Virtuals Protocol (Virtual) is a trending token for Coingecko after posting notable profits over the day and last month.

But my mind goes wild amid concerns that whale control, weak foundations, and AI hype could fuel volatile gatherings.

Virtual Whale Holding Raises Red Flag

Virtual is a burgeoning AI theme token that surged nearly 300% in May, earning 46% in the last 24 hours alone. Coingecko’s trending data shows that it was trading at $2.13 at the time of writing.

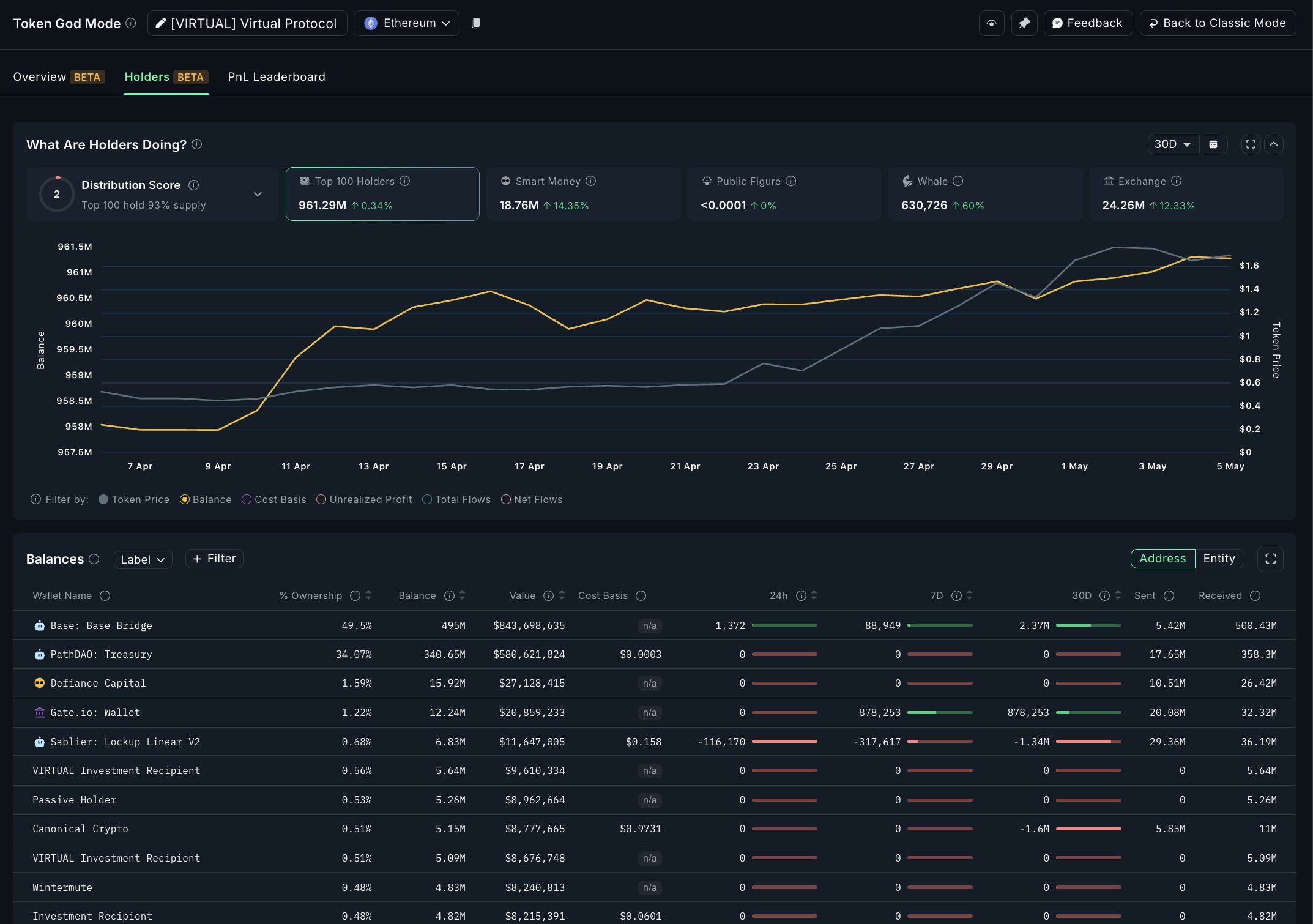

But there’s a nasty focus behind meteor price action. According to blockchain analytics company Nansen, the top 100 wallets currently hold 93% of Virtual’s total supply.

“This isn’t just a focus — vacuum dense…and Smart Money Holdings?

