Solana Price has recently skyrocketed above $200, but has since been revised. Currently, it has fallen more than 6% a day, trading around $185. Like Solana-based memecoin, Solana’s core tokens also appear to be in the short-term cooldown phase.

But is this a healthy dip before bounce? Or is there a deeper loss brewed? On-chain activity and key technical zones quickly tell the story of a strong support cluster, suggesting that the reversal may not be too far away.

The new wallet is still visible

Despite the dip, short-term holders are not bailed out. They’re in. The 3-month HODL Waves chart shows wallet band spikes for “one day to one week” suggesting that new buyers are accumulating Solana.

Both important short-term HODL bands have increased during recent DIP.

Wallets jumped from 6.67% to 8.67% for the day to week, and wallets rose from 30% to 8.73% to 9.3%, up about 6.5%

About Token TA and Market Updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

This spike is important as it reflects previous trends since May when Solana saw a price drop. At the time, Dip was ultimately overturned. A similar rise suggests the belief of growing buyers despite prices chilling.

In short, wallets that have kept Solana for less than a week have not finished. It is usually a sign of bullishness during the correction.

Hodl Waves measures the distribution of coins by age of retention. The rise of young bands means new buyers are entering the market.

Support cluster: Zones from $175 to $180 remain unchanged

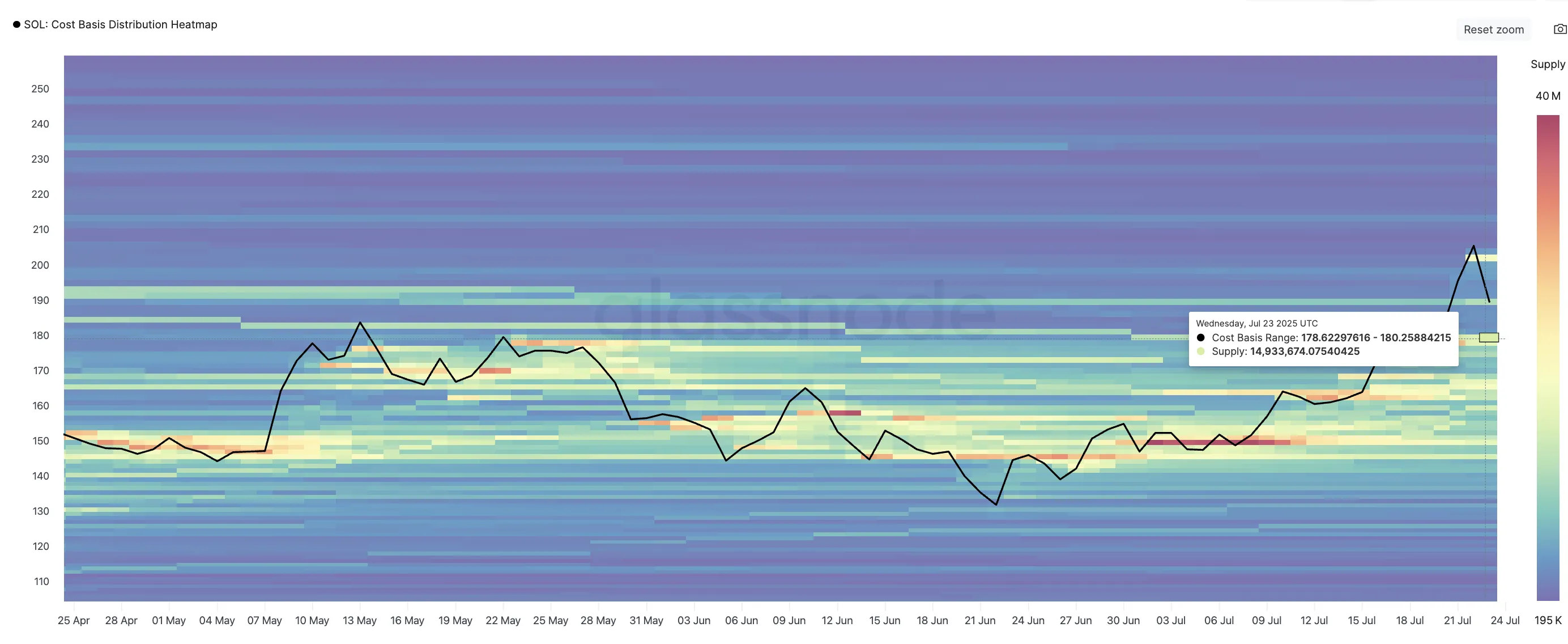

The next thing to look at is whether Solana holds the current level of support. A cost-based heatmap shows a dense cluster of wallet accumulations between $175 and $180, one of the most powerful zones since April. This is where many traders are likely to buy and defend their position. The total supply within this zone is up to 38,964,258 SOL.

