Decentralized Exchanges 101

Cryptocurrency has expanded rapidly, and new methods of trading electronic assets appeared. One of the most talked-about trends is Decentralized Exchanges 101. These websites are altering the manner in which individuals buy and sell crypto in that they eliminate the intermediary and place the owner of the assets in complete control. Unlike traditional exchanges that rely on a central authority, Decentralized Exchanges 101 operate on blockchain technology, where every transaction happens peer-to-peer. Such an arrangement enhances privacy and security besides creating trust among users who would want privacy and control.

What Are Decentralized Exchanges 101?

Decentralized Exchanges 101, often called DEXs, are online trading platforms built on blockchain networks. Users are able to exchange cryptocurrencies with one another directly without giving their money to a third party with their help. You simply keep your wallet and personal keys in your possession. These transactions involve smart contracts which are computer programs that carry out trades when certain requirements are fulfilled and nothing occurs in a sinister manner. DEXs are open-source, so one can verify the operation of such. This transparency assists in developing credibility and trust among the crypto fraternity.

How Decentralized Exchanges 101 Work

When you are making a standard exchange, you keep the money in a wallet of that business. But with Decentralized Exchanges 101, your money stays in your control. You attach your digital wallet to the exchange which is either the MetaMask or Trust Wallet. Then, on the one hand, a smart contract can take your order when you feel like trading. This is to be able to be sure you do not lose your hard copy keys. All the transactions are on-chain versus being off-chain inaccessible to anybody. This is because this kind of setup restricts the possibility of hacking, or committing fraudulent activities, as there is no central server to attack. It is a transparent process that is fast and smooth.

Key Benefits of Decentralized Exchanges 101

- Complete Control of Finances: Clients have access to their funds every time. You do not need to put your money in someone to keep.

- Increased security: No money is kept in a central database, and so, there is nothing that the hackers can steal through the platform itself.

- Privacy Protection: You do not have to provide personal information in order to trade. The purchases are made directly between wallets.

- Global Access: Anyone with an internet connection and a crypto wallet can use Decentralized Exchanges 101 from anywhere in the world.

- Transparency: All the trades are recorded in a blockchain making them fully accountable.

Types of Decentralized Exchanges 101

DEXs exist in various types, and they have different characteristics.

- Order Book DEXs: They are the same as in the traditional exchange, where there are buy and sell orders. Trades are however held between users without human intervention with smart contracts.

- Automated Market Makers (AMMs): The most popular one. As opposed to finding individual sellers and buyers, they rely on liquidity pools. Such platforms as Uniswap and PancakeSwap can be used.

- Aggregator DEXs: These simply draw prices together through a number of DEXs to assist users to immediate seek the most advantageous deal.

Liquidity and Decentralized Exchanges 101

The liquidity is important to any trading platform. It is the ease in which assets can be sold or purchased. In Decentralized Exchanges 101, liquidity comes from users who add their coins into pools. They, in turn, receive some percentage of trading fee. This is referred to as liquidity mining and can therefore persuade more individuals to sponsor liquidity thus facilitating trade easily. The more the users the greater the stability in the prices, and the less the slippage (price variation between trade order and execution).

Are Decentralized Exchanges 101 Safe?

They tend to be safer than centralized exchanges, but that is with regards to the quality of smart contracts used by the platform. Users control their wallets, and they are, therefore, not under the risk of loss of money to exchange hacks. Nevertheless, it is necessary that the user should confirm the authenticity of the DEX before linking their wallets. The frequent audits and high trust to the community combined with the employment of well-known platforms that use open-source codes becomes an additional security measure.

Challenges Faced by Decentralized Exchanges 101

Although DEXs are rather advantageous, they have some issues. The largest one is user experience. A user savvy with decentralized interfaces would get lost with some of the novices. In addition, transaction fee may also increase when there is congestion along the network. There is also the problem of a lack of support of fiat currencies, you cannot trade in it directly using regular money such as dollars or euros. Nevertheless, developers are striving to overcome these hurdles, so that DEXs become faster and less expensive and complicated to operate.

The Role of Smart Contracts in Decentralized Exchanges 101

No decentralized exchange can exist without smart contracts. They also purchase and sell automatically when they attain defined conditions, without the involvement of the middlemen. This automation saves on the human factor, it minimizes cost, and enhances the efficiency. Once a smart contract is deployed it becomes impossible to change it, not even the developers. This immutability comes in and guarantees fairness and transparency in all trades.

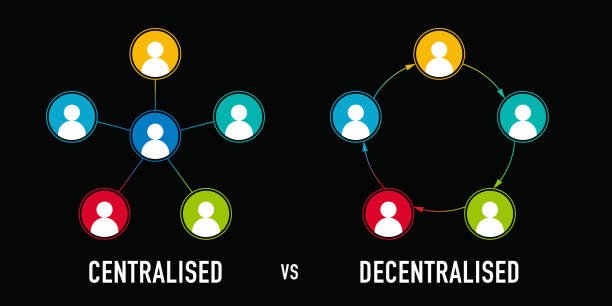

Decentralized Exchanges 101 vs Centralized Exchanges

To see the difference between these two models, we should take them and compare them with each other:

- Control: DEXs provide maximum accountability to the user concerning funds. Your money is deposited with the exchanges that are centralized.

- Security: It is more likely that DEXs can be hacked less as a central storage does not exist.

- Regulation: The centralized exchange is to be guided by strict KYC and AML policies. ParityDEXs, in their turn, are privacy-oriented.

- Speed: Centralized exchanges lack speed slightly, yet the DEXs gain momentum towards new blockchain technologies.

Conclusion: Why Decentralized Exchanges 101 Matter

Decentralized Exchanges 101 represent the true spirit of blockchain — transparency, security, and freedom. They empower the users to have control over their assets and trade without involving third parties. Despite the difficulties that need to be overcome, the rising popularity of DEXs indicates a very obvious transition in the direction of decentralization. Whether you’re a new investor or an experienced trader, learning about Decentralized Exchanges 101 helps you understand where the future of crypto is heading.

FAQs About Decentralized Exchanges 101

Are Decentralized Exchanges 101 better than centralized exchanges?

Yes, they have greater control and privacy as well as security. Nevertheless, the beginners would feel more comfortable using centralized exchanges at the initial stage.

Do I need verification to use Decentralized Exchanges 101?

No, identity verifying is not the prerequisite of most of the DEX. You only need the crypto wallet to begin trading.