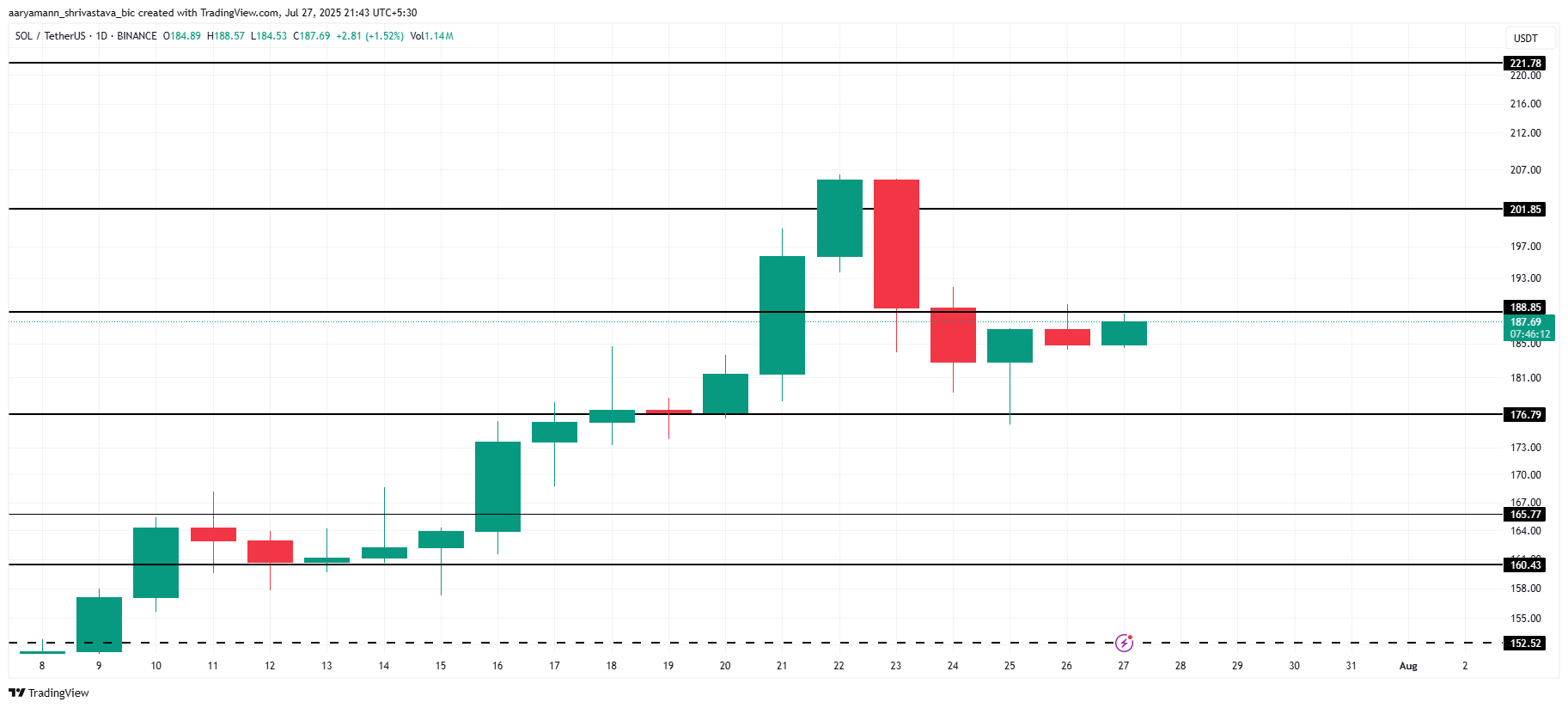

Solana (Sol) recently tried to break the $200 mark, but failed as investor sentiment changed. Altcoin was unable to maintain momentum after temporarily exceeding this level.

Solana prices are now falling even further as market conditions weaken and investors’ behavior changes.

Solana investors are bearish

Vibrant metrics have been rising sharply over the past 12 days, reaching monthly highs this week. Vitality measures long-term holders (LTHS) movements, and when it rises sharply, it usually informs sales activity.

This is currently the case with Solana, as many LTHS sell their holdings. Given that LTHS has a major impact on price action, this sales pressure is contributing to a lower price. Large sales can increase downward pressure, making it difficult for Solana to regain traction in the market.

