Ethereum is not just a coin you can trade any more. For the past three months, ETH prices have exceeded 100%, with July alone increasing profits of nearly 50%. But what’s even more interesting about Ethereum’s 10th anniversary is that people no longer just chasing the price charts. They are chasing the yield.

ETH pumps sparked activity across staking, retouring, synthetic yield hubs and even funding rates. Simply put, these are ways to not only hold or trade it, but also get a passive return on ETH. Billions are parked in protocols designed to squeeze extra returns from the same ETH, and the data proves that.

As Ethereum prices rise, betting demand rises

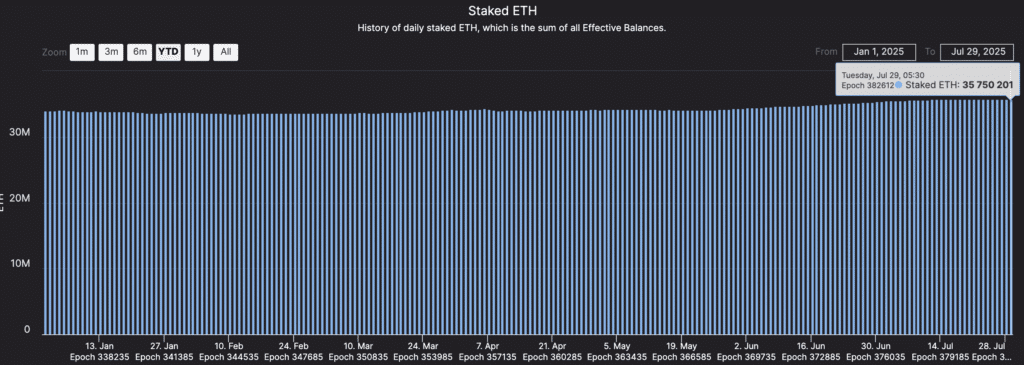

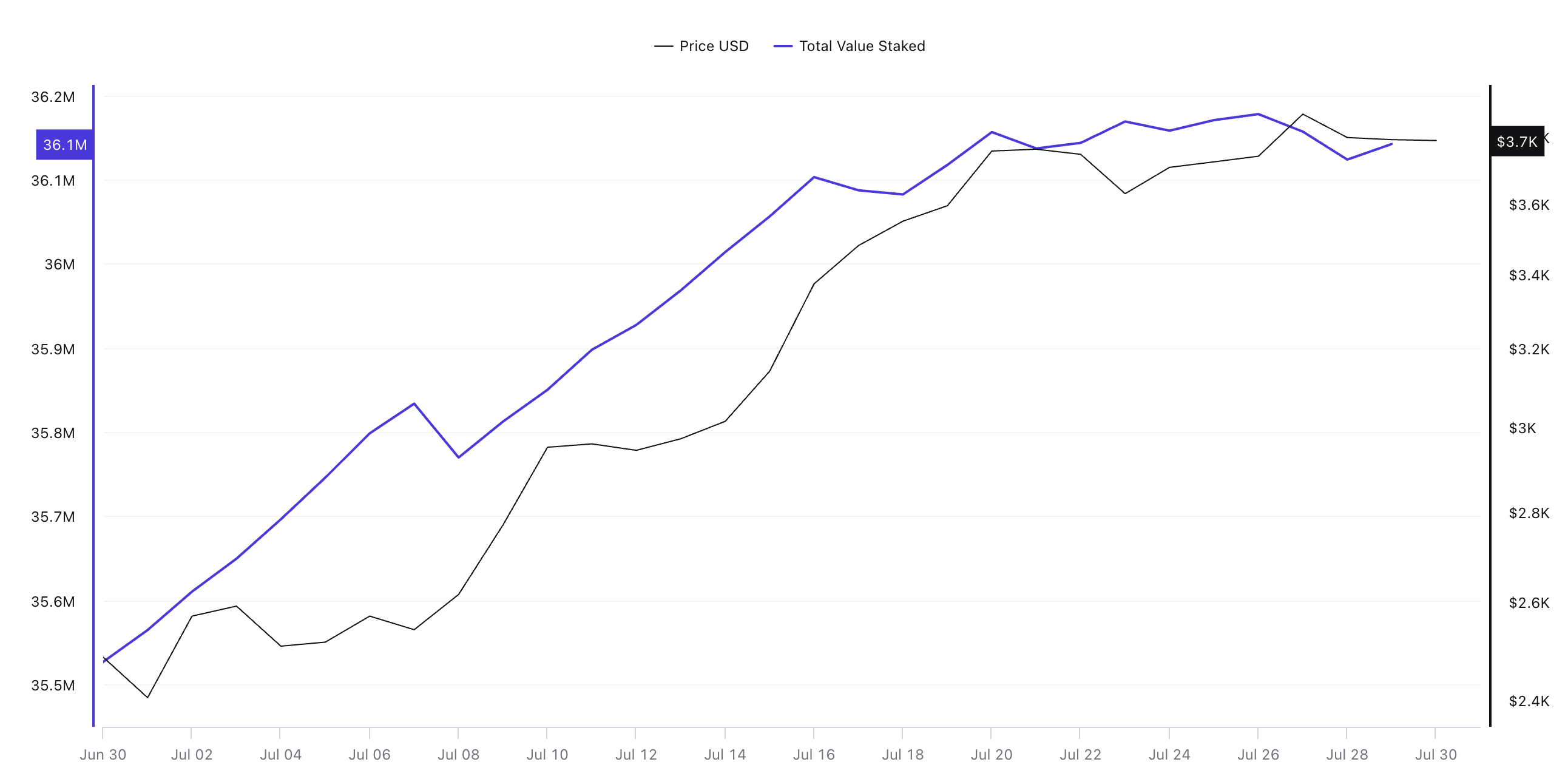

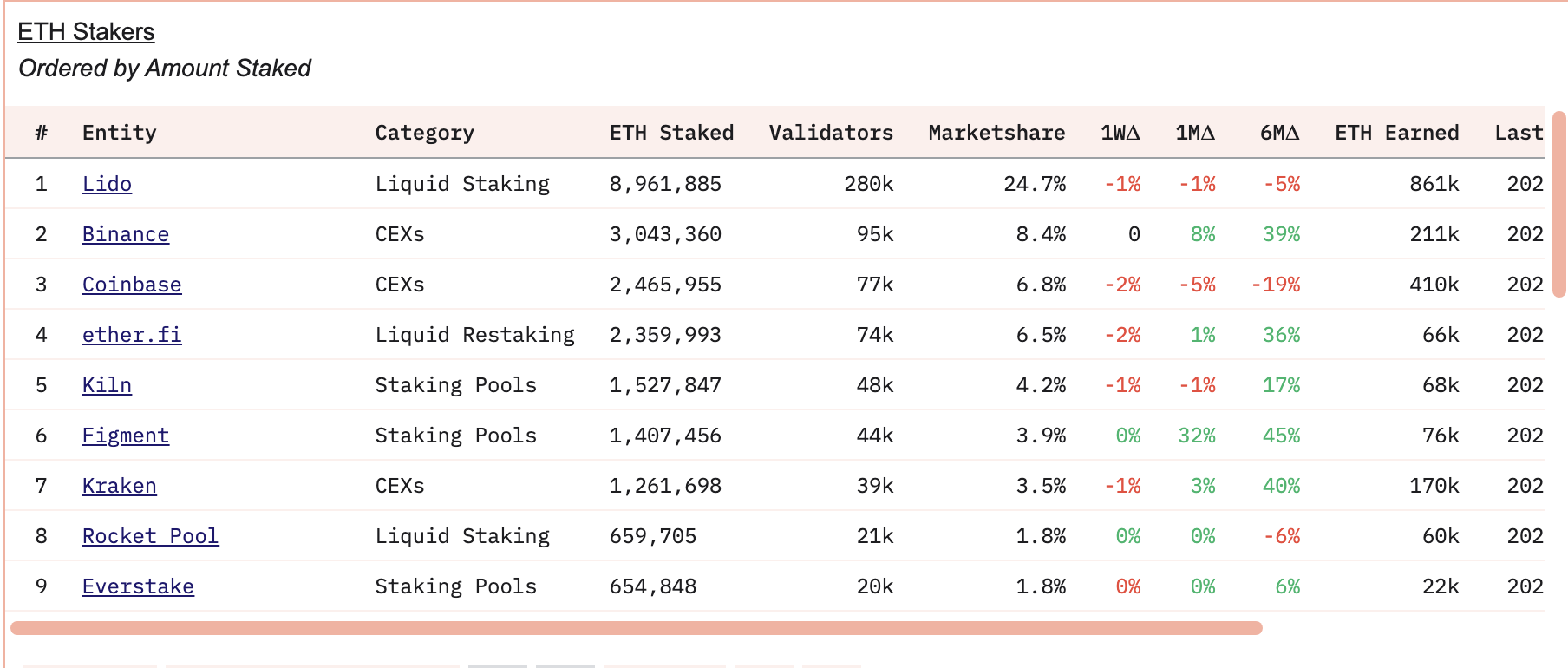

Ethereum’s recent rally will draw more coins into staking contracts as investors chase additional returns beyond price increases. Beacon chain data shows that as of July 29th, 35,750,201 Ethereum (ETH) have betted, indicating that it has been steadily growing since the start of the year.

Staking means locking ETH on your network to help you secure it and earn rewards in return. The Beacon Chain is the main staking layer of Ethereum, tracking all validators and betting ETH across the network.

This trend marked one of the biggest monthly spikes in 2025, marking one of the biggest monthly spikes on June 2nd, with inflows exceeding 213,961 ETH in one day, at which point the rally was underway.

