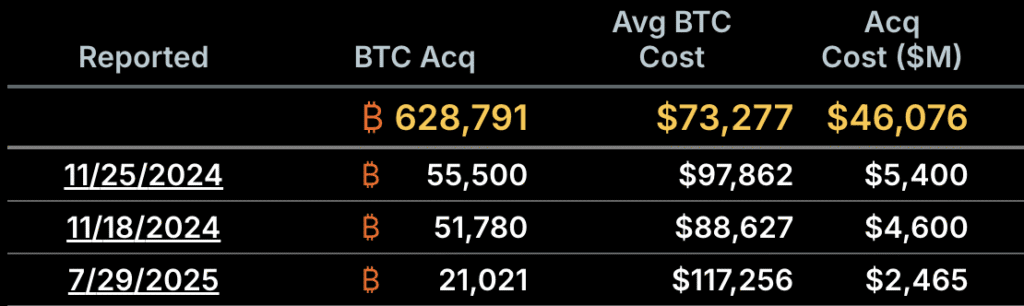

The Strategy (previously the MicroStrategy) recently implemented the third largest Bitcoin purchase in terms of dollar cost. The company achieved great success in the second quarter of 2025, making this move just before it showed its stable, long-term commitment.

Chairman Michael Saylor recently appeared in an interview, explaining his vision for the company’s future. Despite a slight drop in BTC last week, he is confident in his vision for a multimonth of code.

Strategy continues to buy bitcoin

The strategy was a pioneer with Bitcoin Treasury techniques and became a world leader in corporate crypto acquisitions in particular.

After months of consecutive stock offerings and ambitious purchases, the company bought its third largest purchase in US dollars last week. This shows a firm commitment, surpassing the company’s biggest move in 2025.

The latest Bitcoin acquisition of strategy is very impressive for several reasons. First of all, this happened towards a quarterly tail that was very profitable for the company, following a bleak post in the first quarter of 2025.

The strategy continued to buy before the new net profit was fully realized. Secondly, Bitcoin prices fell shortly after this purchase for unrelated reasons.

What’s next for MicroStrategy’s Bitcoin Strategy?

To explain his unorthodox moves, Strategy Chair Michael Saylor agreed to an interview to discuss this ambitious Bitcoin purchase.

His comments were extremely enthusiastic and brushed the minor price setback as usual.

“This is digital capital. If you use the traditional Treasury as capital, you perform your S&P 500 10% per year. You’re burning your money. If you use Bitcoin, you’re outweighing things like 40% per year.

EssentiallySaylor contemplates a scenario in which the potential risk of a strategy Bitcoin purchase and continually purchases inventory to earn a higher profit.

Rather than claiming that the company will hold the property forever, Saylor said he wanted to detain BTC for 21 years. On the other hand, these stock sales generate large yields.

Saylor was also asked if he would consider investing in Altcoins, and praised the Ton ecosystem accordingly. He pays tribute to Ton’s technological innovation and enthusiastic community, but Saylor is firmly at the BTC Maximalist Camp.

No matter what happens next, Saylor won’t get off this train anytime soon. He spoke about the desire of strategic investors to use Bitcoin to achieve double profits, but argued that there is more potential.

For now, the company remains a standard rep for the company’s trust in BTC due to its thick and thinness.

Saylor explains the strategy goals after the third largest Bitcoin purchase first appeared on Beincrypto.