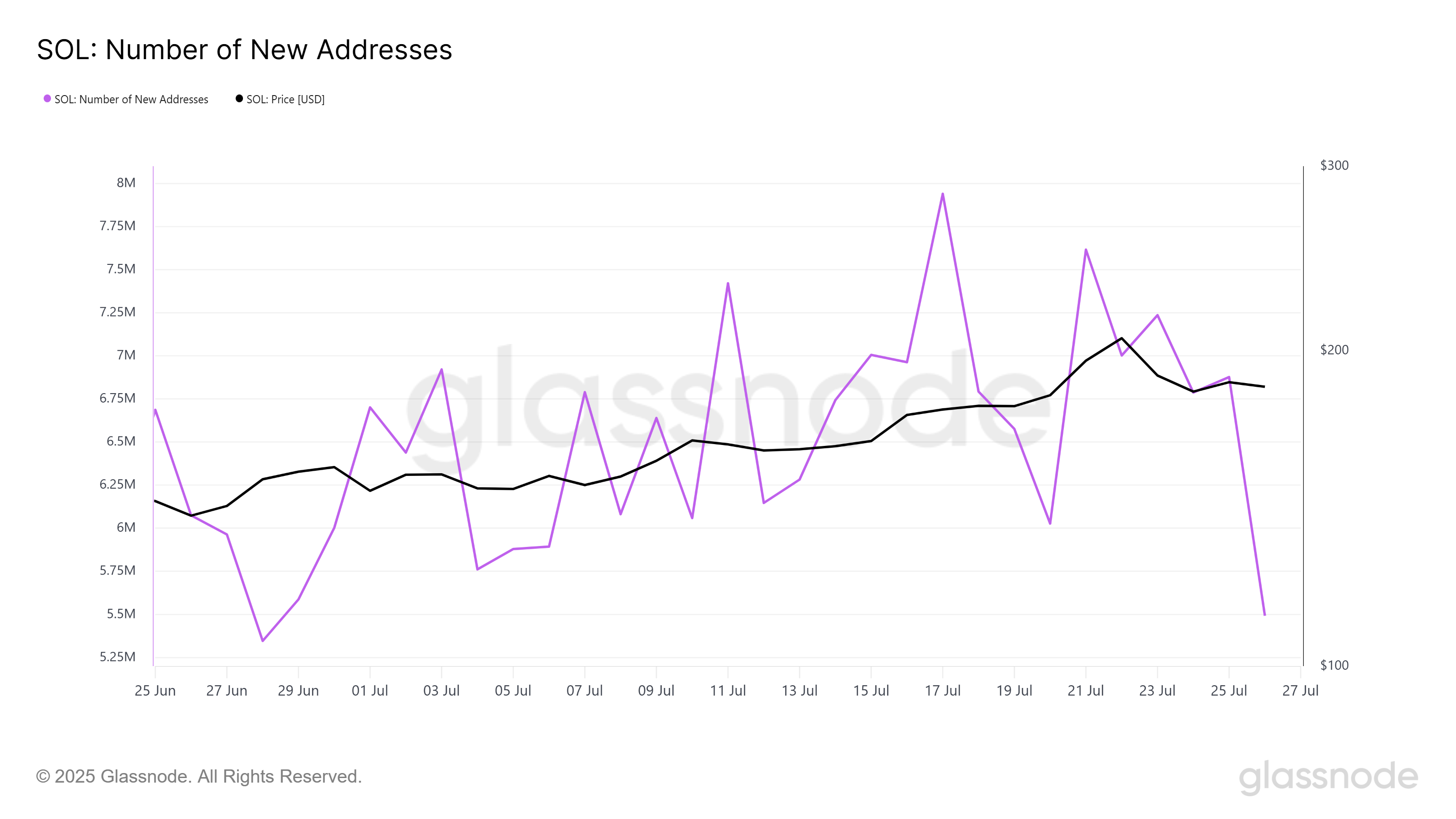

Solana’s macro momentum also shows signs of weakness. The number of new addresses is low each month, and the daily rate of new addresses is drastically lower. Over the past 48 hours, Solana saw a decline in new addresses of 1.4 million, highlighting the lack of interest from fresh investors.

The decline in the number of new addresses suggests that Solana is losing appeal to new investors. With less willingness to invest in assets, the price is more likely to continue retreating.

Sol Price fails again

The Solana price is currently trading at $187, slightly below the $188 resistance. After a recent failed attempt to hold over $200, Altcoin struggled to maintain its value. With LTHS sold out and new investors pulling back, Solana is facing a challenging path ahead.

Given the current market situation, Solana is vulnerable to further price drops. If sales pressure continues, it could fall below $176 support, which could deepen investors’ losses. This confirms the bearish feelings surrounding the altcoin.

However, if the wider market conditions move favorably, Solana could bounce back. Once Altcoin regains $188 in support, it could potentially aim to return to $201, giving them another opportunity to try to hold over $200.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.