The fierce conflict between Israel and Iran has long cast a shadow over financial markets, with cryptocurrencies no exception.

Bitcoin (BTC) was able to demonstrate some resilience, but is trying to hold it above the $100,000 price point, while Altcoins buckled under geopolitical pressures, falling below the substantial margin of King Coin.

Bitcoin’s market share increases while Ethereum and altcoin are behind

On June 13th, Bitcoin rule rose after Israel carried out a massive operation against Iran. Now, it has increased by nearly 1% at 65.30% since the first Israel attack.

Meanwhile, Altcoin’s market capitalization, excluding the top 10 coins, fell over the same period. Other tracking Altcoin’s market share continues to decline, currently at $2300.08 billion.

At the same time, the ETH/BTC ratio has decreased, indicating that Ethereum continues to suffer a performance degradation relative to BTC in most Altcoins. Even Kingcoin itself is struggling to maintain its upside-down momentum, further weakening the wider altcoin market.

All signs point to one conclusion. You may not be ready for the Altcoin season.

Bitcoin domination rises as Middle Eastern unrest slows the altcoin season

In an exclusive interview with Wefi’s growth director Agne Linge, we confirmed that it is not uncommon for investors to transfer capital to assets they find safer during these global uncertainties.

“During global conflicts that usually affect political and macroeconomic stability, investors tend to shift capital from dangerous assets to assets that are perceived as safe shelters,” Linge explained. “It used to be the Ministry of Gold and Treasury. But you can see that Bitcoin also serves as a digital safe haven.”

According to Linge, as conflicts intensify between Israel, Iran and the United States, this rotation in this capital can be collected from the decline of others. At the press conference, this is $23.071 billion, a cut of $12 billion over 10 days.

“The market capitalization of Altcoins, excluding the top 10 coins, fell quickly as the conflict began to escalate. That means traders were spinning capital allocations from Altcoins to safer shelters like Bitcoins and Stablecoins,” he told Beincrypto.

She further noted that the growing BTC dominance in the ongoing conflict confirms capital turnover into the coin.

“BTC.D shows Bitcoin control and altcoin, and has been rising since the conflict began,” Linge said.

At the time of this writing, BTC has dominated 65.30%. For context, it briefly climbed to a multi-year high of 65.95% on Sunday, pulling back slightly.

During the same period, the ETH/BTC ratio fell.

“The ETH/BTC ratio is also an important indicator. This means that the majority of Altcoins are based on the Ethereum blockchain, and the rate of increase is Ethereum outperforms BTC. The ratio has declined since June 16th and has been stagnant,” she added.

These measurements suggest that even with the relatively stagnant price of BTC, its market domination is strong, further delaying the Altcoin season.

It’s still Bitcoin season

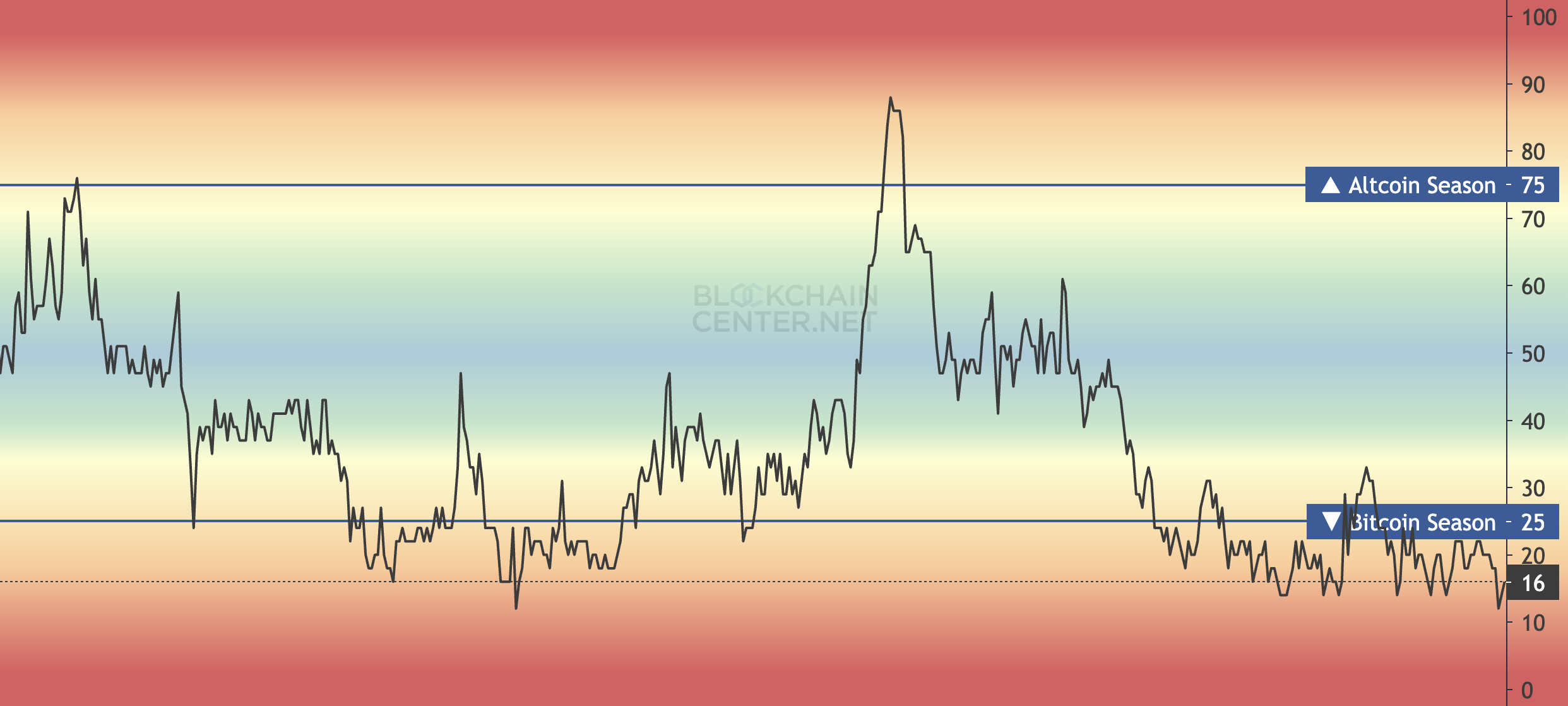

Measurements from the Altcoin Season Index show that the market remains firmly in place at the BTC dominance stage. The Altcoin season begins when at least 75% of the top 50 Altcoins outperform BTC in 90 periods.

According to the Blockchain Centre, only 16% have been able to do that in the last 90 days, lagging behind Altcoin’s performance, suggesting that the true Altcoin season is still far apart.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.