Ethereum (ETH) has recently skyrocketed to seven months’ heights, but cryptocurrencies have not yet violated the psychological level of $4,000.

Altcoin shows impressive growth, but overcoming this important barrier can prove challenging. As investors closely monitor it, ETH’s next move can determine future price directions.

Ethereum is focusing on the top of the market

Currently, 94% of Ethereum’s total supply is profit. Historically, profitable supply exceeds 95%, marking the top of the market. This is followed by price adjustments as investors begin to secure profits. As a result, Ethereum prices could face pullbacks if the trend continues, potentially turning recent profits back.

The market tops often show a saturated bullish momentum, with many investors beginning to sell their holdings. This shift could slow Ethereum upward movement as the market responds to potential saturation.

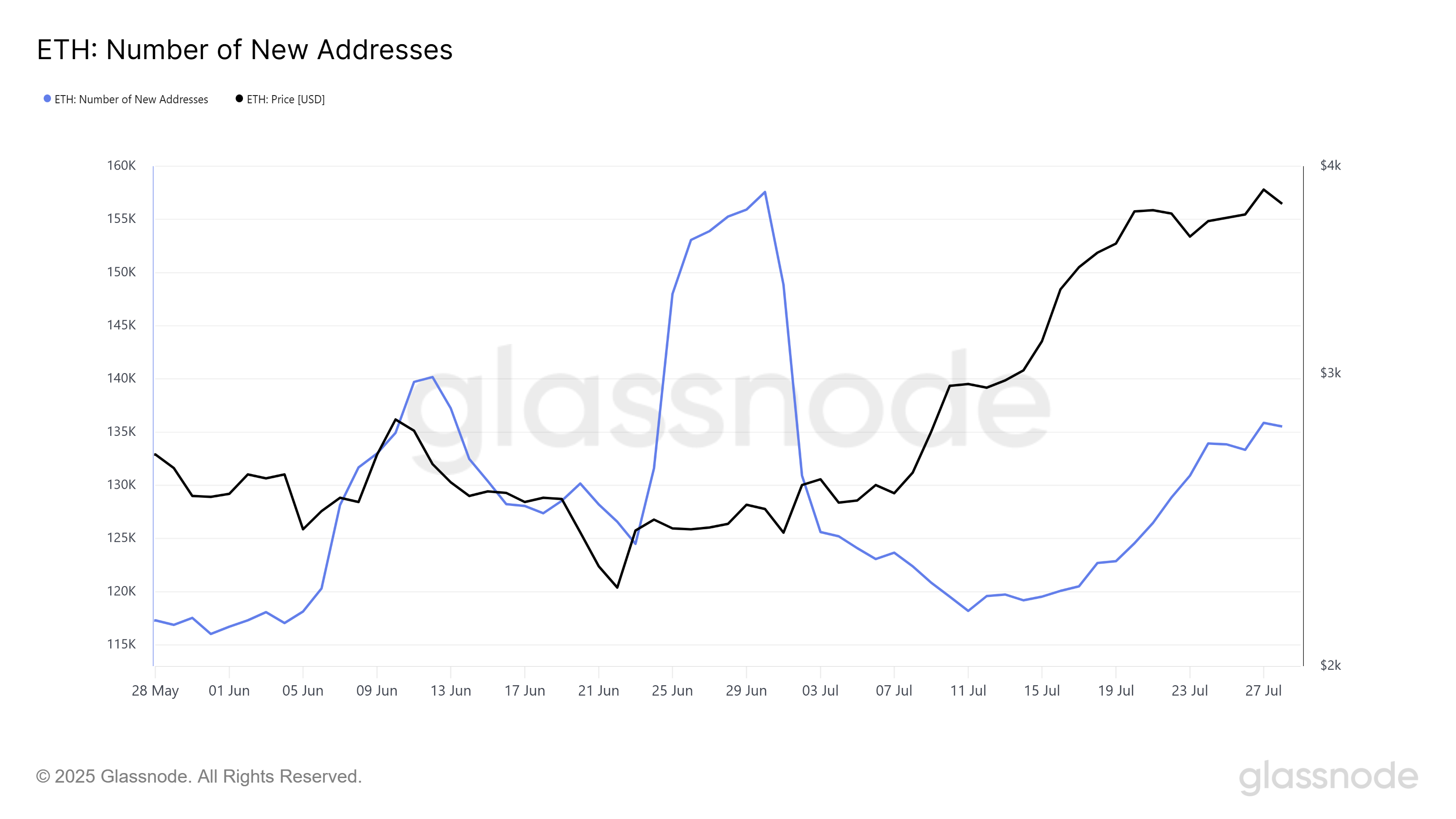

Ethereum macro momentum has seen mixed trends focused on new addressing activities. The number of new addresses skyrocketed earlier this month, but has since dropped sharply. However, recent data shows that new addresses have increased by 13% over the past 10 days, up from 119,184 to 135,532.

