MicroStrategy announced today it would purchase $22 million in Bitcoin, highlighting the growing fear of shareholder dilution. The company refused to recover guardrails that could prevent this.

MicroStrategy is stuck between two bearish scenarios. Stopping BTC purchases can disrupt market trust. However, diluting shareholders to fund these purchases will continue to degrade the performance of their assets.

Sponsored Sponsors

MicroStrategy’s dilution crisis

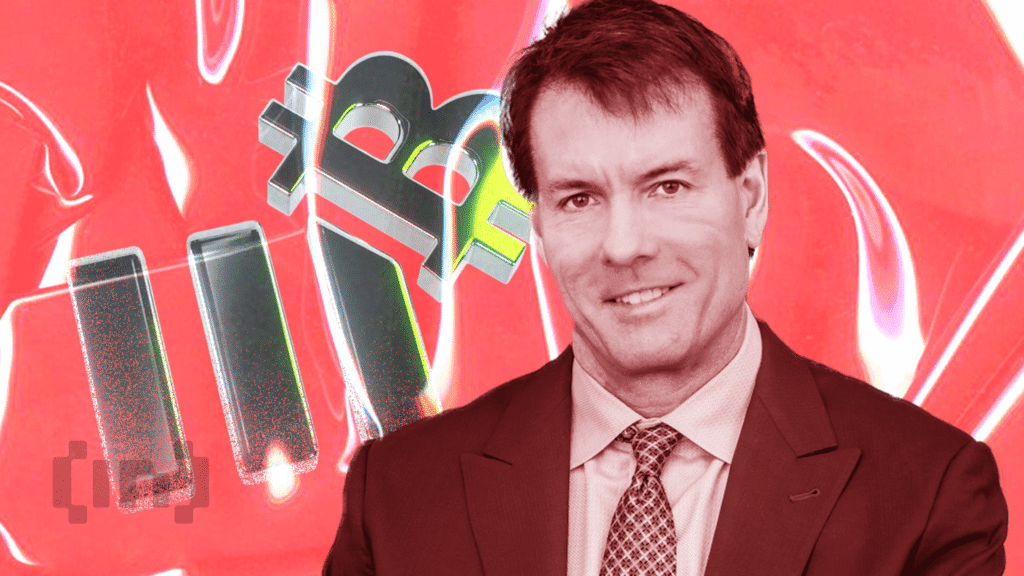

MicroStrategy has had many successes in its Bitcoin accumulation plan, but in recent weeks some cracks have been formed. The company’s purchases have been declining recently, with Chairman Michael Saylor today announced its $22 million acquisition of BTC.

Compared to some of my previous purchases, this total is quite small. Additionally, the new report will help explain the urgent dilemma of micro-tactics. The company is increasingly leaning towards diluting shareholders to fund these purchases.

This pattern can be bubbly into an explosive crisis when reducing shareholder trust.

Dangerous warning signs

Michael Saylor insisted in July that the micro strategy would not dilute shareholders’ exposure to Bitcoin, but took steps to change the policy last month.

Specifically, he announced that he could sell the stock for new reasons other than buying BTC, and removed the guardrail to protect the position of investors.

Sponsored Sponsors

Since MicroStrategy enacted these measures, the company has reduced its common shareholders by 3,278,660 shares and funding more than $1.1 billion in new Bitcoin purchases. Therefore, this 1.2% shareholders directly funded around 94% of the company’s BTC acquisition last month.

MicroStrategy stock dilutions are dangerous for several reasons, but one is especially important. This directly undermines your motivation to invest in MSTR instead of purchasing BTC. The company has purchased around 10,000 Bitcoin since August, but is well below the token.

There’s no clear way

The company recently shunned class action lawsuits, which is a huge warning sign. MicroStrategy’s inconsistent revenue has already caused great praise for it, and shareholder dilution could be even worse.

The company has a fiduciary responsibility to maximize shareholder value. Shareholder value can be at odds with its acquisition goal.

Just like the Red Queen of Alice in Wonderland, the BTC Digital Assets Treasury Department must continue to run faster and faster to stay in the same place. MicroStrategy is the pillar of corporate trust in Bitcoin. If purchases are stopped, the token price will be reduced. The dilution is gentle.

There is no easy way to get out of this crisis. Michael Saylor isn’t just about making money. He needs to surpass Bitcoin. Diluting shareholders may be the only way to maintain microstrategy for now. Nevertheless, it can cause even bigger explosions.