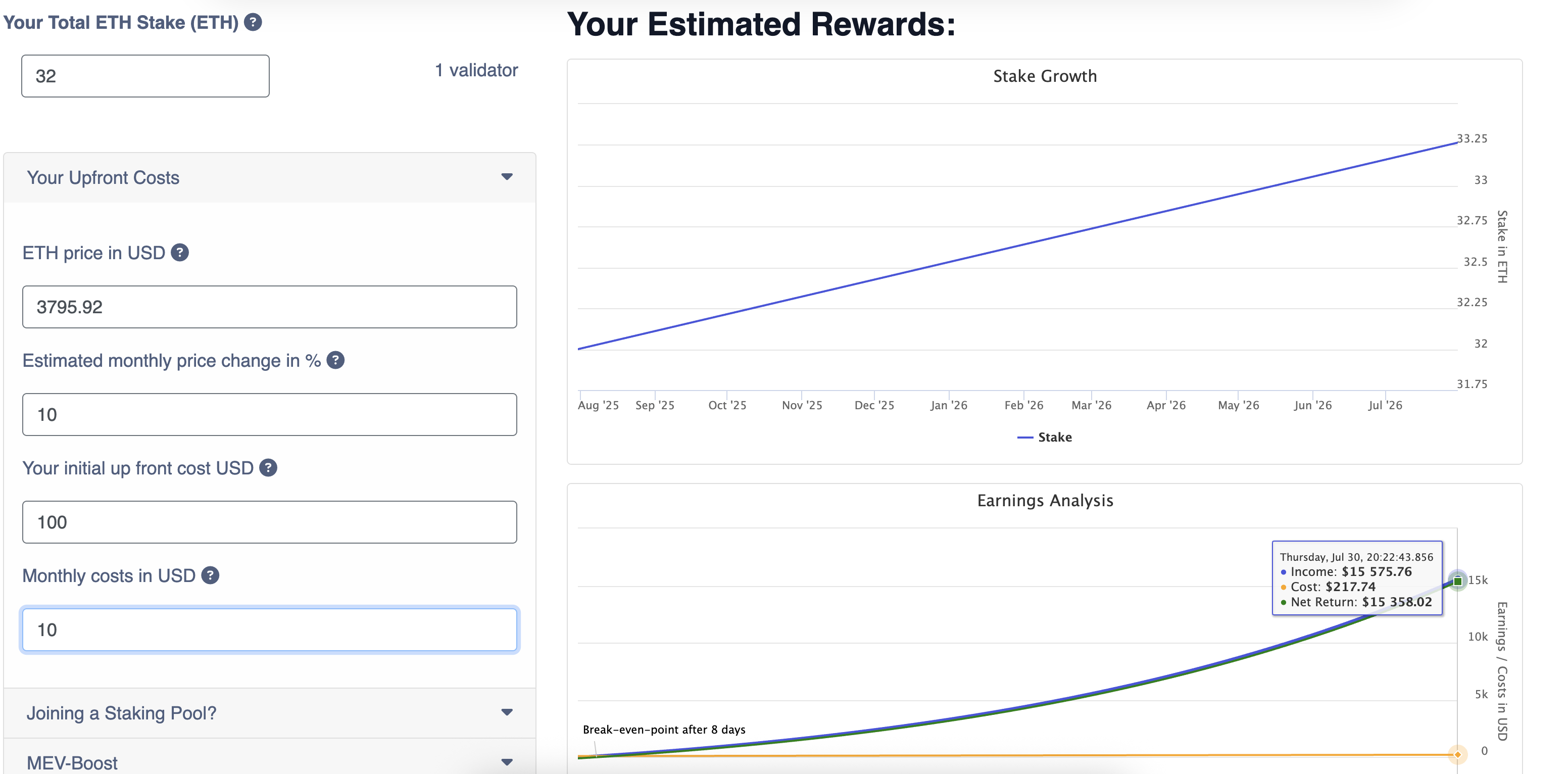

The rewards remain compelling as the network continues to restrict this route to large holders despite the need for 32 ETH to run solo balloters. The standard validator can earn a net profit of approximately $15,358 in a year, assuming the current ETH price of $3,795 and average growth rate.

A validator is a computer node that validates a transaction and receives rewards for doing so.