If this new address continues to grow, it could counter the impact of the top market, providing Ethereum with support to maintain price increases. New investors will help strengthen demand for Ethereum and reduce the risk of market pulling.

ETH prices require push

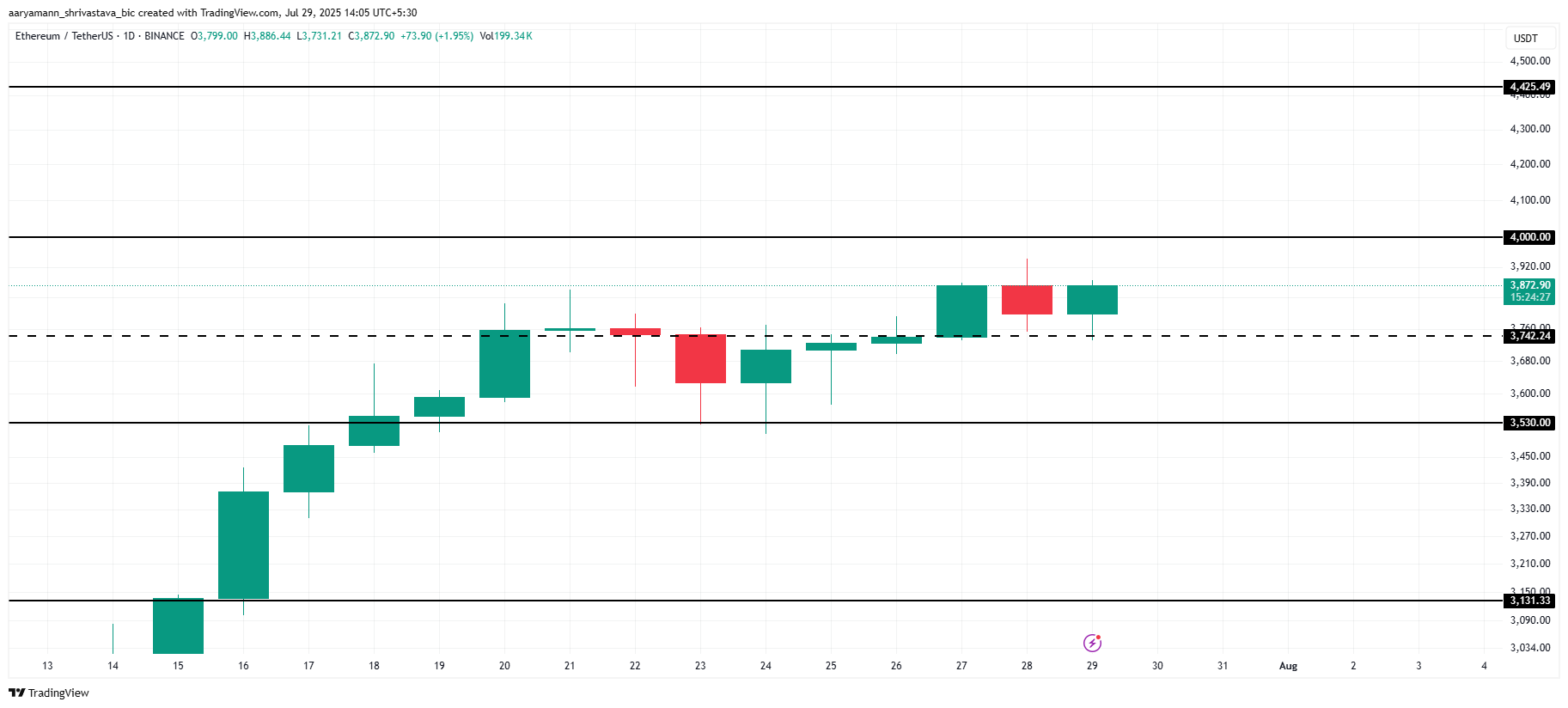

The current price for Ethereum is $3,872 and local support levels are above $3,742. ETH is approaching the $4,000 mark, but has yet to violate it. This resistance could continue to be held, limiting the immediate possibility of Ethereum’s further benefits.

If the market top shows a reversal, Ethereum prices could drop below $3,530. A sudden decline to $3,131 is also possible, erasing much of the recent profits made in the past month. Such a move would negate the bullish sentiment that has fueled Ethereum’s growth.

Meanwhile, if the influx of new addresses continues and strengthens, Ethereum could ultimately break through $4,000 in resistance. If this happens, ETH could potentially jump to $4,425 with a new surge in prices. This disables bearish papers and pushes Ethereum into a new bullish stage.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.