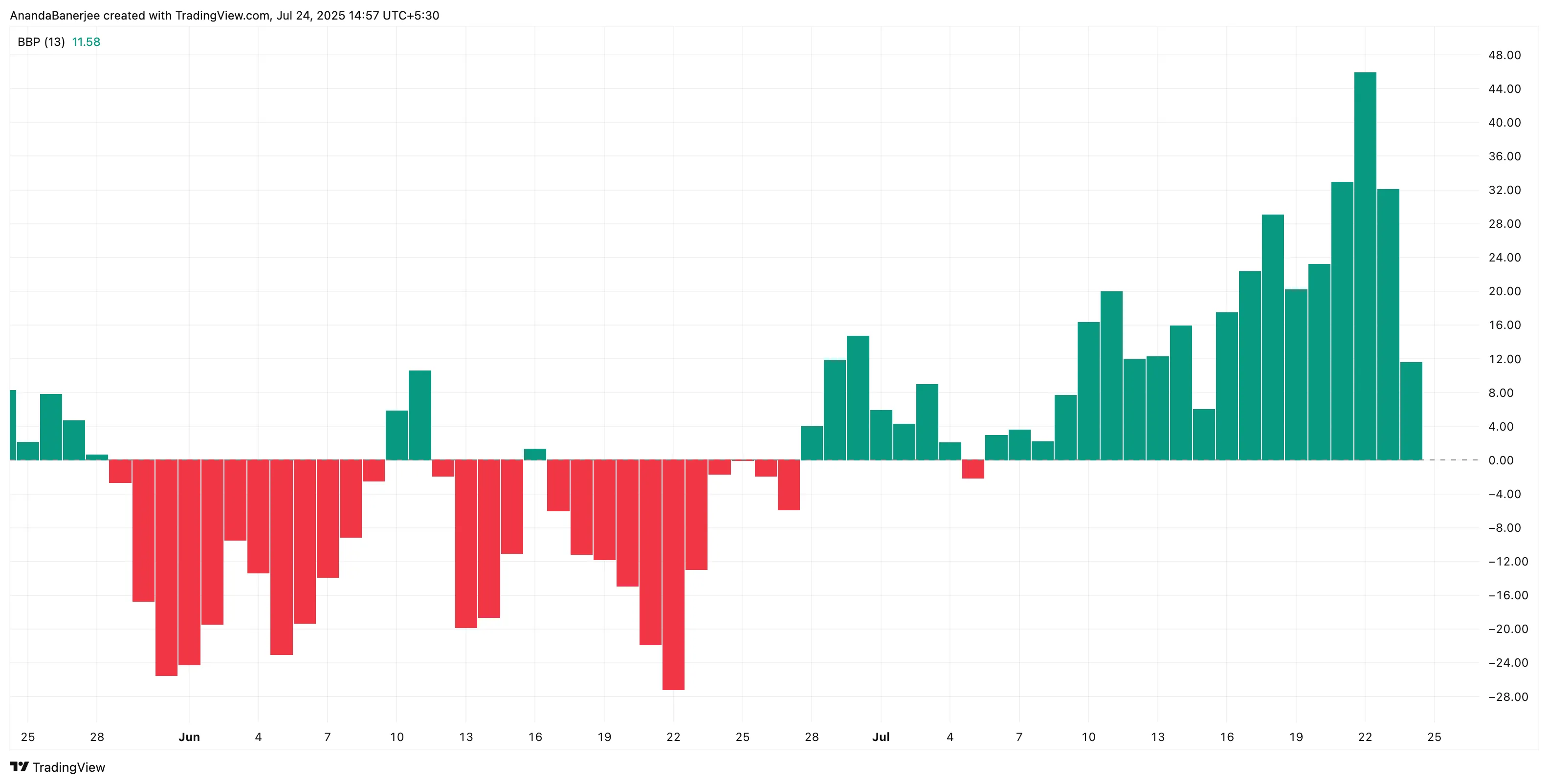

At the same time, the Bullbear power index remains in favor of the bull. The indicators are slightly cooled, but buyers are still outperforming sellers. It’s an important clue that Dip hasn’t turned his emotions over yet. And the Bulls may be able to support the Heatmap price range.

This combination: strong support for maintaining cost-based zones and control points to potential bounces around $175, even if prices drop low. A drop to that level is only a 5.4% move from the current price. You can quickly flip onto a card, unless this range is disassembled vigorously.

