Bitcoin prices have skyrocketed above $116,000, registering a new all-time high, surpassing the May 2025 peak. However, unlike last time, this assembly has a strong institutional tailwind.

South Korea’s K Wave Media reportedly acquired 88 BTC as part of a massive $1 billion financial plan. The problem now is that this BTC price breakout can avoid the same fate as the May meltdown at $98,000. Decode your on-chain data and chart data.

The exchange inflow volume decreases. Where can I find the sale?

According to Cryptoquant, Bitcoin exchange inflows plummeted to just 32,000 BTC per day, the lowest since 2015 (at the time of writing). In December 2024, the number was around 97,000 BTC during the breakout of the $100,000 Bitcoin price.

That’s been significantly reduced. Even with this new ATH, the owner simply hasn’t moved to exchange coins. A clear indication of low selling pressure and assets trust.

Exchange inflows usually track the number of coins sent to exchanges for sale. The sharp drop here shows confidence. Whales and retailers should at least not leave yet. And that alone makes dumps like May less likely structurally.

Additionally, in an interview with Beincrypto, interim CEO of Ziliqa, Alexander Zahnd, the company said momentum appears to be real.

“In the short term, momentum appears to be real. Institutional demand is rising, ETF inflows are strong, and businesses continue to add bitcoin to their balance sheets,” Zahnd told Beincrypto.

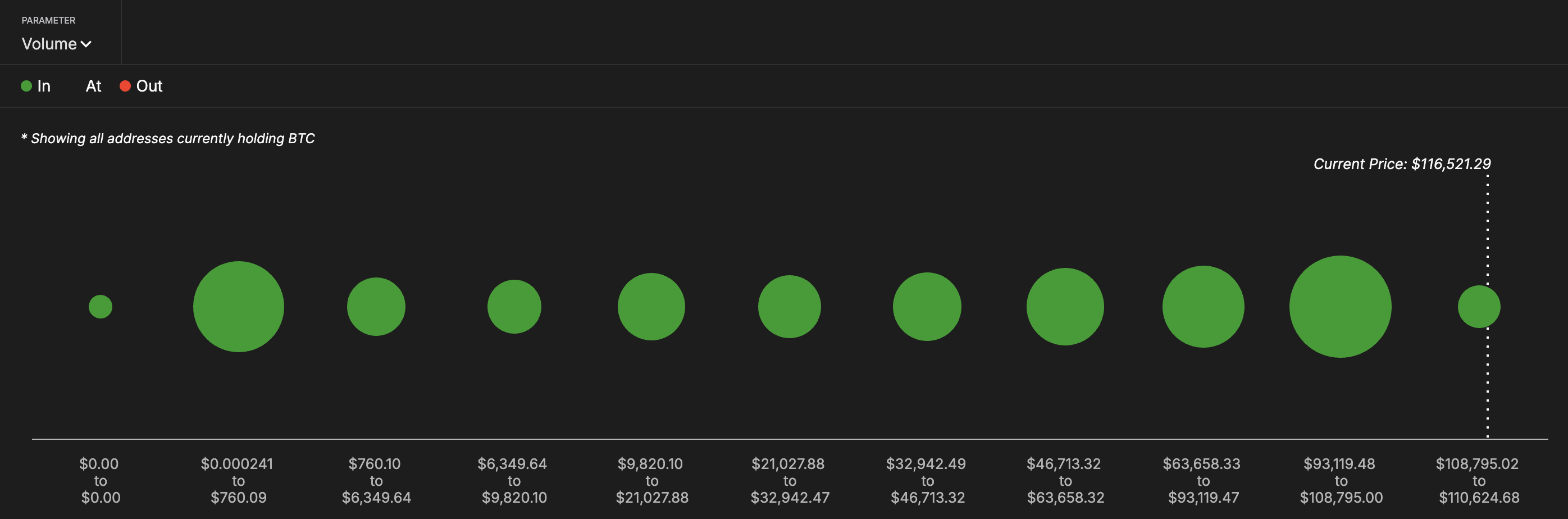

Wallet cluster supports Bitcoin prices

Next, let’s talk about defense. According to IntotheBlock’s In/Out of Money and Money About Price (IOMAP) metrics, over 645,000 addresses purchased BTC between $108,795 and $110,624. This is 476.65K BTC near current levels, forming a major barrier to demand.

Prices collapsed in May as the support zone quickly cracked. This time, if Bitcoin stays above this address cluster, it means that the short-term buyer is still green. That strengthens confidence.

IOMAP indicates the status of a buyer in the past and whether it is profit (in money) or loss (in money). When large address clusters overlap with price ranges, these regions act as important support or resistance.

RSI Divergence says “caution”, but still there is no panic

This is the risk. BTC prices continue to score highs, while the relative strength index (RSI) produced lower highs. This can often precede the fix.

However, the RSI remains under the overheating zone (under 72 years old) unlike May, which was spiked to near 80. This is the important difference. Divergence exists, but we have not yet reached a level of panic. So, while a large revision seems unlikely, you can expect a retracement.

RSI tracks momentum. The difference between price and RSI indicates a declined belief. However, it is not over-bought yet, so there may still be fuel left in the current uptrend.

Trend-based Fibonacci levels provide clear upward targets

As BTC enters price discoveries again (the lack of historical reference lines), trend-based Fibonacci extensions help to express potential resistance.

From a swing low of $74,543 to a May peak of $111,980, take the next level of resistance, taking into account the retracement to $98,000.

0.382 for $112,439

0.5 $116,857

0.618 for $121,274

1.0 for $135,576

Bitcoin’s latest wick is consistent with a 0.5 Fibonacci expansion at nearly $116,500, suggesting that if Bitcoin’s price exceeds this resistance level, it could pave the way towards $121,000 and $135,000. These levels act as guide posts for continuance, but only if momentum is maintained.

Bitcoin is currently above the May high, supported by lower selling pressures, clear institutional purchases and strong support clusters. Fibonacci’s roadmap suggests more room for the upside.

However, caution is required. A divergence of RSI has appeared. If the price loses momentum below $109,632 (one of the main support levels), this breakout could lead to another May-like retracement, potentially overriding the bullish hypothesis. Let’s see if Bitcoin can turn this ass into a sustainable rally.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.