Hedera’s native token HBAR has fallen nearly 20% over the past seven days as Bitcoin’s recent price pullback continues to weigh in the wider Altcoin market.

On daily charts, tokens are dangerously close to violating key support levels, raising deeper correction concerns. However, not all signals are bearish. On-chain data flashes two indications of encouragement that could suggest a potential reversal.

Hedera’s Hbar is facing a breakdown

HBAR/USD’s daily chart measurements show Altcoin trading near the 20-day index moving average (EMA). If a violation appears under this key support floor, formed at $0.22 due to the pressure on the climbing sell side, it will likely be visible in the next few trading sessions.

About Token TA and Market Updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

The 20-day EMA measures the average price of assets over the last 20 days, giving weight to recent prices. This is a widely used technical indicator that helps smooth out recent price actions and identify trends.

If the asset price is poised to fall below this support level, its short-term momentum will weaken.

Especially after an extended uptrend, if prices fall below this line, it indicates a potential shift from bullish to bearish emotions. This setup is often sold further as traders interpret it as a loss of short-term support.

Hbar slides, but Bulls holds the line

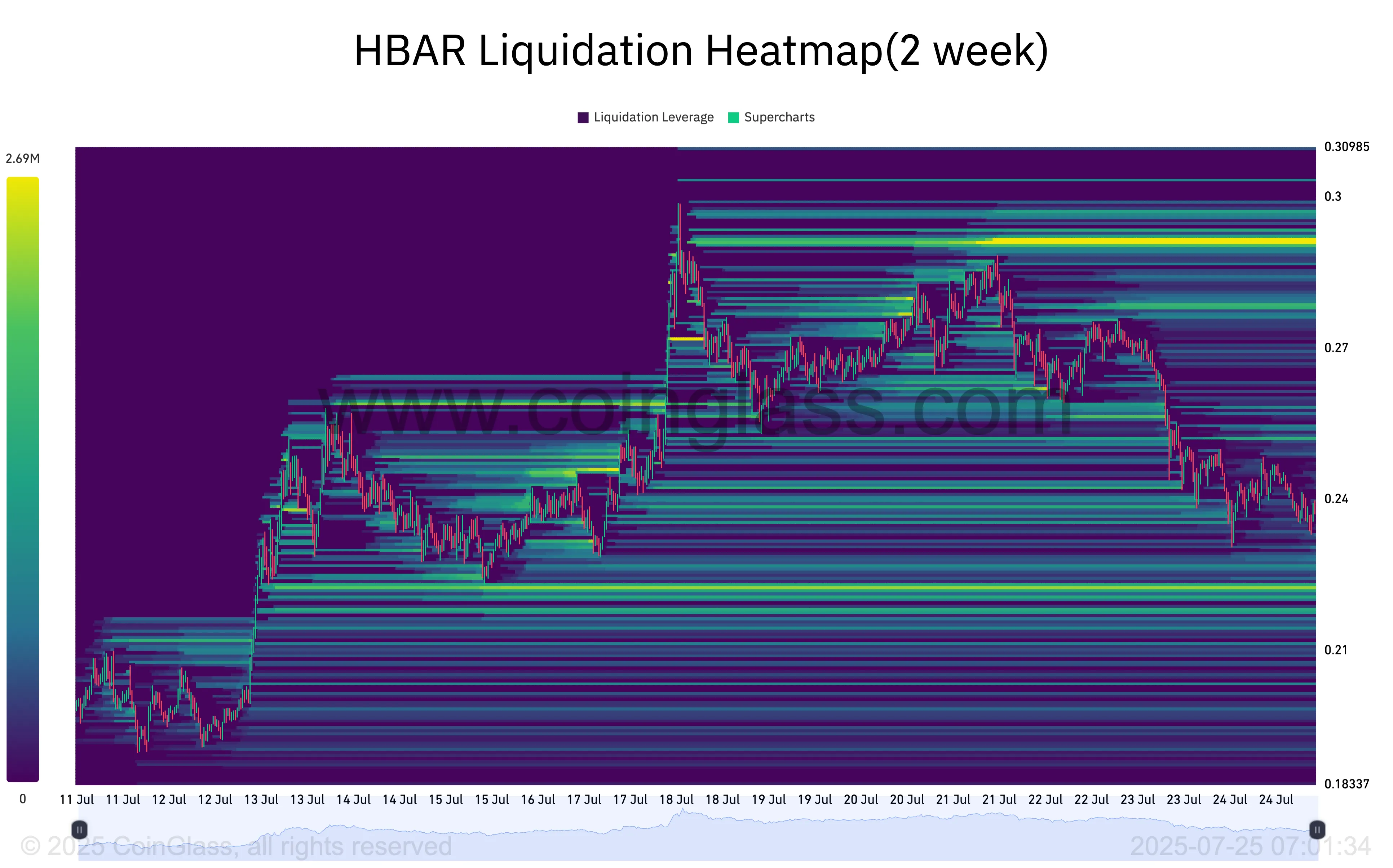

However, not all signals are bearish. Some chain data suggest that a potential reversal may be ongoing. First, the HBAR liquidation heatmap shows a prominent liquidity cluster of approximately $0.29 per Coinglass data.