Liquid staking is also attractive enough

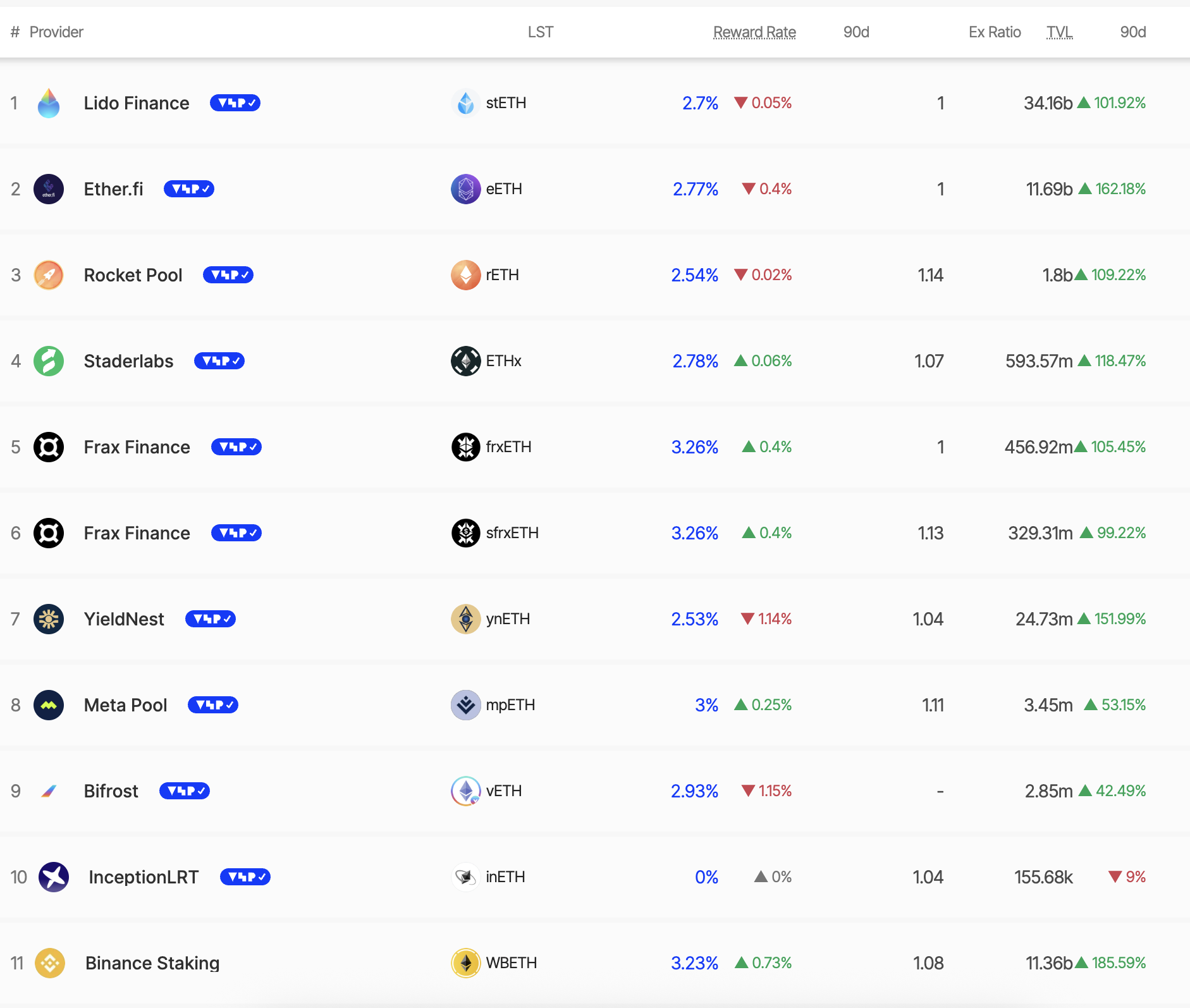

For smaller players, liquid staking protocols such as Lido, Frax Finance and Rocket Pool have opened the door to partial staking. Currently, these platforms offer yields of 2.5% to 3.3%, with total total deposits increasing by more than 100% this year during the assembly. (For most players).

Liquid staking means you can wager any amount of ETH through the platform, but you can still maintain a tradable token representing your staked funds.

