The price of Bitcoin (BTC) recently surged to a new all-time high (ATH) at $123,218, but today it traded at $117,500 and faced a small dip. US CPI is expected to increase by 2.7% year-on-year in June, so there is likely a decline due to forecasts surrounding future inflation data.

Nevertheless, current investor behavior reflects ongoing optimism, but market conditions show concern about potential pullbacks.

Bitcoin observes support from the spot market

Spot volume has skyrocketed 50% since July 9th, showing strong interest in purchasing Bitcoin. This increase is a sign as the rally is not driven solely by derivatives, but rather the volume of futures increases by 31.9%. These figures show a growing interest from spot investors, but both volumes are below the early 2025 (YTD) average.

Spot volume averages 23.4% for YTD, with futures below 21.9%, indicating that market participation has improved, but remains relatively cautious compared to the beginning of the year.

Despite the positive growth, investors are still hesitant. Care has been paid to institutional traders and retailers, particularly due to slow volume growth in futures.

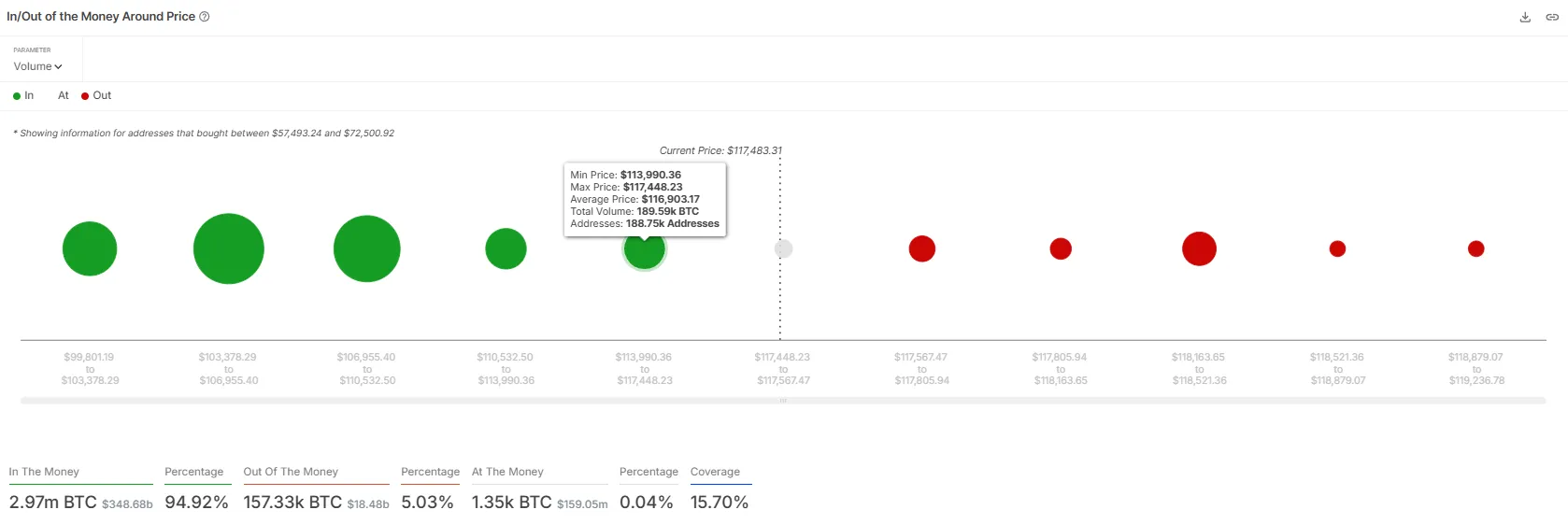

Looking at the momentum of Bitcoin’s macros, IOMAP (outside the money above the price) reveals a key demand zone between $114,000 and $117,500. Over 189,590 BTC has been purchased within this range, which amounts to over $22.3 billion.

This accumulation means that many holders have purchased at these levels, meaning that they are unlikely to sell at loss. This demand zone is extremely important as it creates a cushion for Bitcoin prices, making it less likely that cryptocurrencies will fall below this range. When prices approach this level, they can trigger buying activity, strengthen Bitcoin’s upward momentum and provide confidence to traders.

Can BTC prices bounce back?

