CFX is the native coin for the Conflux network, which claims to be China’s only regulatory public blockchain, and today has surged 12%, making it the highest token in the entire crypto market.

This rally occurs despite the wider market pullbacks. It appears to be fueled by installing optimism ahead of the Conflux 3.0 upgrade, which is scheduled to be released in August.

Conflux gains momentum ahead of the 3.0 tree graph upgrade

CFX is surged in double digits today as excitement builds around upcoming mainnet upgrades. At the recently concluded Conflux Technology & Ecosystem Conference, the network has announced details of Conflux 3.0, Codenayed Tree-Graph, which is scheduled to be released next month.

The Tree-Graph upgrade introduces parallel processing blocks that increase blockchain throughput to over 15,000 transactions per second. It also integrates Conflux with the Artificial Intelligence (AI) industry by enabling calls in the chain of AI agents.

Additionally, this upgrade lays the foundation for network cross-border trade and real-world asset (RWA) tokenization.

The expectations of these enhancements and the belief that they significantly increase Conflux’s usefulness and adoption have led to a surge in investor demand. This renewed interest has increased the value of CFX amid growing investor attention.

CFX shows strong rally potential with bearish fades

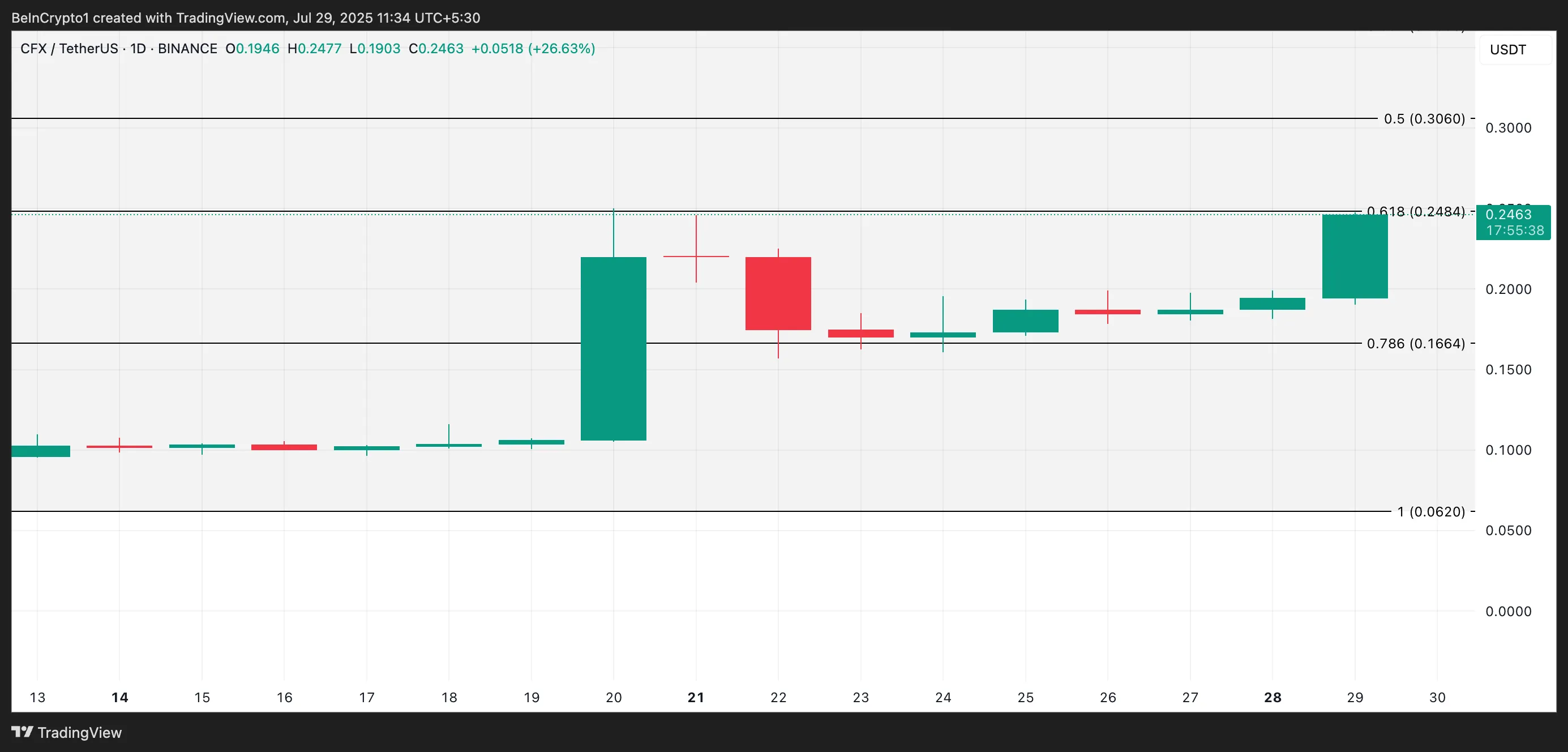

On the daily charts, CFX trades beyond its West Kaiun major spans A and B, reflecting bullish sentiment among coin holders. Currently, these lines form dynamic support levels below $0.1811 and $0.1550, respectively, the prices of the CFX.

