Ethereum has seen periods of sideways over the past 10 days, despite the wider cryptocurrency market experiencing significant price drops.

We were able to retain a stable sign, a sign of resilience, but ETH has not yet reached an absolute inversion point. This is important to trigger a wider price shift.

Ethereum has a long way to go

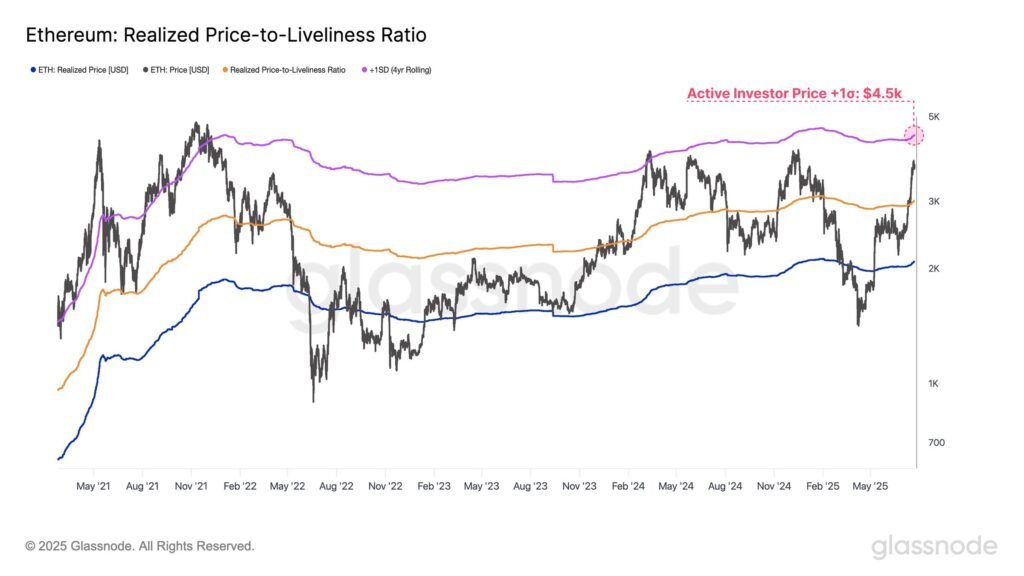

The ratio of realised prices to vibrancy for Ethereum shows signs of a critical threshold for the current gathering. This ratio indicates that Ethereum’s current resistance is $4,500. This is the level that has served as an important barrier in past market cycles. In particular, this price range served as a resistance in the March 2024 and the 2020-2021 market cycle.

Historically, breakouts that have increased risk of structural instability beyond the $4,500 signal market well-being have become important structural pivots for Ethereum. As a result, this price level is not just resistance, but also a potential absolute inversion point for Ethereum.

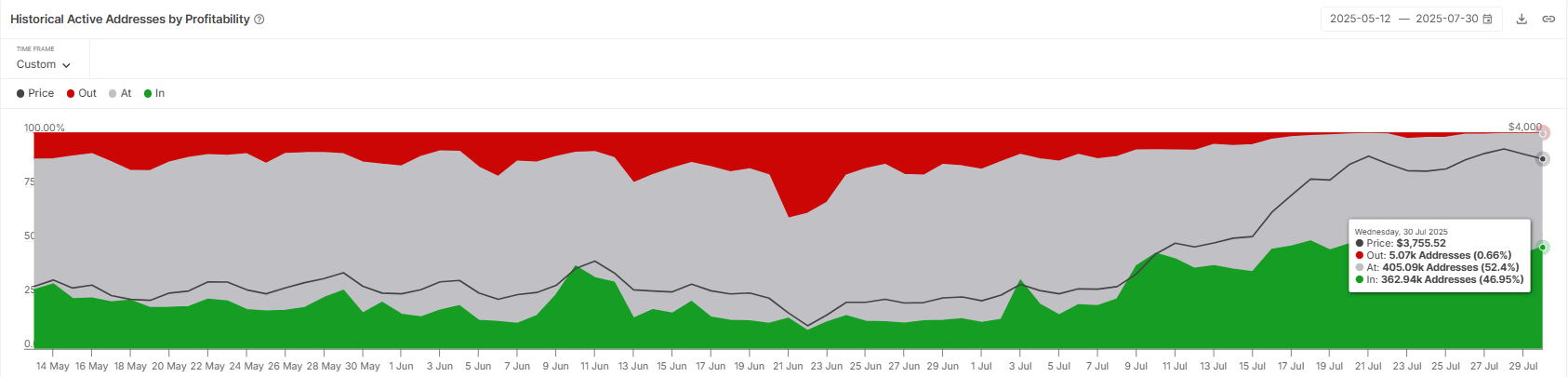

The momentum of Ethereum macros is affected by the concentration of active addresses. Almost 47% of these addresses belong to investors who are currently profitable. This may seem like a positive sign, but in the short term it raises concerns.

