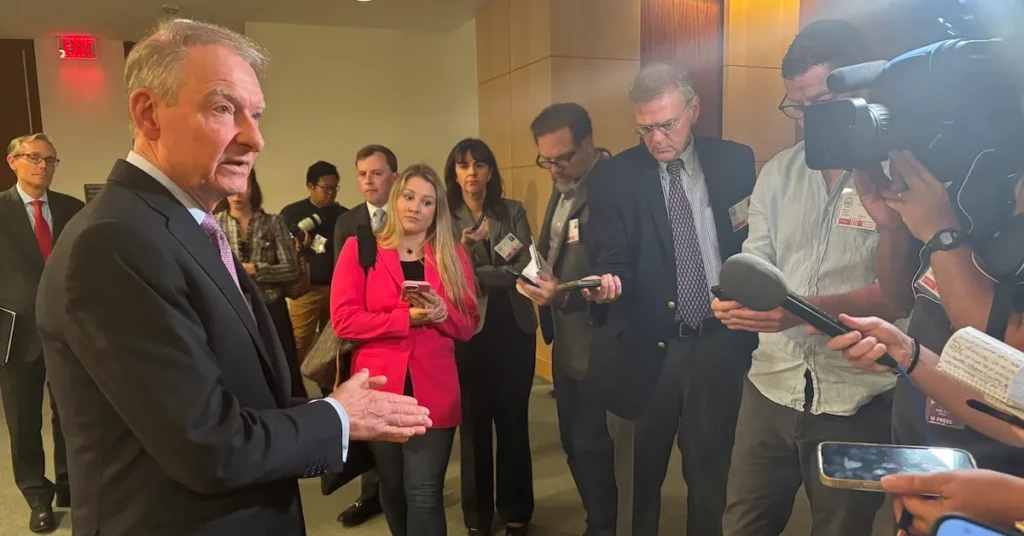

Today, at the Media Scrum, a starter at the SEC-CFTC roundtable on regulatory harmonization efforts, U.S. Securities and Exchange Commission (SEC) Chairman Paul Atkins expressed excitement about bringing tokenized securities into chains, but did not provide insight into what platforms and protocols these assets trade with.

The latter may be particularly important for Bitcoin enthusiasts. This is because wallets used to trade tokenized securities on-chain require identification information, and such rules can ripple over Bitcoin wallets.

So I asked the chairman what the securities coming on-chain would look like to him: Does it look like a gate platform like Fidelity or Charles Schwab?

He did not respond directly to my questions.

Instead, he first shared how securities trading on blockchain can reduce settlement times.

“The great thing about tokens (it’s) you can exchange real assets online at the same time for payments. It’s basically instantaneous clearance,” Chairman Atkins told me.

And he followed the statement with mild concern.

“So we may need to build it like a speed bump to make sure there are no mistakes or wire money in the wrong place,” the chairman added. “We’ll be working realistically for next year or two to try to get to a place where there’s a good guardrail around the system.”

Words like “speed bump” and “guardrail” indicate some form of control, so they trigger an alarm bell and often KYC if there is a control.

If tokenized securities end up trading in the walled gardens of traditional brokerage companies, KYC issues are not so concerning, as these platforms are already KYC customers.

This issue becomes even more important when tokenized securities can be traded through protocols such as UNISWAP through wallets such as MetaMask or Trust Wallet.

If this occurs, it asks for the following questions: Does this lead to all crypto wallets having to KYC users? Will this rule be eventually blown away into a Bitcoin-only wallet?

Based on my interactions with the Chairman, I was under the impression that he currently had no answers to these questions. In other words, he wasn’t really circumventing, as he waited for Congress to act, so he didn’t know exactly what the wider pictures around tokenized securities look like they are now.

As the Senate discusses and revises the Clarity Act (Clarity), a digital asset market structure bill, much of the crypto market regulation falls on balance. The chairman said he was paying explicit attention in a way that would allow him to go through the legislative process.

“There’s a Market Structure Act that cleared the House of Representatives and is now (discussed) in the Senate,” he told me. “We’ll see what happens.”

Bitcoin Magazine will follow up with Atkins Chair on this issue if Clarity passes.

In the meantime, if you want to protect your personal and unauthorized right to use your Bitcoin wallet, be sure to contact an elected official as part of your campaign’s Satoshi needs.

Source: https://bitcoinmagazine.com/politics/sec-crypto-policy-chairman-atkins-vague-on-wallet-rules