One day before the US CPI print, the Crypto whales show clear positioning. Bitcoin stays close to high prices, but the one that’s attracting attention from the top wallet is the mid-cap altcoin.

For the past seven days, tokens such as 1 inch (1 inch), ChainLink (link), and Curve (CRV) have seen fresh accumulation visible through holder balance spikes and small exchange spills. Let’s take a closer look at where the money is heading and what it means.

Over the past 24 hours, 1-inch whale holdings rose 5.65%, pushing the total balance held by these wallets to 9.56 million tokens. At the same time, the top 100 addresses still hold about 1.26 billion inch, but their share is slightly immersed, suggesting a redistribution rather than an exit.

The balance chart shows a steady lift from around noon on July 14th, showing new demand while token prices hover between $0.32 and $0.33. On the other hand, smart money and exchange balances are barely moving, suggesting that the action is primarily a large wallet accumulation.

Despite a 5.65% spike in whale holdings, it is suggested that the price of one inch could be soaked nearly a day a day, and could be located earlier than expected on-chain volume spikes rather than chasing short-term profits.

Crypto whales may be spinning to an inch as CPIs drop and risk-on sentiment returns, and DEX activity spikes when trading volumes on the chain increases.

ChainLink

Since July 10, Link has increased its whale holdings by 6.19% and is currently sitting at 2.84 million tokens. The most notable surge occurred between July 11th and 12th, with a visible balance just before token prices reached local highs of nearly $16.

Currently, the top 100 addresses have risen slightly at the beginning of the week to hold 654.73 million links. Exchange balance has dropped by 1.51%, supporting the view that links are moving to independent wallets and cold wallets. Link prices have skyrocketed almost 18% over the past week. This indicates that crypto whales are accumulating.

This suggests a new optimism.

Curve Dao (CRV)

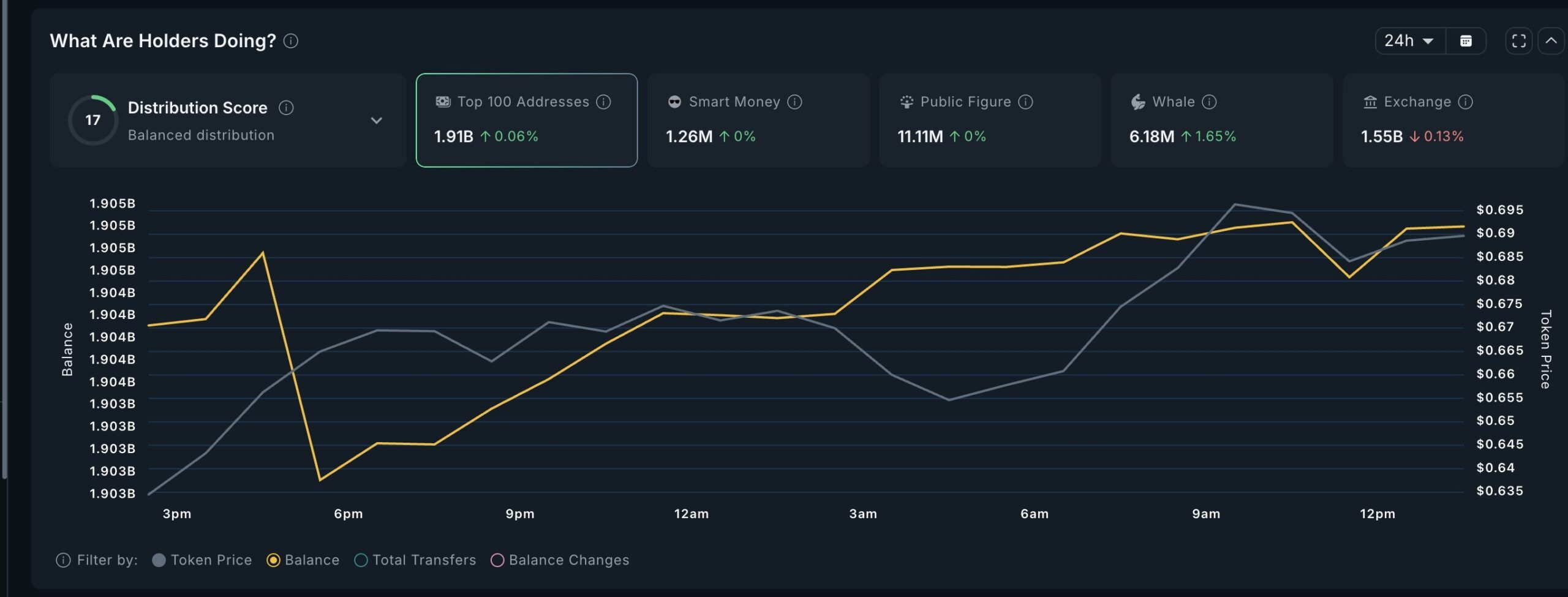

CRV’s Cryptographic Whale Wallet added 1.65% more tokens, bringing its total holdings to 6.18 million. The shifts are small, but the patterns have been consistent over the past 24 hours. The yellow balance line indicates that you will climb steadily all night long until the morning of July 14th.

