Cardanoprice has not escaped selling the broader market. Cardano prices have fallen 7.6% in the last 24 hours, trimming much of its recent profit. However, on a monthly scale, the ADA is still up 28.6%, with traders getting caught up between optimism and fear.

Behind the scenes, a bigger battle unfolds. Super Whale sells, retailers remain bullish, while short sellers are piling up the derivatives market. All three forces can pull the ADA in different directions to determine who will ultimately be on top.

Super Whale Trims Retention as Network Activity Decreases

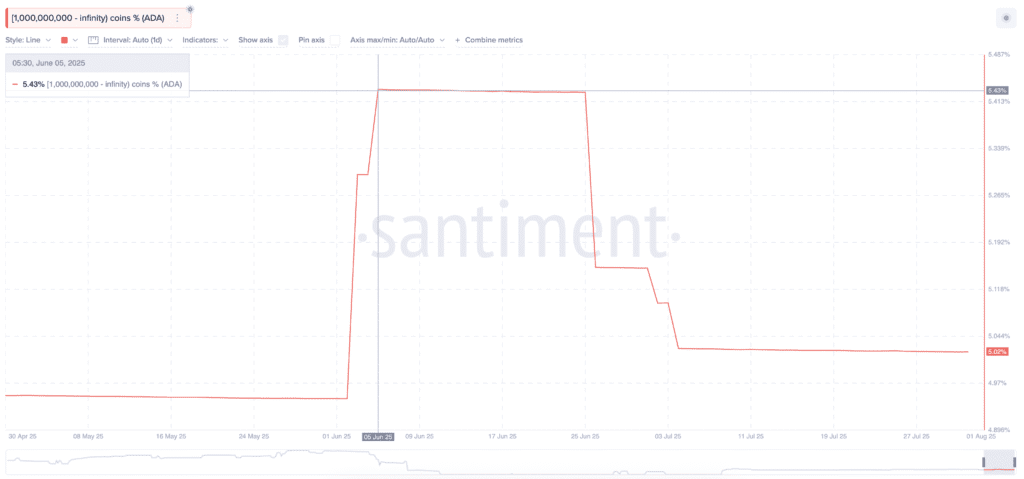

On-chain data shows Cardano’s biggest wallet, held from 1 billion ADA to infinity, cut its holdings to 5.02% from 5.43% in late June, showing a clear bearish slope from key players. The percentage of DIP is not read very often, but even a half decrease in whale holdings is a big deal.

In addition to this pressure, the active addresses of the Cardano network are sliding according to the monthly chart. The address has peaked on July 18th, exceeded 40%, at 42,000.

This drop coincided with ADA Price Dip as Peak preceded the local top 0.92. The drop in address may be one reason for whales’ indifference.

About Token TA and Market Updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

Retailers stay bullish and short pressure builds up

Despite whales reaping stocks, retailers are confident. Netflows in exchange have been negative for several months. Usually this is bullish. It indicates that the owner has accumulated and is not on sale.

However, derivative traders are with whales. Bitget’s 30-day liquidation map shows a short position of $141.7 million and a long position of just $74 million. This is a clear bet that there is more space in the price of the ADA. And these traders are clearly bearish. This illustrates a three-way battle featuring whales, retail and leveraged traders.

If whales continue dumping, the shorts are controlled, the adas are lower and the more liquidation can be forced. But a sudden, short narrowing led by retail sentiment, managed to flip the script and win optimism.

