Bitcoin (BTC) prices responded to US Consumer Price Index (CPI) data that showed inflation fell below target in July.

This comes as US President Donald Trump’s tariffs continued to be stabbed, allowing the Federal Reserve to be tied down.

Inflation rose by 2.7% per year in July, according to CPI data

The U.S. Bureau of Labor Statistics (BLS) released CPI data on Tuesday, showing that in July U.S. inflation rate rose at 2.7% per year.

This shows a similar reading to June inflation data, with Beincrypto reporting at 2.7%.

Despite falling below the expected 2.8%, this CPI print suggests that US inflation remains high. This highlights previous reports, which showed that the high inflation component of the US inflation basket increased to 40% in July 2025.

The data also show a weighted share of CPI components growing faster than 4%, suggesting sustained inflationary pressures despite recent declines from the 60% peak in 2022.

Together these data suggest that tariffs’ price pressures are more clear.

Bitcoin responded to the US economic signal, recording a modest increase to approach $119,000. Given that the CPI met economists’ expectations and thus reduced concern, a calm response was brought about as the market was already affecting it.

Similarly, Ethereum prices have risen, reaching the $4,400 mark after a surge of over 5% over the last 24 hours.

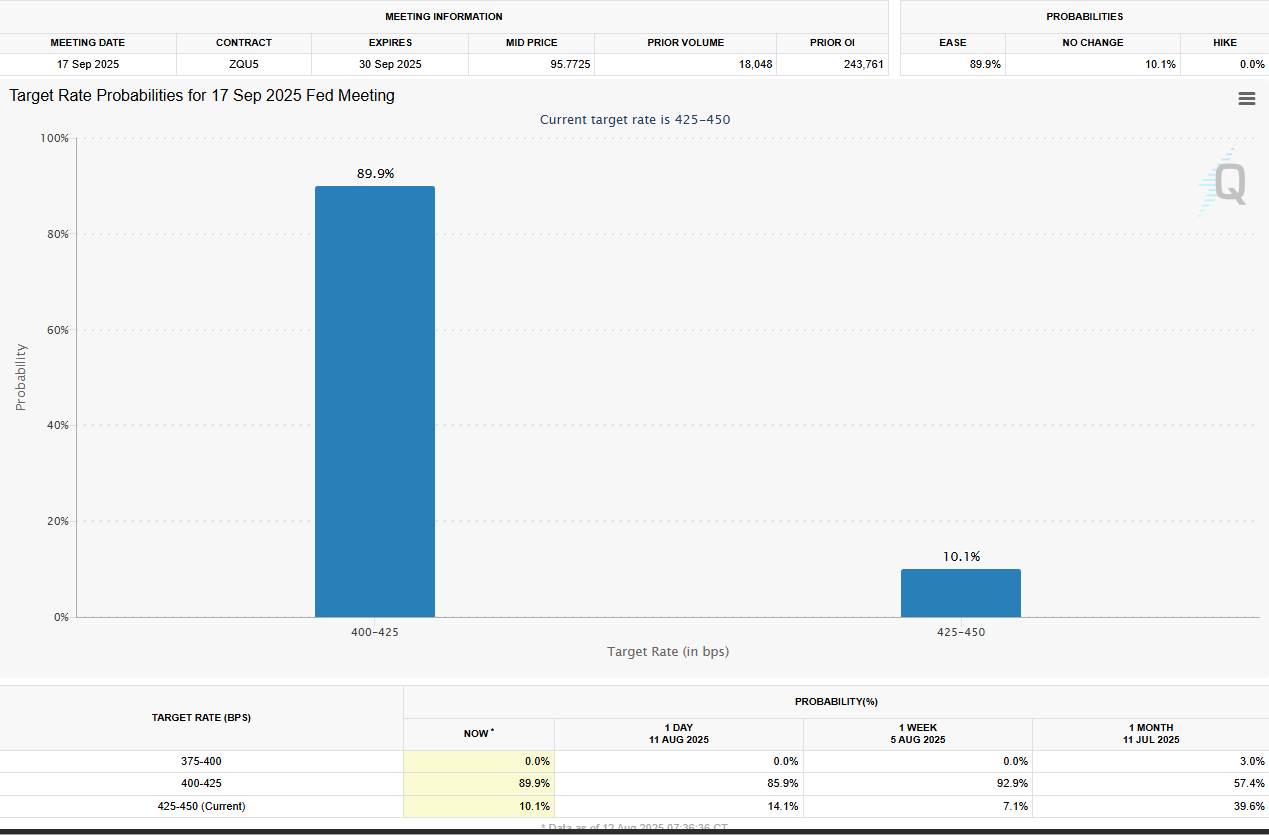

Once the crypto market digests CPI prints, all eyes are in the Federal Reserve (Fed). Interest bettors see a 90% chance that policymakers will cut their fees in quarterly basis points (BP) in September.

Before the US CPI, the CME FedWatch tool reduced the 84.4% chance of interest rates to 4.00-4.25% with a 15.6% chance of a stable rate of 4.25-4.50%.

In fact, today’s CPI report is a big deal before next month’s Fed meeting. With inflation rates of 2.7%, the chances of interest rate reductions in September remain high.

The Fed maintains a cautious outlook and is stabilizing interest rates as its 2% inflation target remains elusive.

However, despite the latest CPI prints, their firm attitudes can change amidst the vulnerability of the labour market and are therefore bound.

Hopes for the Fed rate in September follow bad employment data showing signs of weakening the labour market. Despite rising inflation in the US, policymakers may be forced to lower fees to pursue a double mission.

Price stability (2% inflation target) and maximum employment.

Against this background, analysts had anticipated a muted response to Bitcoin prices after CPI printing.

“The Fed will have to cut fees in September due to poor job data, so it doesn’t really affect the Fed’s decision because of the high CPI. A decline in CPI only increases confidence,” writes analyst Bull Theory.

Analyst Miles Deutcher has repeatedly expressed sentiment, saying the Fed will cut interest rates in September.

When US CPI inflation data lands under the target, the first appearance in Beincrypto will climb Post Bitcoin.