagazine.com/markets/why-liquidity-matters-for-bitcoin