There is a lot of chatter at Ethereum prices. Will it break $4,000 or another collapse brew? The bear appears to have won this round. Over the past seven days, ETH prices have taken over 8.6% and are currently trading at around $3,533, but still have a record high of 27.1% off.

But beneath the surface, the data draws a different picture. It’s possible that your smart money has already set up a trap. Three distinct signals and bullish patterns suggest that Ethereum’s recent failure could only be an orchestrated bear trap.

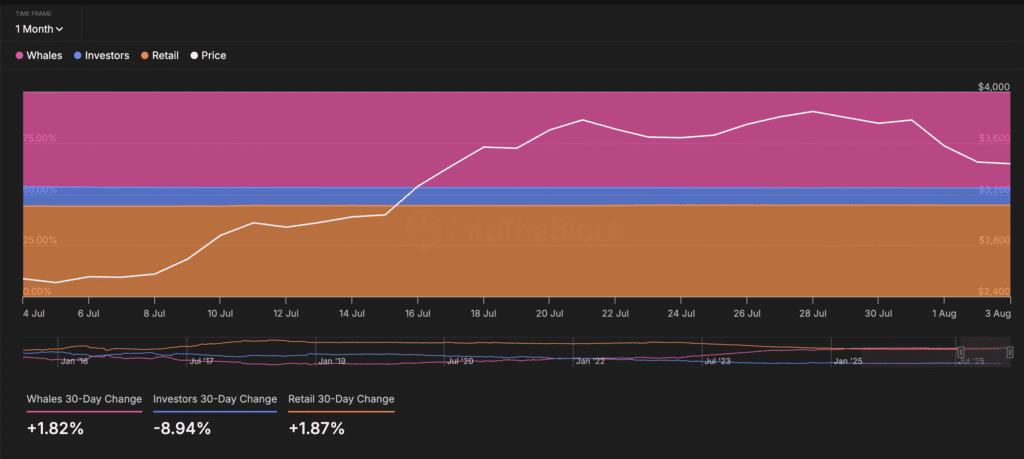

Whale and retail concentrations turn bullish

The first signal is obtained from Ethereum’s on-chain concentration metric. Over the past 30 days, Whale Holdings has risen 1.82%, while Retail Wallets (small holders) have risen 1.87%. In most cases, whales move outweigh investors and retail moves due to the large trade.

And this time, retailers are chasing ETH whales, leaving perhaps investors and medium-sized people in a kind of trap.

Interestingly, medium-sized investor wallets are offloaded and could suggest redistribution towards extremes. Whales and retail are two groups known for having very different motivations, but both seem confident here.

Adding weights to this view is the Intotheblock Bull vs Bear address chart, without using the typical sentiment metrics. Instead, it tracks the behavior of your wallet. Bull buys more than 1% of daily trading volume, while Bear sells at least 1%.

Over the past seven days, the Bulls have outperformed Bears 7: Slim Edge, but are sufficient to suggest certainty, leaning towards accumulation rather than distribution.

About Token TA and Market Updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

Long/short account ratios indicate traders are bullish

Despite sideways action and frequent dips, traders are still not banging bearish. According to Binance’s long short account ratio, Ethereum’s metric is currently 1.91, meaning that there are accounts that are almost twice as long as the short account.

It is important to be careful. This is not the same as the long position volume ratio. Account ratio measures not only the trade size but also the number of user accounts that hold long and short positions.

This data, taken over the past 24 hours, suggests that more traders expect to continue upward, despite prices approaching major resistance. Historically, similar proportions have been held just before major directional movements.