About Token TA and Market Updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

One-sided cloud tracks the momentum of asset market trends and identifies potential support/resistance levels. When assets trade above this indicator, they exhibit strong bullish trends and upward momentum. Market sentiment is positive and if it is held beyond its support zone, assets can continue to rise.

The area above the cloud is a bullish zone, indicating the market’s positive sentiment towards CFX. If this trend holds, the coin can post new profits over the next few trading sessions.

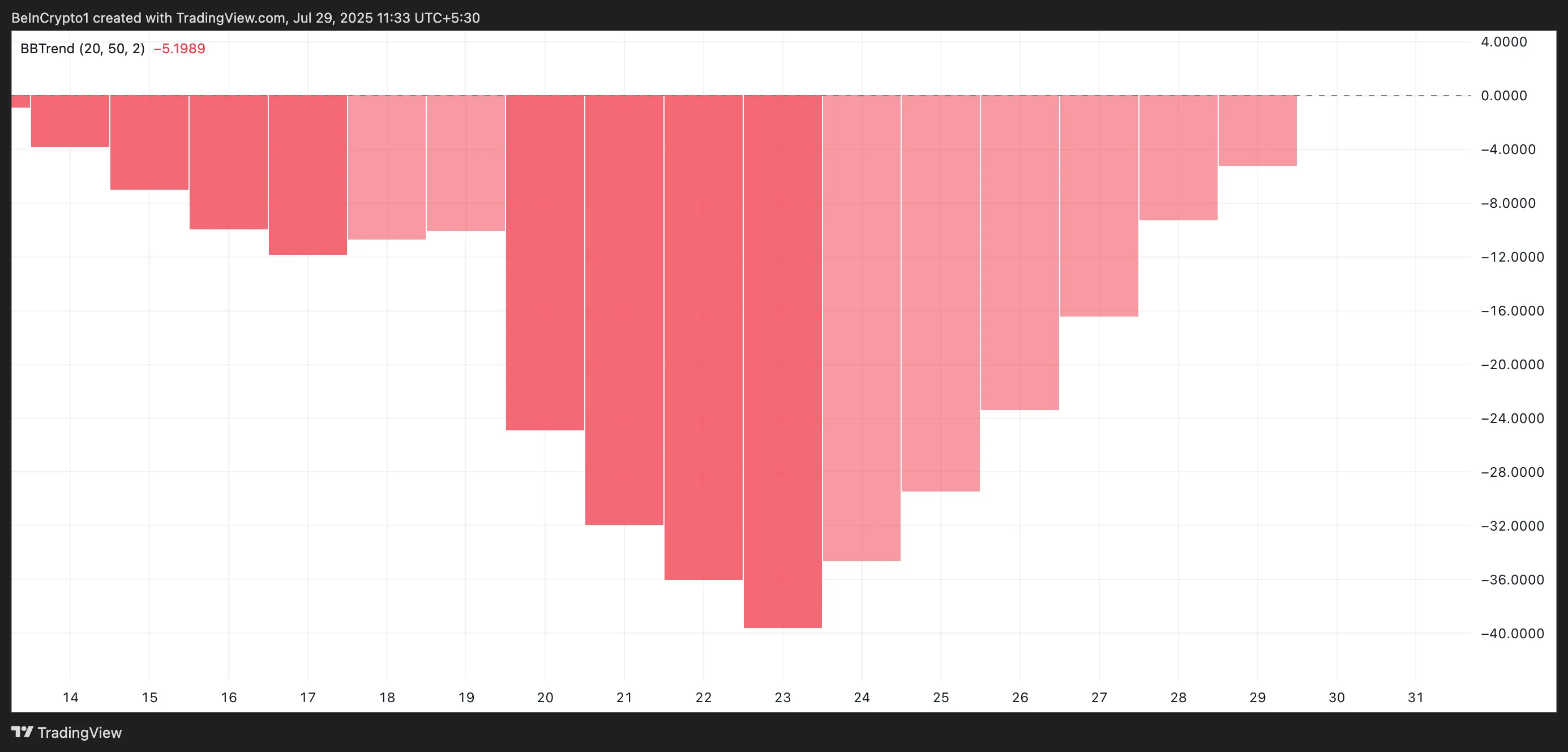

Additionally, daily measurements of CFX/USD indicate that the red bars on the BBTREND indicator are beginning to shorten. This indicates a waning bearish pressure and could pave the way for potentially sustained price growth.

The indicator measures the intensity and orientation of the trend by analyzing price movements compared to the Bollinger band. Shortening the red bar will weaken the market’s bearish momentum.

This marks the potential beginning of a new bullish phase in CFX. Particularly because it comes with other positive metrics such as increased trading volume and positive price performance.

Can the bull push the $0.24 barrier to $0.30?

CFX is trading just below the long-term price barrier formed at $0.2484. Due to the pressure of the climbing buy side, if this resistance violation is successful, the CFX could cost $0.30.

However, this bullish outlook is void once profits begin. In that case, the value of the CFX could drop to $0.1664.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.