Amidst the hype around the general bullish wave of the crypto market, traders and investors must embellish their volatility with the expiration option of Bitcoin (BTC) and Ethereum (ETH) contracts.

As traders adapt to the new trading environment, the market tends to stabilize immediately after options expire.

What Traders Should Hope from Today’s Expired Options

With Crypto Markets riding a bullish wave, today’s key options expiration dates can shake the market and impact market behavior over the weekend.

Specifically, the expected value of over $5.76 billion is tied to Bitcoin and Ethereum contracts, which are scheduled to expire this Friday.

According to Derivatives Exchange Deribit, Bitcoin’s total open interest amounts to 40,945 contracts, representing the expected $49.1 billion.

The maximum pain point, which is a price that most options expire worthlessly, is an astounding $114,000. This is well below the current spot level, with BTC at $120,259 at this time of writing.

With a put-to-call ratio of 0.78, traders appear to be leaning steadily, favoring call buying options that benefit from price increases.

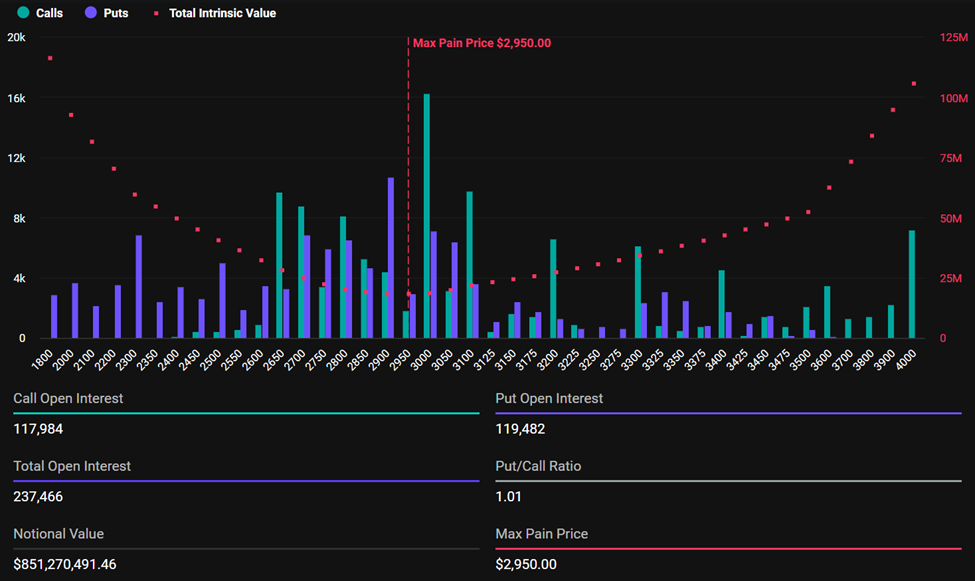

In contrast, the Ethereum options market shows a more neutral tone. Public interest is 237,466 contracts.

Meanwhile, the estimated value is $851 million and the put-to-call ratio is 1.01, indicating an almost balanced sentiment between bearish and bullish bets. The maximum pain level is $2,950, which is significantly lower than ETH’s current market range.

In particular, the options expire this week are slightly more than last week’s contract. As reported by Beincrypto, the 36,970 BTC contract with an estimated $4.31 billion lapsed on July 11th. In the same tone, the 239,926 Ethereum contracts expired, with an estimated value of $712 million.

Cautious optimism ahead of options expiration dates

Analysts at Greeks.live explains that it is a mix of broader emotions. While some traders believe the top is following the recent rally, others continue to target higher ratings later this year.

“…We are looking for 150,000 BTC by the fourth quarter, but we expect a revision until September,” the company said.

In the short term, however, traders have adopted risk reversal strategies, a classic tactic in the options market. This will show bullish posture while selling 30-day puts, buying 30-day call and adding a small put position for Black Swan protection.

This strategy suggests that while some market participants are hoping for a continued upward trend, they are paying attention to sudden downside shocks.

As traders take charge of volatility, current market positioning reveals the divergence of sentiment across the Bitcoin and Ethereum markets.

Volatility remains an important focus. Ethereum’s implicit volatility has hovered around 70% even after recent price surges. Analysts say this creates opportunities for base trading and volatility squeeze play.

According to Greeks.live, traders actively manage their exposure before the expiration of today’s choices, and expect significant turbulence. In particular, the combination of large conceptual values, distorted maximum pain levels, and divergent emotions sets a stage of potential volatility.

With both assets trading above the maximum pain level, Bitcoin and Ethereum prices will likely be pulled back as these options are near expiration. However, as traders adapt to the new trading environment, the market may then stabilize.

Disclaimer

In compliance with Trust Project guidelines, Beincrypto is committed to reporting without bias and transparent. This news article is intended to provide accurate and timely information. However, we recommend that readers independently verify the facts and consult with experts before making decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.