Hedera (HBAR)’s recent price action has shown a sharp decline of 11% over the past three days. Altcoin is off the Bitcoin (BTC) trajectory, reflecting a shift in market sentiment and weakening investor trust.

HBAR is currently vulnerable to further declines, and the market situation is exacerbating, which has driven outflows.

HBAR investors pull back

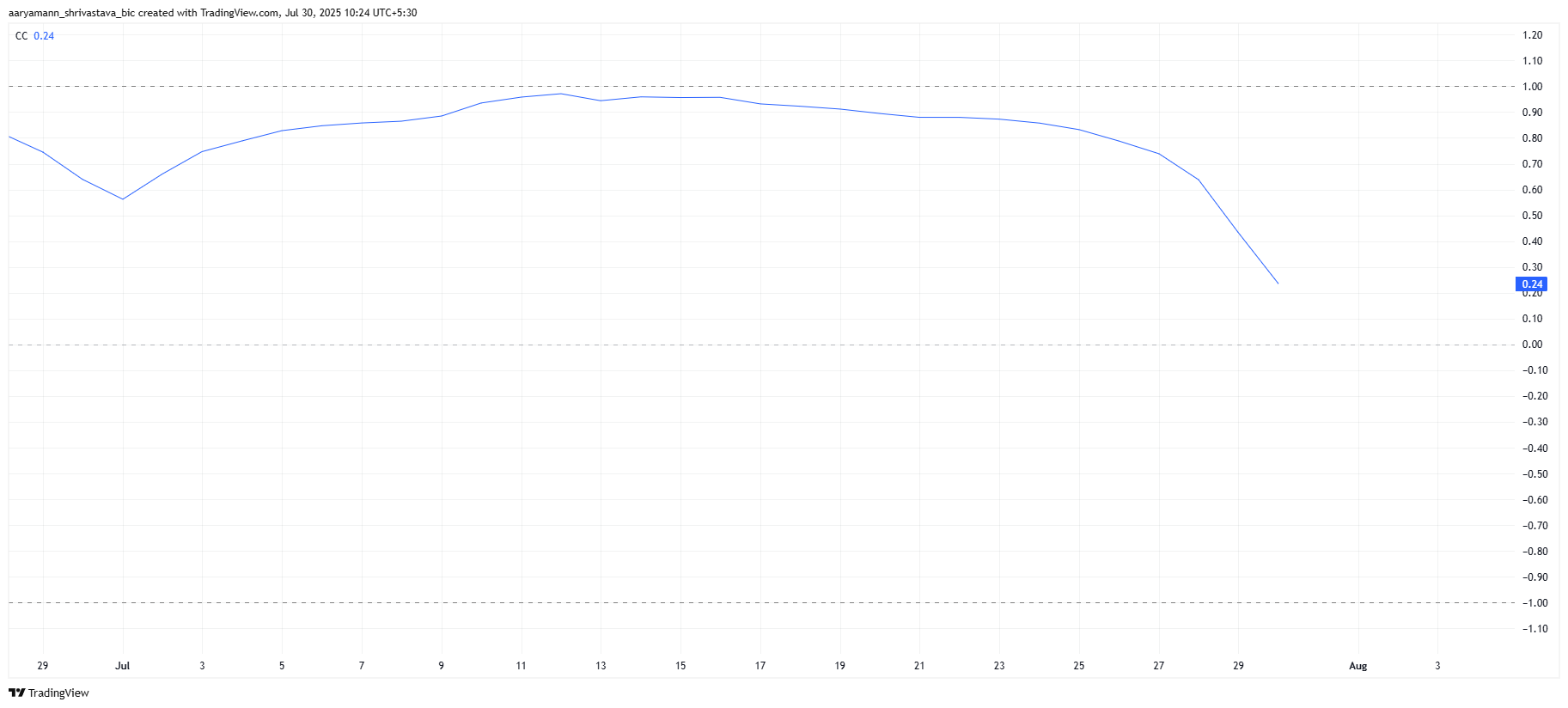

HBAR’s Chaikin Money Flow (CMF) is currently sitting at a low of nearly four weeks near the zero line. This suggests that investors’ outflows dominate, leading to a major shift from accumulation to sales. If it falls below the CMF’s zero line, we will ensure that sales pressure is overwhelming the right to purchase.

Current market sentiment is characterized by investor uncertainty. A weaker reading of CMF emphasizes a lack of confidence in the potential price of HBAR soon. When Hbar faces these spills, Altcoin could face a sharp decline.

HBAR’s broader market momentum is heavily influenced by its correlation with Bitcoin. Currently, the correlation between HBAR and BTC is low for nearly two months. This weakened correlation is HBAR’s double-edged sword, as it can profit from the price drop of Bitcoin, but BTC’s gatherings can have a negative impact on HBAR’s prices.