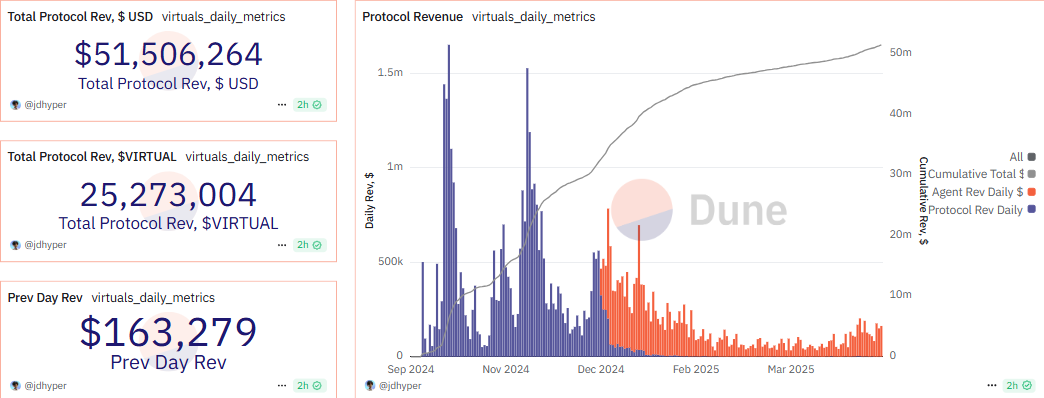

Despite the hype, trading revenue from Virtual’s underlying protocol tells a different story. Revenue peaked at just $163,279 on Thursday, according to Dune Analytics. This is relatively low for tokens that have exceeded 300% in the last 30 days.

The sudden disconnect between price increases and actual revenue generation has sparked concerns about sustainability, particularly as a small number of large holders dominate the supply.

“Virtuals prices have been pumped three times since April 20th, and the protocol revenues look like this,” one user said.

Based on X’s sentiment, speculative interest in the virtual protocol AI agent platform could affect virtual prices spikes. Some analysts have been called the “second wave” of decentralized AI, with Crypto analyst Hitesh Malviya explaining the growing traction in the protocol.

“There’s a second wave of AI agents here, and it’s happening in a new form of Virtuals Protocol. A better lineup of agents, a fair launch mechanism, and a new mechanism called Virgin Points,” Malviya said.

Virgin Points create fresh demand for virtual tokens

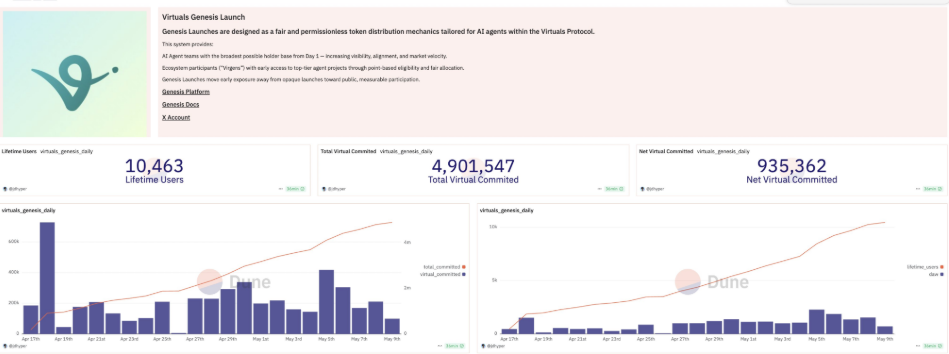

Virgin Points is a new loyalty-based allocation system that allows retail users to access early stage token launches. These points allow users to pledge tokens in exchange for cap allocations, creating a theoretically more equitable participation.

“By exchanging binding curves, we use contributing system proofs to reward users based on participation in the ecosystem via Virgen points and $virtual tokens. It promoted critical user engagement with 8,300 unique addresses and 18,900 transactions recorded by early May, peaking at 2,274 transactions on May 5th.

According to Dune data, more than 4.9 million virtual tokens have been committed by over 10,000 participants across these launches. The data also shows the average daily commitment of 250,000 tokens. This mechanism appears to create new demand for virtual ones.

“Recently, virtual prices have seen new demand for tokens. Token prices have risen 3.7 times higher in the last 30 days,” Malviya added.

However, the combination of whale control, lukewarm revenues, and sudden price increases raises questions about the long-term viability of token valuations.

The increase in smart money activity is noteworthy, but it can easily represent opportunistic speculation rather than deep beliefs.

Virtual’s Rally coincides with Altcoins’ wider rebound amid improved market sentiment. However, tokens can face increased volatility due to such strictly held supply and the use of relatively low protocols. This is especially true when larger holders become profitable.

The story of AI innovation and decentralized participation is compelling, but the data behind Virtual’s Meteoric Rise calls for attention.

As attention intensifies, we will test in the coming weeks whether this price surge reflects actual utility or just another speculative bubble.

Disclaimer

In compliance with Trust Project guidelines, Beincrypto is committed to reporting without bias and transparent. This news article is intended to provide accurate and timely information. However, we recommend that readers independently verify the facts and consult with experts before making decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.