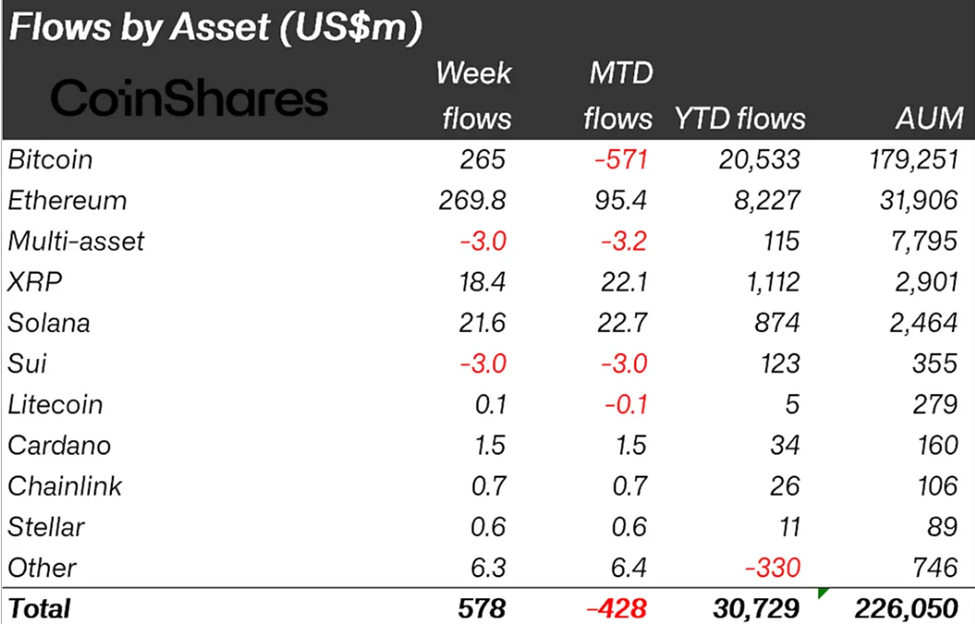

Crypto Inflows overturned trends seen in the week ending August 2nd, reaching $578 million last week. But while Ethereum was the former Spearhead, Bitcoin is steadily catching up.

Trump’s recent move to include code in the US 401(k) was the main cause of the reversal seen within a week.

How Trump ignited mid-week recovery due to a code influx

In the week ending August 2nd, the code influx reached $223 million, showing significant contraction after the $2 billion seen the previous week.

But Trump’s recent move to Crypto fall into the US 401(k) has affected emotional reversal, pushing the influx to $578 million.

“Sorry bullish for the cryptography!” said Crypto analyst Lark Davis in X.

This points to hype around inclusion that outweighs negative feelings from FOMC and macroeconomic distress. The US was at the forefront of the majority of crypto influx last week.

“After an early leak of US$1 billion to weak US pay data, after a government 401(k) crypto approval, the inflow was rebounded to $1.57 billion, reading an excerpt from the latest Coinshares report.

In particular, Trump’s orders overturned the leak of code. This reached $1 billion mid-week amid concerns from negative economic signals in the US.

James Butterfill, research director at Coinshares, explains that Crypto Markets recorded a positive flow of $1.57 billion later in the week after allowing digital assets on its 401(k) retirement plan.

However, the amount of Crypto ETFs (Exchange-Traded Funds) remained 23% lower than the previous month due to quiet summer months.

Bitcoin is sneaking up with Ethereum lead

Meanwhile, Ethereum has maintained a greater lead than Bitcoin over the past few weeks in an Altcoin-led rally. As reported by Beincrypto, Ethereum recently pushed the crypto influx to a record weekly high of $4.39 billion.

But in Trump’s code push, Bitcoin is catching up. Ethereum-related crypto influx reached $269.8 million, while Bitcoin was $265 million in nearly two seconds.

This is a significant shift from a positive flow of $133.9 million to Ethereum and a $404 million outflow from Bitcoin investment products the previous week.

“Bitcoin saw a recovery after two consecutive weeks of leaks,” writes Batafil.

Against this background, JAN3 CEO Samson Mow says that most ETH holders have acquired a lot of Bitcoin during their first coin product (ICO) or insider allocation.

The JAN3 executive says these ICO investors are riding on the story of the Ethereum financing company by converting this into Ethereum and pushing prices up.

According to MOW, these investors will return the funds to Bitcoin if the price of Ethereum exceeds a certain level.

In line with Mow’s perspective, Bitcoin pioneer Davinci Jeremie tells his followers not to spare just one dollar to buy Bitcoin, urging investors not to sell Bitcoin for Ethereum.

Disclaimer

In compliance with Trust Project guidelines, Beincrypto is committed to reporting without bias and transparent. This news article is intended to provide accurate and timely information. However, we recommend that readers independently verify the facts and consult with experts before making decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.