Wells Fargo significantly expanded BlackRock’s Bitcoin ETF, IBIT in the second quarter of 2025 (second quarter).

This move comes as Abu Dhabi’s sovereign wealth fund maintains its position as the world’s largest Bitcoin ETF.

Wells Fargo’s $160 million bet shows an aggressive push to Bitcoin ETF

According to a new SEC filing, the US bank, the fourth-largest by assets, has held more than $160 million in stake in iShares Bitcoin Trust (IBIT) as of June 30th.

This represents a sharp increase from just $26 million at the end of the first quarter.

The Wells Fargo and Bank of America’s (BOFA) Merrill unit began offering spot Bitcoin ETFs in February 2024 to mediate clients in the Asset Management department.

In particular, this was only a month after the financial product was approved in the US.

“The brokerage company at Merrill Arm and Wells Fargo & Co. offers access to ETFs that invest directly in Bitcoin, reflecting the increased acceptance of mainstream companies of their products,” Bloomberg reported.

The bank offers approved ETFs to several wealth management clients with securities accounts requesting the product.

So Wells Fargo’s second quarter submission suggests that the bank has done more than opened the door to client demand. Currently, we have a direct institutional allocation to our own books.

Diversify into multiple Bitcoin funds

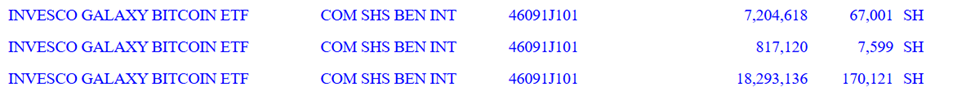

Meanwhile, Wells Fargo’s Bitcoin exposure exceeds BlackRock’s flagship product IBIT. The bank also increased its interest in the Invesco Galaxy Bitcoin ETF (BTCO) to approximately $26 million, from $2.5 million in the same quarter.

Grayscale Bitcoin Mini Trust (BTC) holdings have grown modestly from around $23,000 to $31,500. Meanwhile, the grayscale Bitcoin Trust (GBTC) position rose from $146,000 to over $192,000.

Wells Fargo also reported smaller positions in Bitcoin ETFs managed by Cathie Wood’s Ark Invest/21Shares, Bitise, Coinshares/Valkyrie, Fidelity and Vaneck. Banks are also diversifying their allocations to find Ethereum ETFs.

The move shows an increase in banks’ investment exposures related to crypto. This reflects the institutional interest in Bitcoin as an asset class and the increased acceptance of ETFs as a priority access point.

Abu Dhabi’s $681 million Bitcoin ETF holdings

Elsewhere, Abu Dhabi’s sovereign wealth funds remain unshakable in a substantial Bitcoin ETF position.

SEC filing shows that Mbadara, one of the world’s largest state-owned investment companies, owns 8.7 million shares, as of June 30th, of $534 million.

Al Warda Investments, managed by the Abu Dhabi Investment Council, reported 2.4 million shares worth $147 million during the same period. Together, these holdings totaled $681 million, which has not changed since May.

“Diamonds reach at the nation-state level,” said Cas Abbe, analyst and Web3 growth manager.

The latest disclosure highlights the expansion range of major institutional players, from US banking giants to Middle Eastern sovereign wealth funds, and makes a calculated move on the Bitcoin ETF.

Wells Fargo’s aggressive Q2 accumulation stands out, betting on it reflecting rising prices, strategic hedges, or increased client demand.

Meanwhile, Abu Dhabi’s unwavering position suggests a long-term, conviction-driven approach in what is considered a strategic asset on the global stage.

The post-SEC submission reveals that Wells Fargo and Abu Dhabi’s quiet Bitcoin ETF power moves first appeared in Beincrypto.

13F Update: Abu Dhabi hugs BTC

13F Update: Abu Dhabi hugs BTC