Welcome to US Crypto News Morning Briefing. An essential summary of the most important developments in future cryptography.

Grab a coffee as influential circles shape bold new bets with code. Capital is poured into it, strategies repeat at speed, and familiar names continue to emerge. But behind the momentum, warning signs appear, leaving questions about how long this cycle will last.

The day’s crypto news: Power, billions, cracks of Wall Street data machines

The tight circle of Princeton alumni is at the heart of one of the boldest bets on the market today, the Department of Digital Assets Treasury (DATS), as shown in recent US Crypto News Publications.

Sponsored Sponsors

The “Princeton Mafia” and people like Galaxy Digital’s Mike Novogratz, Pantera Capital’s Dan Morehead, and Ethereum co-founder Joe Rubin have been repeatedly featured in the $1 billion Treasury deal, raising capital, absorbing coins, and Wall Street reshaping its approach to crypto.

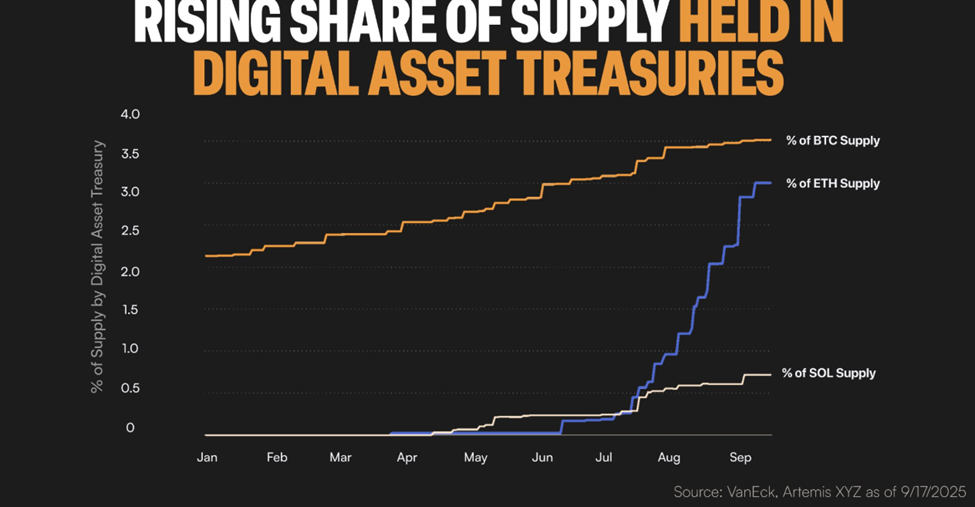

This year, more than 85 publicly traded DAT companies have appeared, attracting more than $44 billion from investors across the US, Asia and the Gulf.

The strategy is simple, but it’s powerful too. Use the Wall Street playbook to raise cash, buy crypto tokens such as ETH or Solana (SOL), keep them on your balance sheet and then repeat.

Due to repeated participation patterns by the same network of elite bankers and fund managers, Dats has become one of the most influential forces in Crypto’s 2025 rally.

The bond between Novogratz, Morehead and Lubin returned to Princeton University in the 1980s, when the three were athletes and classmates. Decades later, their companies often crossed the path of crypto ventures by coincidence or design.

Recent deals show overlap, including Rubin’s ether-centric Sharplink game this year, with support from both Pantera and Galaxy. The two companies also invested in Bitmine Immersion.

Even when competing, the trio’s presence emphasizes gravity in the market, similar to the launch of the Solana Treasury duel from Pantera and Galaxy in September.

Sponsored Sponsors

This impact has spread beyond trading. The group funded Princeton’s power decentralization centre through blockchain technology and helped institutionalize the shared vision of Wall Street, which has been redesigned for Crypto Speed.

Cracks appear in the Ministry of Digital Assets Treasury Engine

But the bold experiment already shows tension. Bitcoin purchases by DATS have plummeted 76% in recent months, falling from 64,000 BTC in July to just 15,500 so far in September, according to encrypted data.

The sharp drop raises questions about whether the DAT model can maintain itself without constant fresh capital inflows.

The sale was hit hard by the open market. The shares of a finance company that once traded online crypto holdings at a large premium have collapsed. In some cases, the price has decreased by more than 90% from the issuance price.

Sharplink plummeted 72% in the day after its stock sales application, while Pantera-backed Bitmine fell 40% after a similar move.

Sponsored Sponsors

Analysts warn that if capital is sour, DAT machines with promotions, purchases and repetition are risky.

The anchor of the assumed institution of Bitcoin would look like quicksand without the corporate Treasury as a stable buyer.

In addition to DATS, the influx of ETFs (Exchange-Traded Funds) has also shaking, losing nearly $2 billion last week.

Despite this, the iShares Bitcoin Trust withdraws $2.5 billion in September, up from $707 million in August. This suggests that retail and institutional ETF buyers may be absorbing demand that is not being met by the Treasury.

Still, slowing down DAT purchases highlights an increased divergence. ETFs provide transparency, while DAT provides exposure to investors to volatility, leverage, and opaque trading structures.

Sponsored Sponsors

The chart of the day

Byte-sized alpha

Here’s a summary of more US crypto news that continues today: