Coinbase Exchange is one of the companies that accelerate the “Saylorization” trend, gradually growing its Bitcoin (BTC) stockpile. With the push to be all exchanges, the platform is also moving forward into tokenized inventory.

However, despite recent fixes, users are unhappy with the platform’s account freeze and suspension.

Coinbase expands Bitcoin Holding to launch a tokenized inventory platform in the US

Coinbase has revealed major strategic moves for the second half (H2) 2025, including a significant increase in Bitcoin Holdings and an ambitious push to tokenized real-world assets.

CEO Brian Armstrong said the exchange acquired an additional 2,509 BTC in the second quarter.

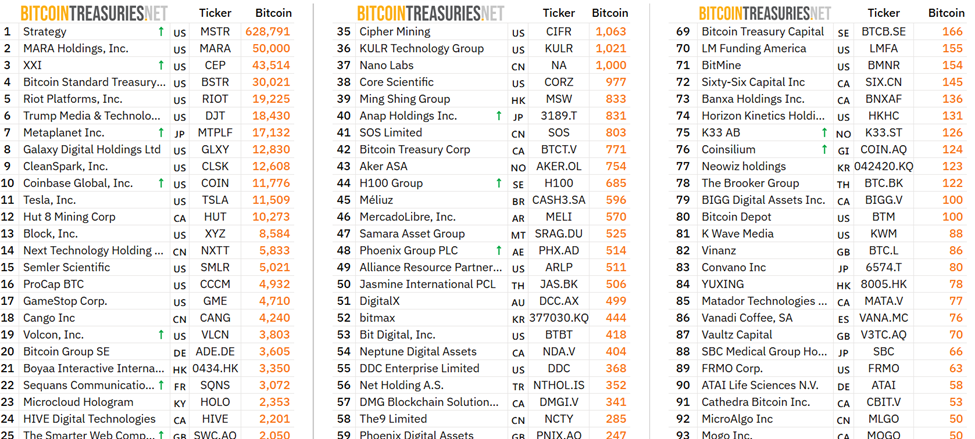

Based on Bitcoin’s Treasury data, this brings a total of 11,776 BTC, with a cost basis of $740 million and a fair value of $1,260 million.

The company’s ambitions go far beyond Bitcoin. Coinbase has announced that it will soon launch tokenized stocks, forecast markets and derivatives for US users. This shows the most aggressive move to build what is called “Everything Exchange.”

“All assets are necessarily moved in chains, so we want to have everything you want to trade in one place,” Armstrong writes.

Speaking to the news site, Max Branzburg, vice president of products at Coinbase, said that exchanges are faster, more accessible and the foundation is building up for a more global economy.

With this move, Coinbase will compete directly with platforms such as Robinhood and Gemini Exchange. In particular, both of these platforms have already introduced tokenized stocks overseas.

Beincrypto was recently reported Among the concerns they present, Robinhood’s tokenized stocks stir up debate Careless competition in Altcoins.

Meanwhile, Gemini has launched EU tokenized stocks featuring stocks such as MSTR.

However, Coinbase aims to lead the US market to gain the symbolism of blockchain under the Trump administration. Similarly, the regulatory momentum is being built through SEC’s newly launched project Crypto.

Coinbase’s upcoming offerings will first be deployed to users, followed by international expansion by jurisdiction.

The roadmap includes tokenized inventory, real-world assets (RWA), derivatives, and early stage token sales.

Coinbase’s Super App Vision raises praise, but there are plenty of censorship concerns

This expanded suite of products is consistent with Coinbase’s goal of becoming the global top financial services app over the next decade.

Two weeks ago, Coinbase launched the base app to consolidate trading, messaging and payments in one place. Some praise the vision, but raise concerns about the risks of control and censorship.

“Coinbase is building chokepoints… everything is chained and once controls move from bank to protocol. But only compliant wallets are allowed. The new system is not free and is filtered,” one user wrote.

Despite these bold moves, Coinbase also faces criticism of the account access issue. Beincrypto recently reported that many users remain locked out of their accounts. Customer support is slow, and complaints are increasing, along with unfair restrictions.

However, Coinbase said it has taken major steps to resolve the issue. Follow-up reports confirmed that we reduced account freeze incidents by 85% after overhauling our internal risk and compliance system. Still, some users remain skeptical.

Coinbase’s ability to balance innovation and user trust is important as it competes to become the go-to platform for encrypted assets and tokenized traditional markets.

While there is a strong confidence that Bitcoin accumulation and strong convictions of RWA push signals, the company needs to prove that it can provide a seamless and fair user experience. This is especially true as regulations, competition and user expectations grow intensified.

Postcoinbase was pushed towards “all exchanges” with Bitcoin purchases, and tokenized assets first appeared in beincrypto.

(@ashrobinqt) July 31, 2025

(@ashrobinqt) July 31, 2025