It is exposed to independent price action as it has decreased connections with Bitcoin. With changes in investor sentiment and external market factors playing a greater role, HBAR prices could experience more ups and downs depending on the direction BTC takes.

Can HBAR rise to $0.30?

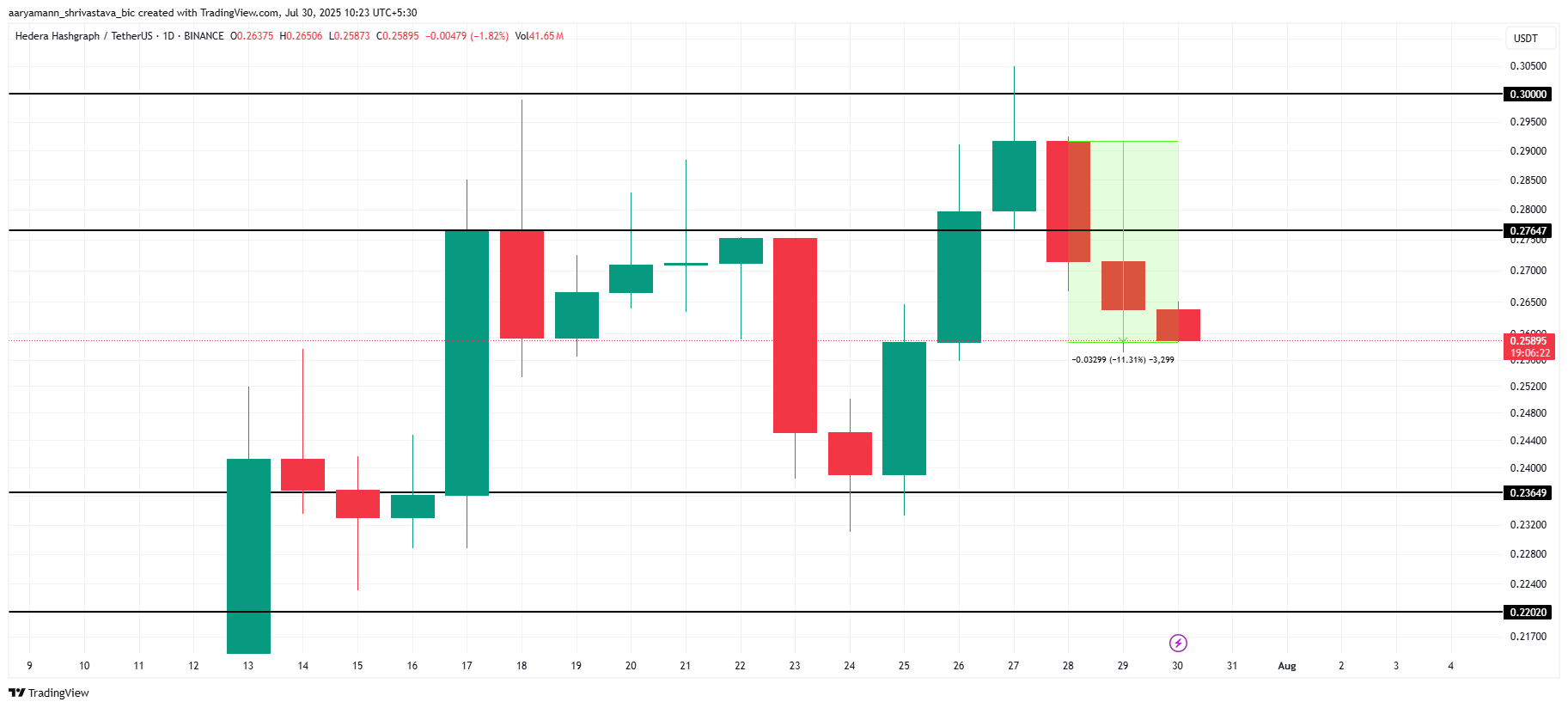

Currently trading at $0.258, HBAR is in a vulnerable position after a recent 11% drop. Altcoin sits just above the main support level and could be reduced even further. In particular, current market conditions and investor sentiment seem likely to result in a drop to a support level of $0.236.

If the downward trend continues, HBAR can continue to consolidate between $0.236 and $0.276. These price levels may provide some stability, but also represent areas of resistance. The long-term integration phase can trap HBARs within this range, with few upward movements in the short term.

However, if the market situation is reversed, HBAR can regain the $0.276 level in support. This opens the door towards a potential price surge towards $0.300. Although it remains uncertain whether this resistance is violated, changes in emotions can drive HBAR to a higher level.

Post-HBAR left Bitcoin’s orbit and due to immediate reaction, prices fell 11%.