The clearing heatmap identifies the price range where clusters at leveraged locations are likely to be cleared. These maps highlight areas of high liquidity, often color coded to indicate intensity, with bright zones (yellow) representing greater liquidation potential.

When capital clusters form the current market price of an asset upward, they often attract upward price movements. Traders target these zones to trigger stop losses or liquidation, creating short-term bullish pressure.

For HBAR, this liquidity cluster acts as a price magnet around $0.29, allowing it to increase its assets as the market leverages its pool of orders.

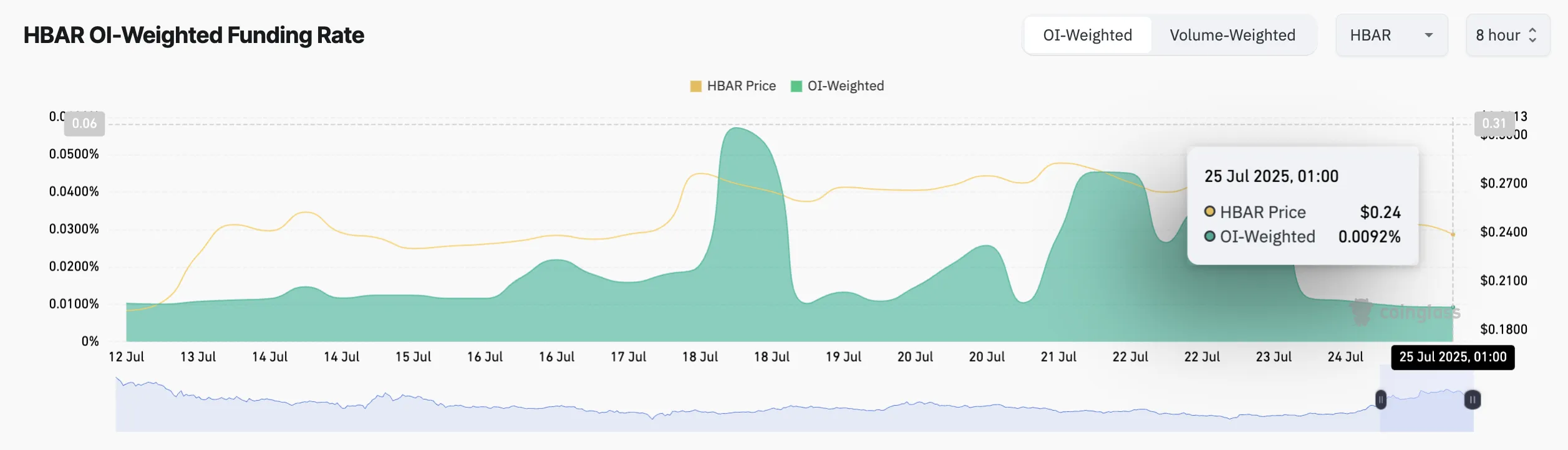

Furthermore, HBAR’s funding rate remains positive despite inactive performance in prices over the past few days. At the time of this writing, this was 0.0092%, indicating the preferences of strengths among futures market participants.

Funding rates are periodic charges paid between long-term and short-traders in permanent futures markets to maintain contract prices along spot prices. If that’s positive, more traders bet on the price of their assets and Longs pays shorts to keep their position.

HBAR’s consistently positive funding rates indicate that even during recent DIPs remains bullish among traders. A steady market situation suggests potential upward momentum.

Hbar’s fate is decorated for 20 days EMA for $0.22

A broader improvement in market sentiment could enhance the dynamic support that HBAR’s 20-day EMA forms at $0.22. If this level is retained, it could act as a launchpad for short-term rebounds towards the $0.26 mark.

However, a critical break below this support zone could expose HBAR further downside, potentially dragging the price as low as $0.18.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.