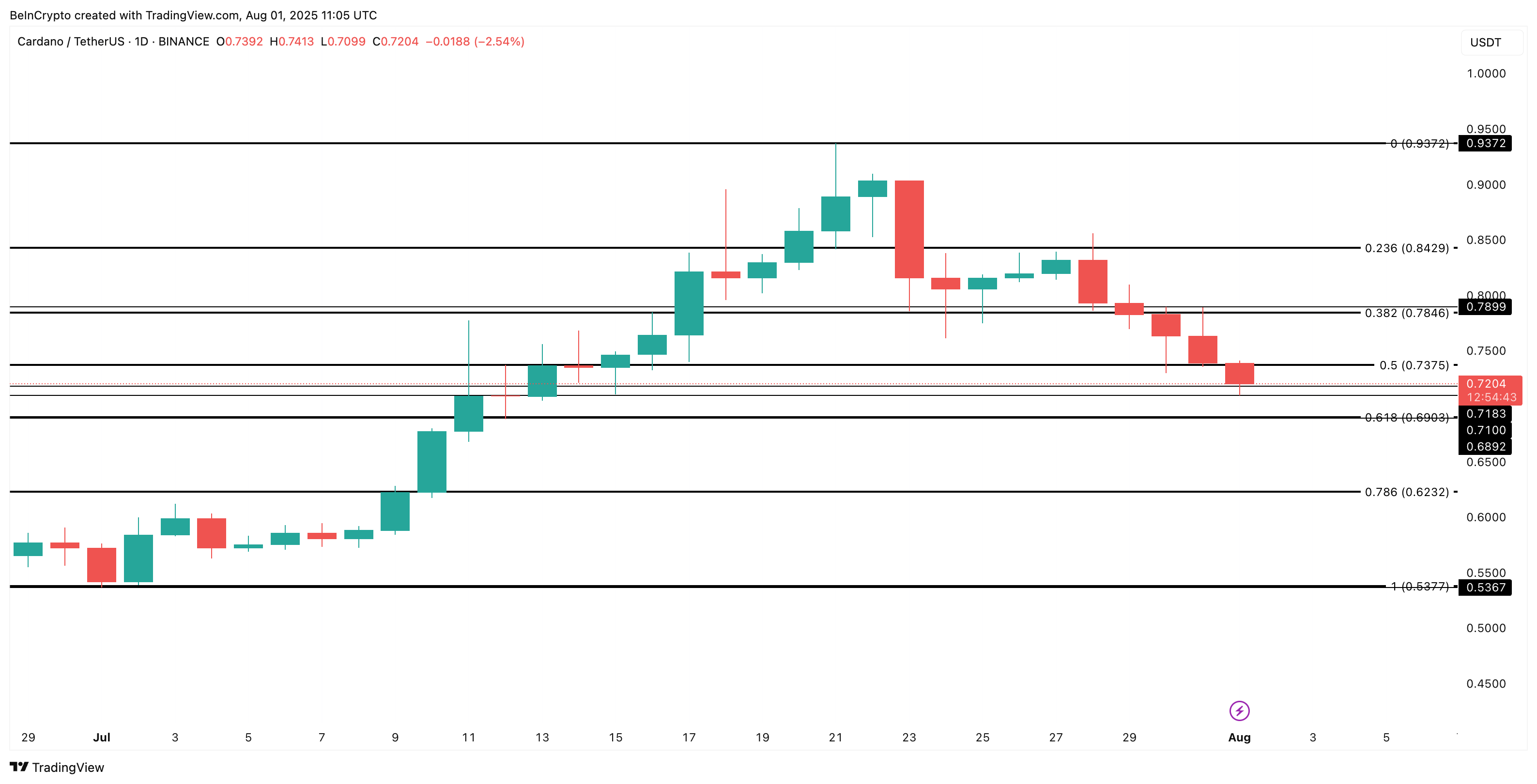

Focusing on important Cardano price levels

The ADA considers it to be close to important support levels at $0.71 and $0.68. A breakdown could drag the price to $0.62, matching the bearish whale in a short position. Based on the liquidation map, a drop to $0.62 will settle what remains in the long position.

However, once the Bulls regain $0.73 and $0.78, momentum could return upside down, negating the bearish hypothesis. It could then push towards $0.84 and $0.93 in favor of retail. It will also settle short positions.

For now, the market remains a standoff as whales trimming, retail owners cling to, derivative traders await profit breakdowns. One factor is whether short-focused positioning causes pressure or puts pressure on them, and it can quickly decide who will win this fight for Cardano’s next big move.

Retail – Price of Post Cardano (ADA) caught up in Whale Crossfire: One factor was able to determine who first appeared in Beincrypto.