Stellar (XLM) prices showed early signs of a comeback this month, but prices have fallen by more than 4% in the last 24 hours. After a robust 53% gain in July, the XLM was beginning to look unstable, with one important technical signal flashing warning that another dip could be on the card.

Looking at the shorter time frames, investor positioning and price levels, you can read early on whether this weekly downtrend has more room for driving.

The 2-hour chart flashes bear signals. Netflows checks it

Understanding whether this weakness is rapid flooding or the beginning of a larger revision is worth examining the short-term time frame. On the two-hour chart, the exponential moving average (EMA) or red lines around 20 were crossed under the 50-cycle EMA (orange line), a set-up called the “Death Crossover.” This usually indicates a boost from short-term sellers.

About Token TA and Market Updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

An EMA crossover occurs when one moving average line crosses another line on the chart. A short-term EMA (such as 20 periods) crossing below the long-term EMA (such as 50 periods) means that short-term sales may be recovering.

Backing up this is a shift in the net exchange flow. Netflows have been slightly negative over the past two weeks. In other words, more tokens were leaving the exchange than they had entered. However, this week the flow finally turned upside down in a cheerful way (although just a small green spot). It’s a red flag, as it often means the holder is preparing for sale.

Bearish momentum is being built, and market bias supports it

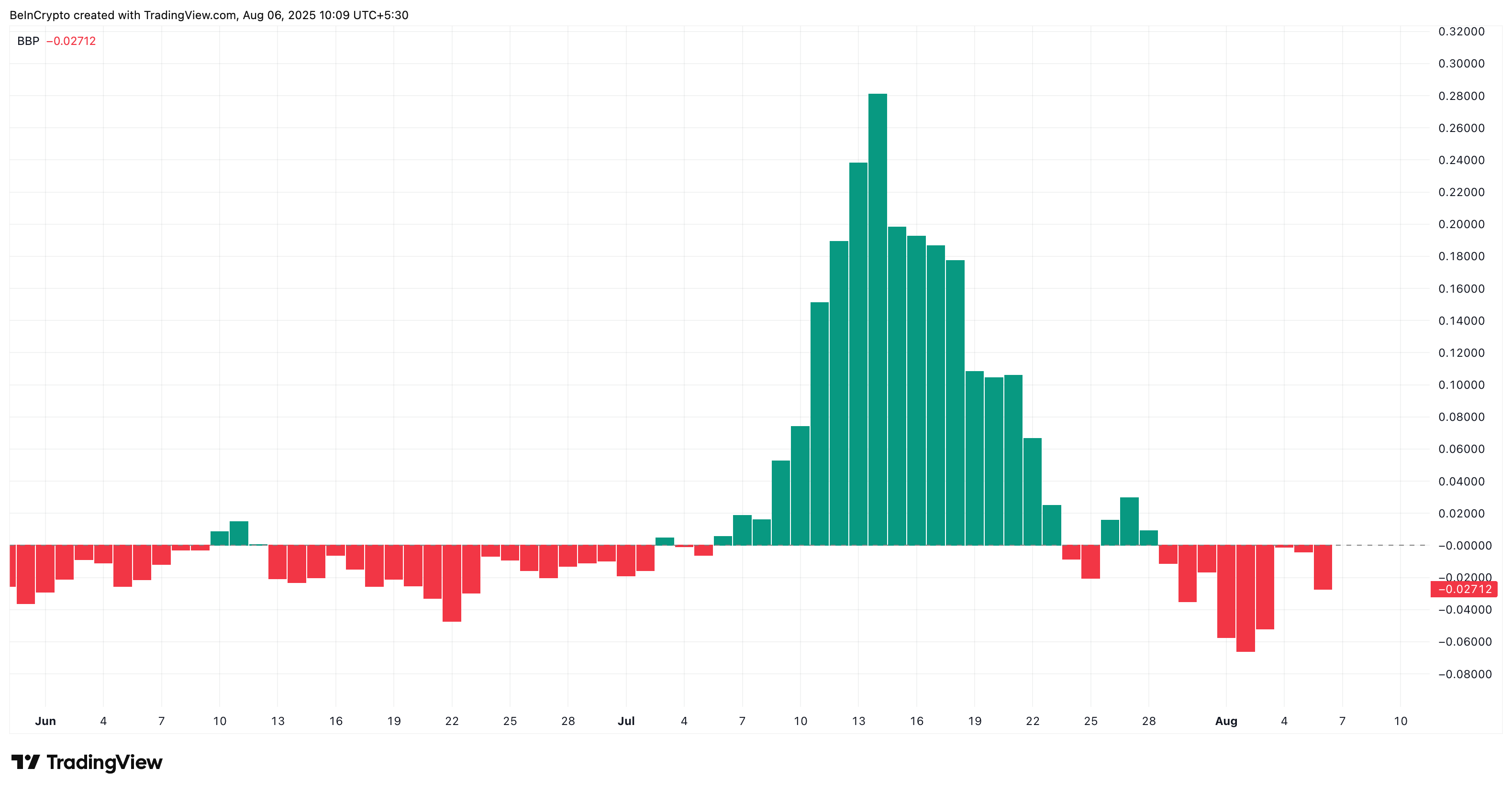

Beyond chart signals, market sentiment shows that bearish momentum is creeping up. The Bullbear Power (BBP) index, which compares recent highs and lows with spot purchasing power, reversed sharply towards the bear in the last two sessions. It suggests that buyers are struggling to keep up, and sellers are dropping great prices.

BBP measures the strength of buyers (bull) versus sellers (bears) in recent price movements. If it’s negative, it indicates that the bear is in control.

The shift is also evident in long/short account ratios. According to Coinglass, 60.67% of traders currently hold short positions in XLM. A significantly reduced market can sometimes lead to shorter apertures, but in this case it matches negative star price action and trend indicators.

Long-term ratios indicate whether many traders bet on the price (long) and decrease (short). A shorter ratio means that the majority expect a price drop for XLM.

Support level for viewing as a star (XLM) price teaser in case of failure

The XLM price is currently trading at around $0.38, just above the short-term support zone at $0.37. A break below $0.37 followed by $0.33 could lead to a deeper sale. If the $0.33 level is not retained, the star price could revisit $0.28. The following dipping checks for a complete breakdown of momentum.

If Bulls holds $0.37 and can exceed the XLM price of $0.40 and $0.45, we still hope for a recovery. Moves above $0.40 invalidate the short-term bearish hypothesis.

The actual test is $0.52. Only a clean break that outweighs this resistance fully confirms the new bullish trend. Until then, the star (XLM) structures remained vulnerable.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.