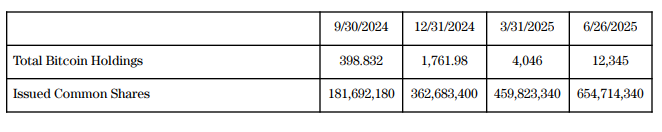

Metaplanet, widely recognized as Japan’s leading Bitcoin financing company, announced today its acquisition of an additional 1,234 Bitcoin, bringing its total holdings to 12,345 BTC. The purchase was valued at 192.7 billion yen with an average price of 15.6 million yen per Bitcoin.

The acquisition is a strategy aimed at accumulation of 210,000 BTC by the end of 2027, part of the company’s newly launched “555 million plan,” which represents 1% of its total Bitcoin supply. The initiative will replace the previous “21 million plan” that had aimed at 21,000 BTC by 2026.

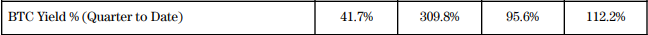

BTC Alied, our proprietary Key Performance Indicator (KPI), which tracks Bitcoin by fully diluted shares, continues to grow. It jumped from 41.7% in the third quarter of 2024 to 112.2% per quarter. This increase reflects a BTC gain of 4,538 and a corresponding virtual BTC gain of 71.2 billion yen, highlighting the effectiveness of our capital allocation strategy.

Capital market activities have played a central role in financing these purchases. Since January 2025, Metaplanet has implemented a series of zero coupons, non-tactile bond issuances, raising over 90 billion yen and USD 121 million. All issuances were redeemed early using proceeds from share acquisition rights exercised under the now fully completed “210 Million Plan.”

“On June 25, 2025, the company completed early redemption and full repayment of its Zero Coupon series of 16, 17 and 18 Zero Coupons issued to EVO funds,” the company said in a press release.

As of June 26, 2025, Metaplanet has expanded its issued common stock to over 654.7 million people. This growing share base reflects our strategy of using stock financing to convert capital directly to Bitcoin, reinforcing our commitment to becoming a long-term institutional owner of Bitcoin.

Source: https://bitcoinmagazine.com/news/japans-metaplanet-acquires-1234-more-bitcoin-total-holdings-reach-12345-btc