After Beincrypto reports US housing credits in light of a Bitcoin-backed mortgage, the colloquial “American Dream” idea may be an upgrade.

Homeowners have long defined economic success in the US, but the growth movement led by Crypto Heavyweights says that even owning 0.1 Bitcoin (BTC) could quickly outperform that milestone.

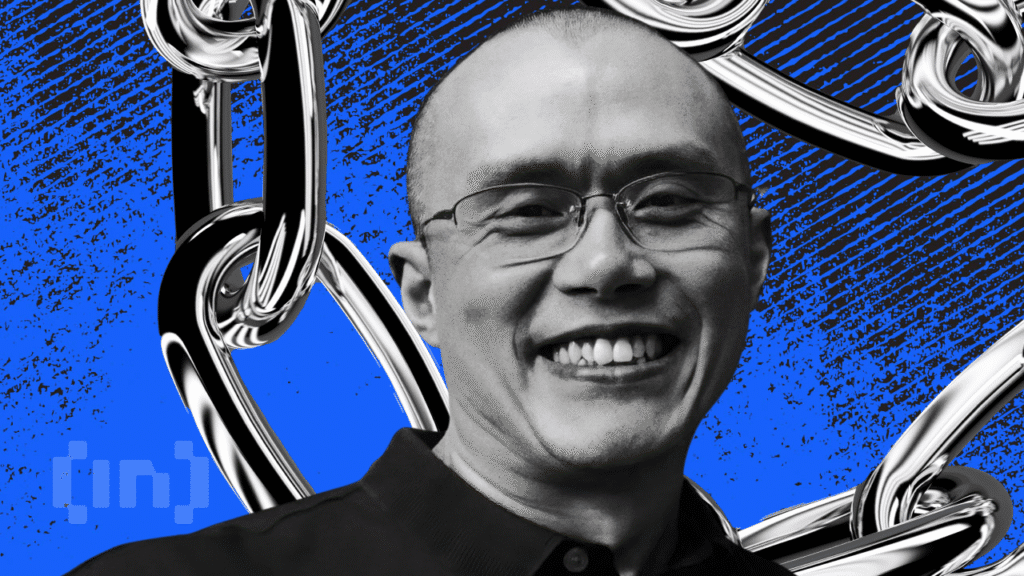

Binance’s CZ says 0.1 btc could make your home abnormal one day

Changpeng Zhao (CZ), founder and former CEO of Binance Exchange, suggested that owning just 0.1 BTC, worth $10,679 at the time of this writing, is one day worth more than a US home.

“The current American dream is to own a home. The future American dream is to own a 0.1 BTC. This will be more than the value of a US home.”

CZ was responding to a post by William J. Prute, a US housing policy officer and code advocate.

According to CZ, this is great. Bitcoin is currently counted as an asset when applying for a mortgage in the US.

Pulte is the director of the Federal Housing and Treasury Agency (FHFA), which oversees key entities such as Fannie Mae, Freddie Mac and Federal Home Loan Banks.

This decision illustrates a fundamental change in US monetary policy. Incorporating this policy, especially with regard to Bitcoin, will increase the popularity of Crypto pioneers among popular investors. More closely, it justifies Crypto as a financial asset in federal housing policy.

“When I bought the house last year, I provided a portfolio summary as proof of Debank’s funds. The banks do not accept such documents, but real estate agents accept documents of cash offers,” one user revealed.

This is in line with a broader trend in digital assets that gain mainstream legitimacy in financial infrastructure, such as Bitcoin ETFs (exchange trading funds) and Ethereum counterparts.

In particular, Pulte has revealed the momentum of the regulations and ordered executives at Fannie Mae and Freddie Mae to provide regulatory changes. After a “productive meeting,” Pulte confirmed that he added code to his US mortgage qualification.

Meanwhile, like CZ, MicroStrategy Executive Chair Michael Saylor sees the move as a Bitcoin foray into America’s dream.

For a long time, Saylor has seen Bitcoin as a long-term valued storage. This latest development highlights its vision and links Bitcoin to basic aspects of middle class life, such as homeownership.

In a recent US Crypto News publication, Beincrypto reported that Saylor offers MicroStrategy’s Bitcoin Credit Framework to calculate credit risk, including BTC price volatility and loan term.

Bitwise’s Jeff Park explains the rise of “Wholecoiner”

Elsewhere, Jeff Park says American dreams are redefine for the younger generation. According to Bitwise’s portfolio manager, becoming a “Wholecoiner” (owning one full BTC) replaces suburban homeownership as a symbol of the economic independence of millennials and Gen Z.

With US home prices rising and weighing heavily on young Americans, the dream of owning property has slipped.

Similarly, student debt is a challenge, and the report suggests a high unemployment rate even when students graduate from the highest institutions.

Meanwhile, Bitcoin, which is trading at $106,796 at the time of this writing, represents an alternative based on rarity, autonomy and global access. The Jumper Learn report reflects this sentiment.

“Owning one Bitcoin is considered a milestone similar to previous generation homeowners, and is fixed in building money and digital autonomy rather than landing,” read the blog excerpt.

Changes in policy reflect broader cultural transformations. Bitcoin is merely an asset and gradually goes beyond becoming a lifestyle anchor, as digital natives prioritize flexibility, decentralization and sovereignty.

Just as Saylor, CZ and Pulte converge around this story, Bitcoin becomes a benchmark for aspirations. Modern American dreams can be measured quickly with satoshis, not the area.

Disclaimer

In compliance with Trust Project guidelines, Beincrypto is committed to reporting without bias and transparent. This news article is intended to provide accurate and timely information. However, we recommend that readers independently verify the facts and consult with experts before making decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.