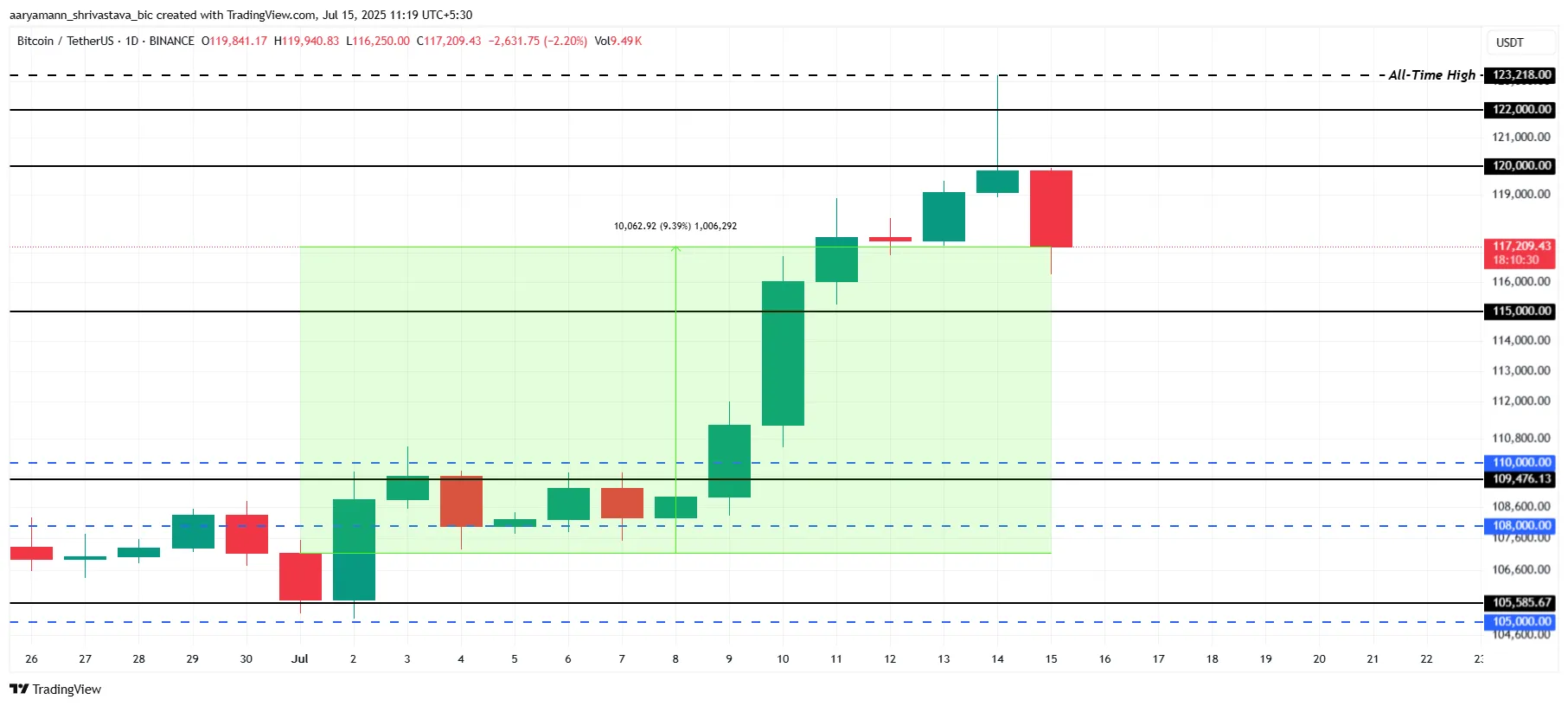

Bitcoin is currently trading at a recent all-time high of $123,218 to $117,209. Nevertheless, cryptocurrency has risen by around 9% since the beginning of the month.

The above factors suggest that Bitcoin can rebound in the next few days. However, before bounce this level of support and pushing it towards $120,000, it may initially drop to $115,000. This move could follow established market patterns.

However, market concerns are rising ahead of the upcoming US inflation report, with the hope that the Consumer Price Index (CPI) will rise from the previous year at 2.4% from the previous year at 2.7% in June. This potential increase in inflation can lead to financial tightening, which can negatively affect risky assets such as cryptocurrencies, leading to the possibility of DIP.

As a result, Bitcoin could fall below $115,000 and even to $110,000. Such a decline has negated current bullish papers and suggested a deeper market correction.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.