The top 100 wallet holdings have increased by 0.06%, suggesting that large holders are gradually re-accumulating. The price of the CRV rose to $0.69, a nearly 7% increase per day, in line with the whale accumulation pattern.

Curve specializes in Stablecoin Swaps, offering lower prices and deeper liquidity. A characteristic that attracts big money by looking for hedges when inflation data deadlines, like US CPI releases.

Honorary mention: SPX6900 (SPX)

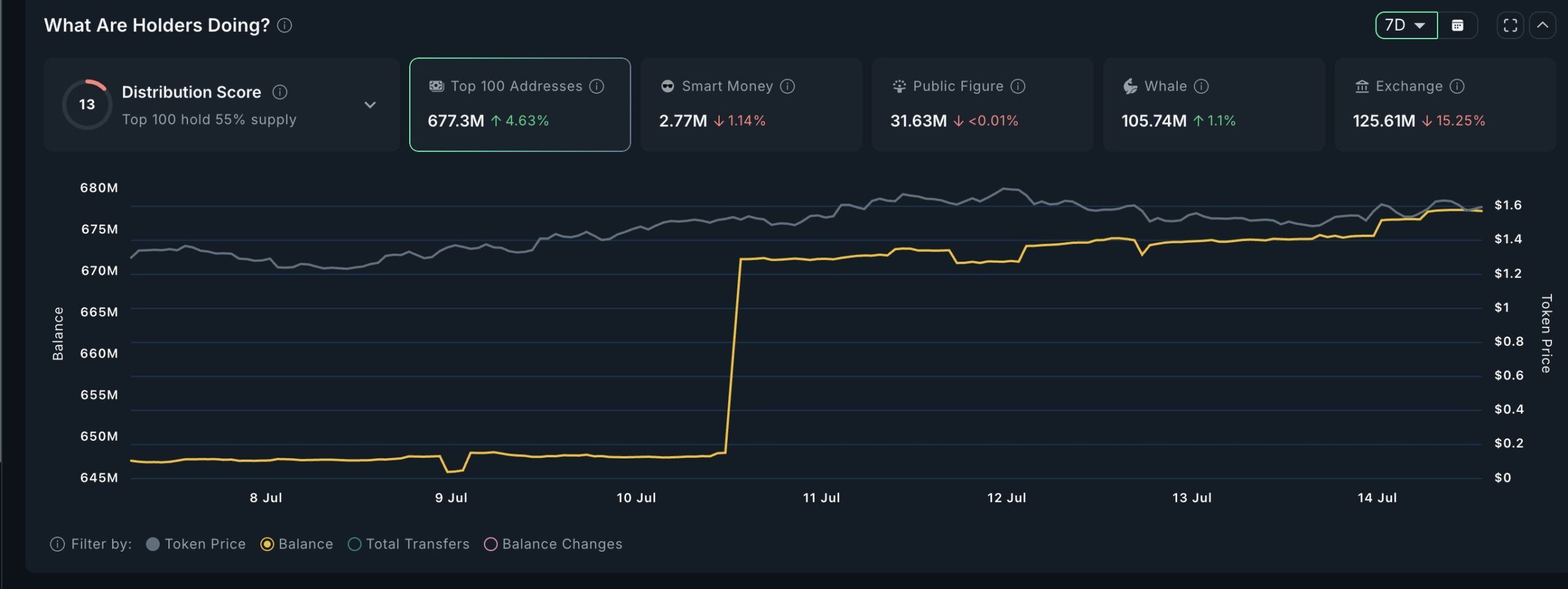

The SPX6900 token, often considered a sector index for meme coins, showed a 1.1% rise in Crypto Whale Holdings, with the top 100 wallets adding 4.63% more tokens this week. The scale is smaller compared to the others, but the flow of direction adds weight to the broader meme coin spin story.

Token prices approach $1.60, with the inflow pattern from July 10th to 13th showing adjusted entry points.

Even with CPI-driven attention, this quiet rise in SPX suggests that some traders are still betting on the Meme Coin supercycle, especially if inflation data prefers risk-on sentiment.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.