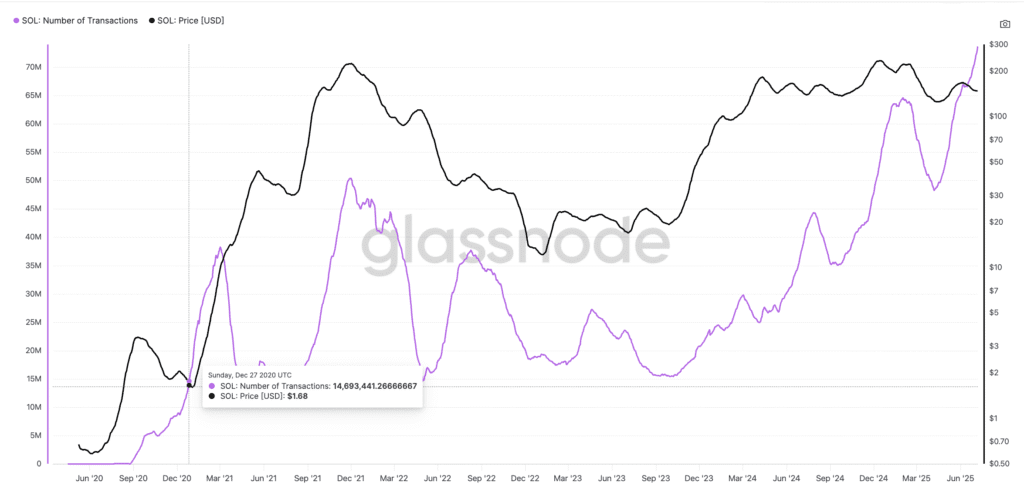

Solana printed an unusual crossover between key network metrics and Sol Price. This hasn’t happened since the beginning of the first Bull Run in 2020. However, this time, even as the network shows its updated strength, prices are still behind.

Is this a signal that lights up the next leg?

Transaction count hits 5 years higher, but Sol Price hasn’t followed yet

Solana’s number of transactions has skyrocketed, exceeding 70 million. But that’s not the best part.

According to the chart, when the transaction count line last crossed the price line, a multi-year Sol Price lurry occurred. This time, in July 2025, the price was about $151 lower, resulting in a similar crossover.

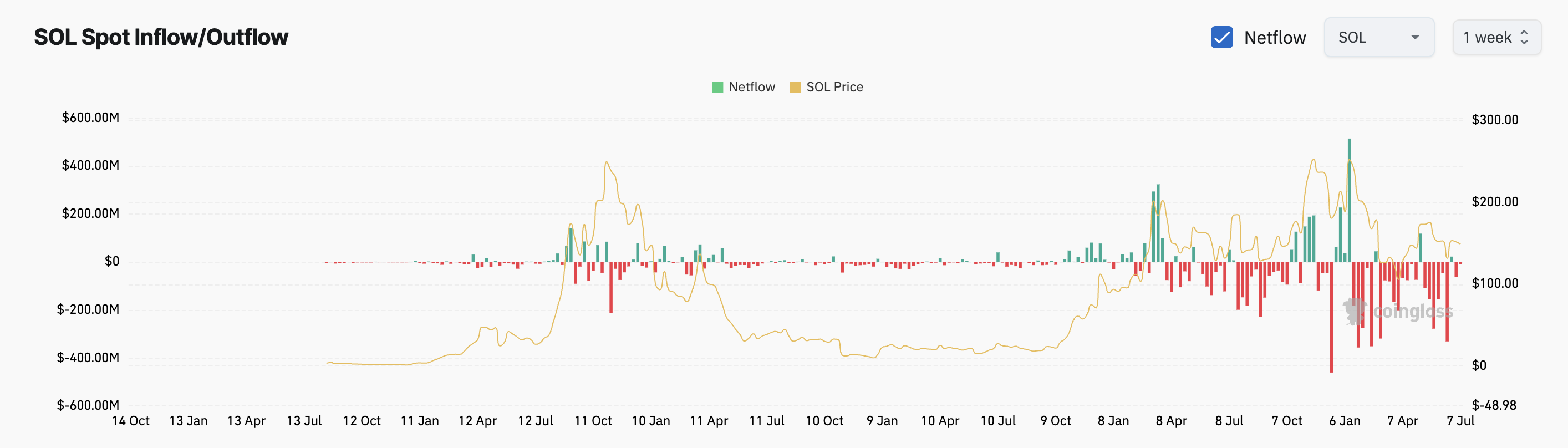

Despite the exchange exit, Netflows is bearish

Coinglass data shows that Solana is steadily leaking through early July. It usually indicates accumulation. However, recent outflows have slowed down and there hasn’t skyrocketed in the inflow.

In short, no one throws it away, but no one rushes to buy it.

This balance may explain why Sol Price has not yet erupted. It appears that traders are waiting for a stronger signal before taking the side.

The SOPR is reversed to below 1. A sign of panic?

Solana’s used output profit margin (SOPR) tracks whether coins are being sold in profit or loss, and has been just below 1.0 since late June. That usually means that holders are being sold at loss or damage, which is often seen at the bottom of the market.

If the SOPR falls below 1, surrender is indicated. Traders are at a loss and are finished their positions. However, when the SOPR begins to rise again to 1, most panic cellars are gone, suggesting that only long-term or broken holders remain.

In this case, a SOPR returns from 0.95 to 1.0 indicates that forced sales may be cooled. Combined with slow exchange spills, it suggests that Solana is stable. Rather, the bottom of this cycle may be formed.

Sol Price Structure: Falling wedges are still playing, but momentum is slow

The Solana Price has been trapped within a wide range of falling wedges since early January 2025. The structure is still undamaged, but Sol tested the top trendline multiple times without breakout. That line is currently just under $155 and the price is hovering nearby without clearing it.

A confirmed move above $155 could change momentum. In that case, the upward targets are $169 and $180, both serving as the main zone of resistance from previous highs.

However, if the Bulls are unable to break the wedge, there is a risk of going back to the old sideways band. This support zone, ranging from $140 to $125, previously locked in Sol prices. Losing that zone will weaken the entire structure, possibly leading to deeper losses. The wedges are wide enough that even small dips won’t break the setup, but once Sol falls below $125, the pattern can be unable to hold the weight.

Supporting the pattern is the moving average convergence divergence (MACD), which is about to be bullish. The MACD line (blue) has been flipped over the signal line (orange), a classic initial momentum indicator. The flip occurred near the low swing and confirmed bullish strength and bottom attempts, also shown by SOPR.

But here’s the catch. The histogram bar, which represents the distance between two lines, is fading. It shows a weak opposite momentum.

MACD is a momentum indicator that helps you find early trend inversions based on two moving lines and histograms.

Solana is traded nearly $151. Unless it crucially beats $155, the falling wedge is in control.

Post Solana (SOL) flashed five years of bull signal. Will the breakout be the next one? It first appeared in Beincrypto.