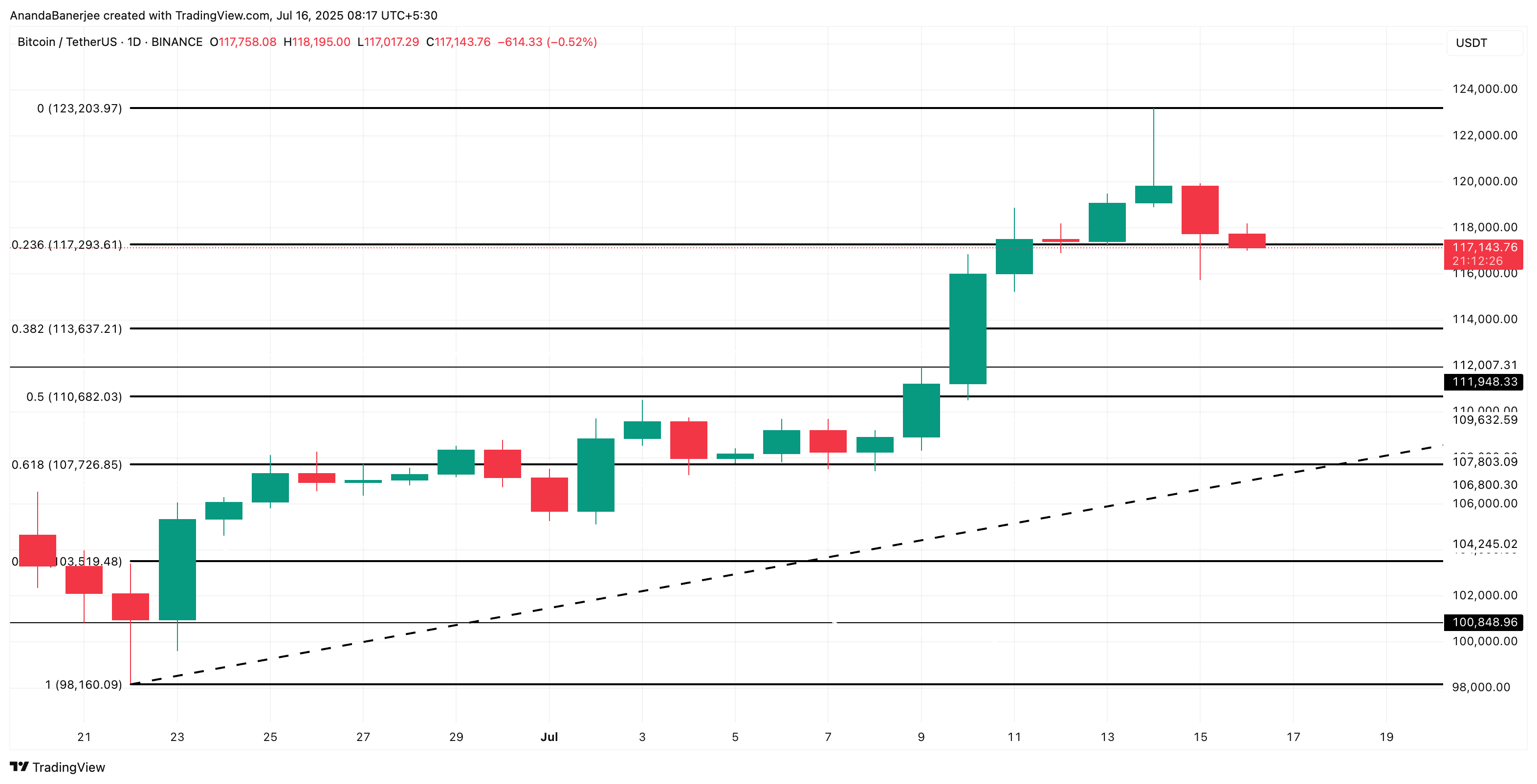

After CPI printing on July 15th, Bitcoin faced a wave of fresh inflow pressure. Prices have already been revised from $123,203 to $117,143 to $117,143, down 4.9%.

With bearish signs retreating buildings and buyers, many suspect that 8% of the dip is still at the table.

Exchange inflow signal mount sales pressure

Data from Cryptoquant shows that over 80,810 BTC moved to central exchange on July 15th. This will allow over $9.4 billion in Bitcoin to enter the platform.

Exchange inflows usually reflect an increase in sales interest. When a large amount of BTC moves from the wallet to the exchange, it is often the holders prepare for off-roading, especially when combined with weakening of price action.

Accumulation Zones Provide Support

GlassNode’s heatmap shows the previous powerful purchase zones in strong purchase zones between $93,000 and $97,000 and $101,000 and $109,000. These are the range of BTC seen high wallet activity, meaning that many investors bought in bulk. This creates a “accumulation cluster” where prices tend to find support during pullbacks.

Of these, the $107,000-109,000 range is particularly important. It’s located near where BTC traded sideways for several days. If Bitcoin continues to fall, this zone is where the dip buyers have returned.

These accumulation zones represent areas with strong historic purchasing activities, which could serve as natural support in downtrends.

Bitcoin’s price structure is weakened. Still dipped 8% on the table

Bitcoin currently trades around $117,143, sliding off its all-time high of $123,203. This nearly 5% drop marked BTC below the 0.236 Fibonacci retracement level at $117,293. This was the first important support zone after the top.

Fibonacci’s retracement levels are derived by measuring the distance between the market’s recent lows and highs. In this case, it ranges from nearly $98,160 to $123,203 from the low swing in June. These levels help you identify where prices are pulled back during the trend.

Looking further down at the Fibonacci ladder, the next important level is the $107,726 0.618 retracement. This level is widely seen as a “golden pocket” where assets often bounce back during healthy pullbacks.

There are mid-level levels at 0.382 ($113,637) and 0.5 ($110,682), but based on the structure of candles and lack of historical purchasing activity in these areas, it may fall outside the critical accumulation zone and provide limited support as BTC continues to decline.

What further strengthens the $107,726 zone is to be directly aligned with the aforementioned accumulation clusters of between $107,000 and $109,000.

If Bitcoin’s price drops from the current price to this 0.618 level, it represents an additional 8% drop. This is a realistic target given the surge in exchange inflows and structural declines. This overlap between FIB levels and previous purchasing activities brings the most likely area the bull will try to defend $107,726.

However, this scenario is invalidated when the price regains a level of $117,293 while experiencing dips in exchange inflows. There is a sustained recovery that could restore bullish momentum and bring the $123,203 peak back to view.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.