A cost-based heatmap visualizes where most of the tokens have been retrieved. Bullbear power gauges have more control in current trends: buyer or seller. The power index of a Bull Bear also measures the difference in strength between the buyer (bull) and seller (bear) to indicate who is currently controlling the price momentum.

Solana Price breaks support, but still doesn’t look weak!

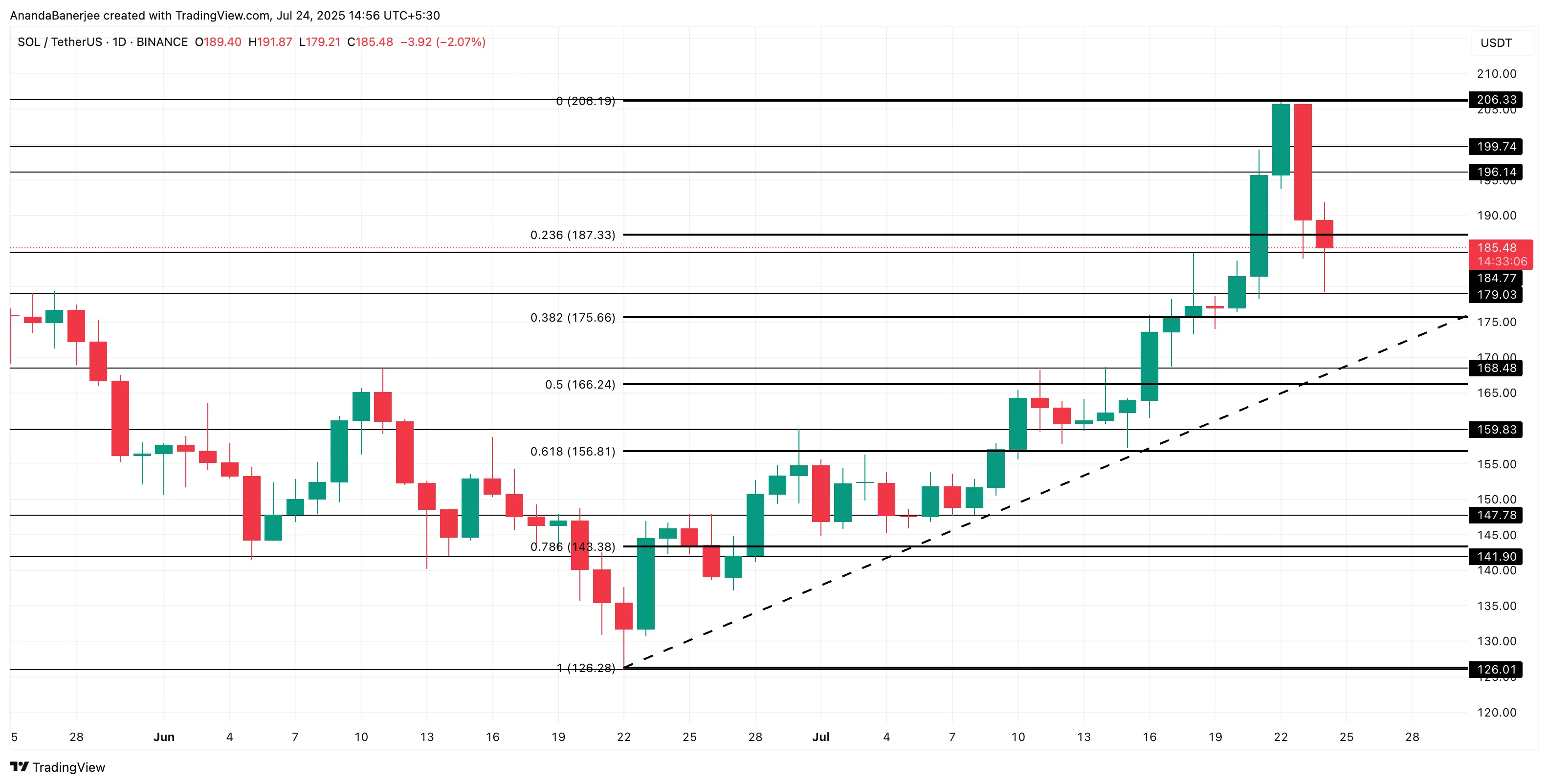

From a technical standpoint, Solana Price is currently testing the 0.236 Fibonacci retracement level at $187, based on its June low of $126 and July high of $206. The level was violated at the time of writing, but Sol Price appears to be working hard to get the same.

The following technical support is $184. If you can’t keep it here, the next strong support is $175, which coincides with the starting point of the cost-based cluster.

This creates a confluence zone between $175 and $180, making it an important level of viewing. Bounce here could continue to keep bullish structure alive. However, a breakdown below $175 could result in a significant loss to under $166.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.