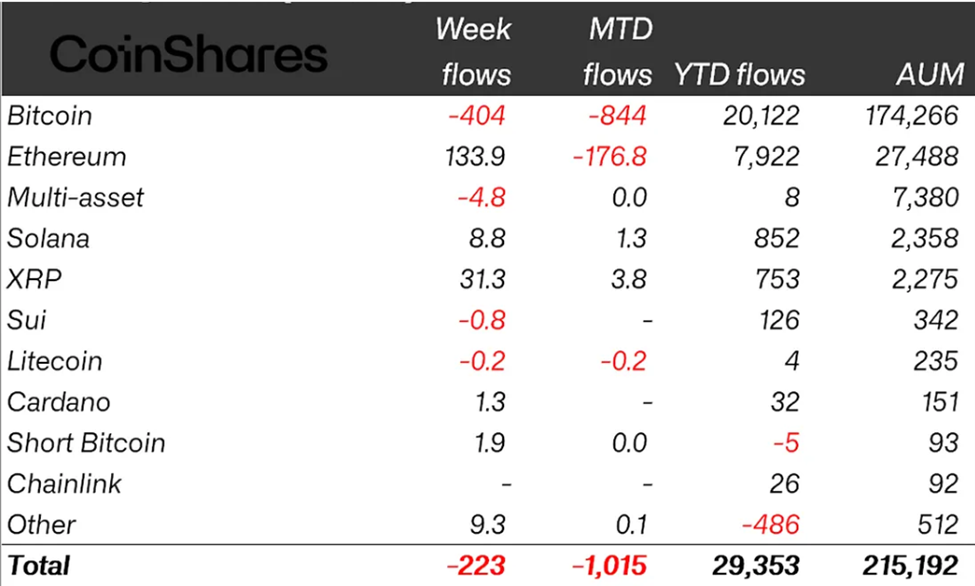

The crypto influx was signed to $223 million last week, shortening the chances of reaching $1 billion after the orbit was made possible earlier in the week.

Following a series of US economic signals, including FOMC, macro data has been better than expected.

Cryptocurrency has flowed nearly $1 billion, but macro data has been reversed to $223 million

The latest Coinshares report shows that crypto influx reached $883 million in the first part of the week, steadily approaching the $1 billion threshold.

However, after Wednesday’s FOMC meeting, the inflow into the digital asset investment program was withdrawn, closing the week for just $223 million.

James Butterfill, head of Coinshares Research, cites FOMC and other macro data, denounces the withdrawal to economic signals last week.

“This week started strong, with an influx of USD 883 million, but this trend reversed later in the week, possibly caused by the Hawkish FOMC Conference and a series of economic data that exceeded expectations from the US,” read the excerpts in the latest blog.

Even more closely, weaker weekend pay data had an incredible implication for the Federal Reserve.

As it happened, the announcement of job cuts in the US jumped above the four-year average, more than doubled the average job cut in July. This background suggests a weakening of labor market data, which could affect the Fed and reduce interest rates.

This turnout has affected general risk-off sentiment, causing code leaks, and recorded negative flows of $1 billion on Friday alone. Beincrypto also reported gaps in US employment data, exacerbating its impact.

Nevertheless, Batafil has also linked a decline in crypto influx to profitable profits after recent market gatherings, with investors cashing for early profits.

“If we look at a net inflow of $12.2 billion over the last 30 days and account for 50% of the inflows in the year so far, we probably understand what we believe is taking minor benefits,” Butterfill wrote.

Meanwhile, last week’s crypto influx showed a significant drop compared to figures recorded in the week recorded by July 26th.

As reported by Beincrypto, Crypto will inflow APPRIt won the $2 billion mark That weekEthereum surpasses Bitcoin at an Altcoin-led rally.

Ethereum expands leads against Bitcoin when Altcoins are charged

Interestingly, Ethereum continues to see Bitcoin from its rearview mirror, managing a positive flow of $133.9 million. Solana and XRP also worked, recording positive trends of $8.8 million and $31.3 million, respectively.

Conversely, Bitcoin has defied this trend and recorded a $404 million outflow or negative flow. This more than doubled the outflow seen in the previous week when BTC flows were negative by $175 million.

Elsewhere, analysts at QCP Capital highlight Bitcoin’s third consecutive Friday sale, pointing to risk-off sentiment in the traditional market.

“… (This is) a confluence of factors: driven by a weaker than expected US employment report and a new round of tariffs from Washington,” wrote an analyst at QCP Capital.

Based on this, the current lull in the market may be related to investors re-adjusting global growth and liquidity expectations.

According to QCP analysts, this will affect the runway into the much-anticipated Altcoin season and cause delays, but not to be completely written down.

“…Even though it’s a pullback, the wider structural setup remains intact,” the analyst added.

Recent pullbacks are post-rally shakeouts, which can wash away excess leverage and set the tone of potentially updated accumulation.

Post-Crypto influx revolved around $223 million in FOMC, with economic data issues first appearing in Beincrypto.