Profit investors are more likely to book profits, which could lead to increased sales pressure on Ethereum. This could slow Ethereum’s potential rise and prevent Altcoin from making significant profits in the near future.

ETH prices exceed support

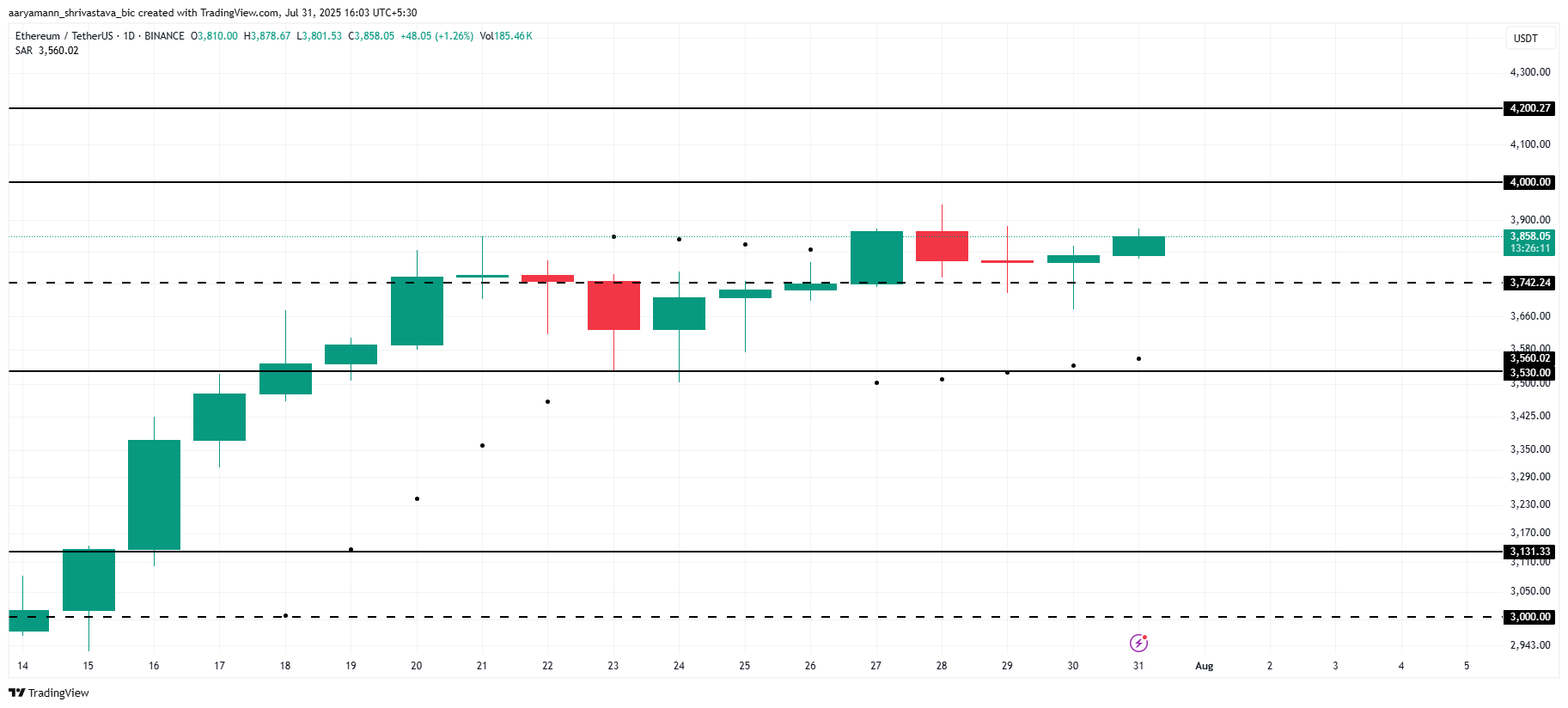

Ethereum is currently trading at $3,858, comfortably surpassing the $3,742 local support level. Parabolic SAR indicators are located under candlesticks to signal active uptrends.

This suggests that Ethereum is currently showing a moderately bullish trend, and could rise further. Given the current market sentiment and price action, Ethereum could move towards the $4,000 level, and in the near future it could support it and push it to a higher $4,200.

However, there is a warning. If Ethereum gets investors’ benefits or sell pressures caused by broader market conditions intensify, the price could slip to a support level of $3,530. If Ethereum falls below this important support, it will invalidate bullish papers and show a reversal of market sentiment.

Although Post Ethereum has been stable amid the decline in the market, $4,500 remains the key inversion zone that first appeared in Beincrypto.