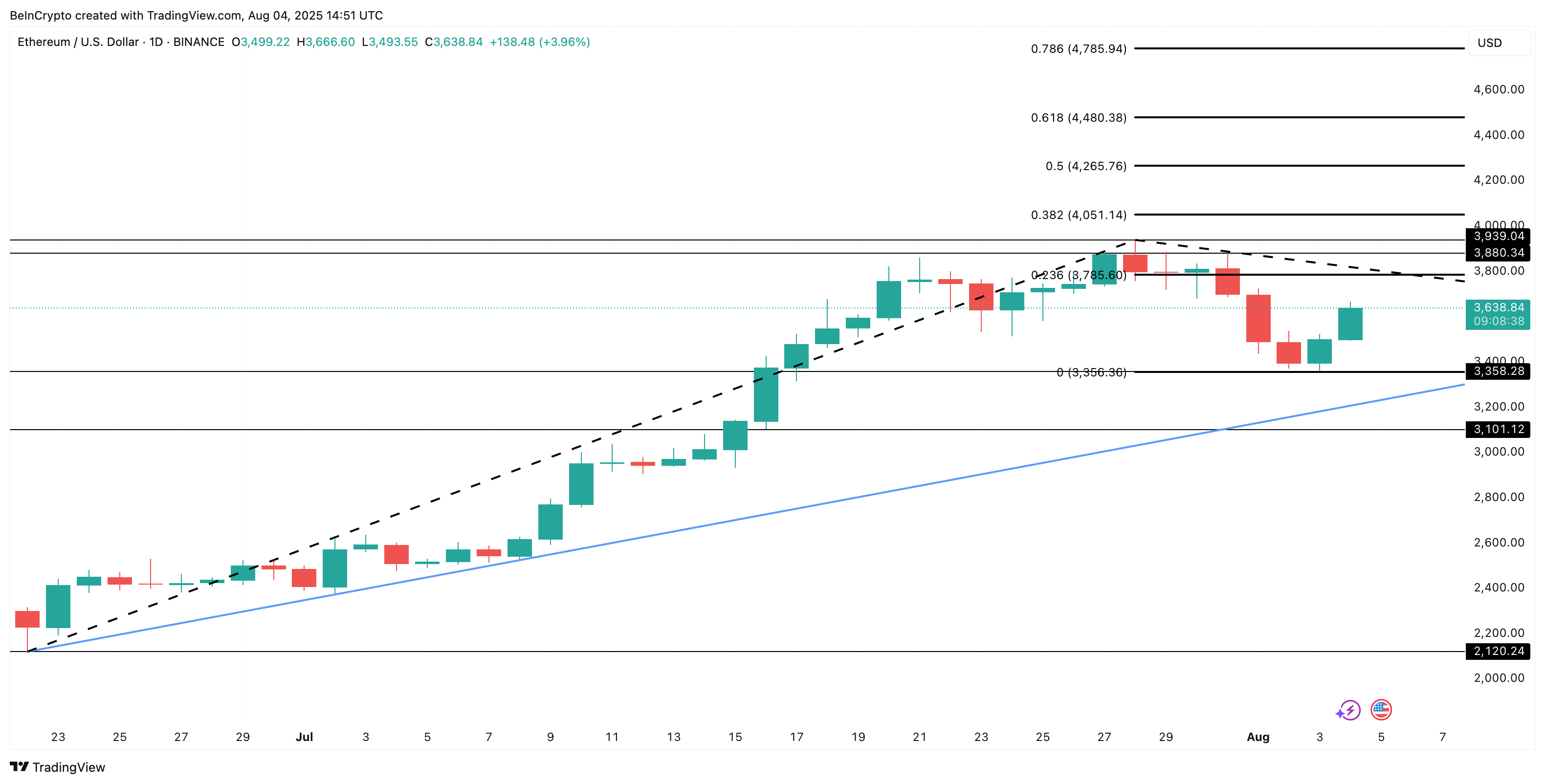

After testing major Ethereum price support, the bullish triangle is still there

The most visually conveying part of the Ethereum price structure is the bullish (rising) triangle pattern of the daily chart. After explosively moving from its low of $2,120 to $3,939, Ethereum entered a tough consolidation range. 0.236 Fibonacci trend extension level, or price level of $3,785, tried to provide support but quickly broke.

A long red candle was followed, corresponding to the time slot when the ETH Short Position took the central stage. ETH SELLIES SELLY SELLIED has intensified a fierce post with traders, assuming even a $3,356 support would break. And guess that support line has been tested temporarily.

The line was tested yesterday and harmonized with smart traders opening short positions. But then the prices would have recovered and already had settled the traders. One bear is trapped!

It is not wrong to assume that many similar short positions have been opened.

However, if your daily candle exceeds $3,785, you only have legs testing ETH prices at $3,939 and then $4,051, and the transition to the latter qualifies as a clean breakout.

But then, if the main support of $3,356 is finally broken, the bullish hypothesis is invalidated

Did Ethereum just catch a bear? The three signals suggest that they may have been first displayed in Beincrypto.