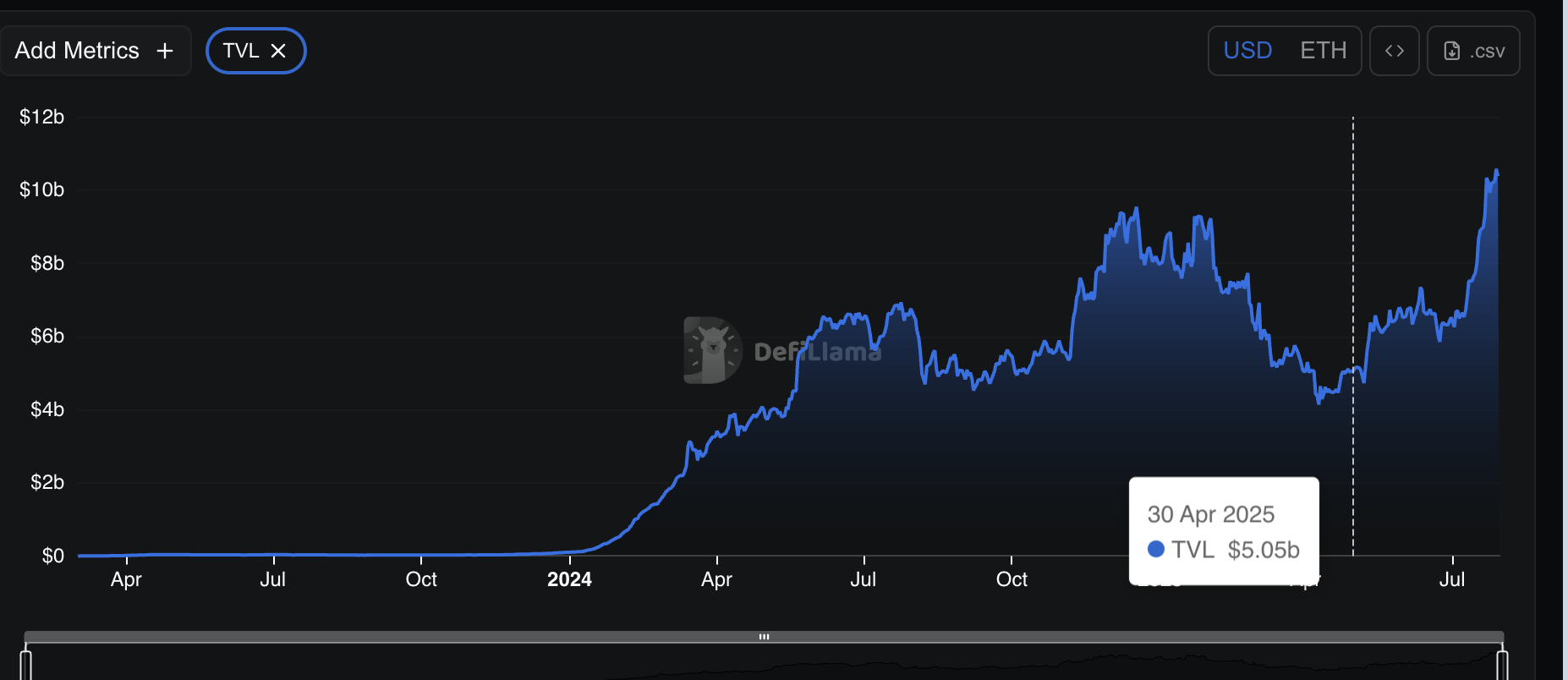

Note: Individual yields on platforms like Lido will decrease over time, even if sediment occurs. Back in November 2022, Lido’s staking appai was around 8.16%, but today it’s around 2.7% despite its record high total (TVL). However, for many such players, the 30-day APY yield curve remains in the green.

This drop occurs because more ETH is staked and rewards are shared among more baritlers as network fee activity is milder compared to past bull runs. In short, your total ETH rewards increase as you build more stakes, but once the staking pool grows and activity on the chain becomes normal, the annual yield of the paper decreases.

Across the network, Total Eth Staked has reached 306.1 million, and continues to rise along with prices, enhancing staking as the first and most natural harvest play linked directly to Ethereum’s ongoing gathering.

Rebuild the boom so that ETH holders chase layered yields

Ethereum’s July rally didn’t just boost staking. It unlocked the second yield opportunity by users taking liquid staking tokens like steth and eet, and redeploying them to earn additional rewards to redeploy them on unique layer-supported platforms.

Refilling means reusing your ingrained ETKEN to ensure additional services, earning additional rewards in addition to your regular staking income.

This layered approach allows holders to effectively stack “double dipping” on the same ETH at an additional 1.5%-2% from the protection of middleware services.

The numbers show how quickly this market is intensifying. The total Etherfi price is locked (TVL) almost doubled, rising from $5.5 billion on April 30 to $103.6 billion by July 30, while Kelpdao rose from $1.03 billion to $1.67 billion over the same period.

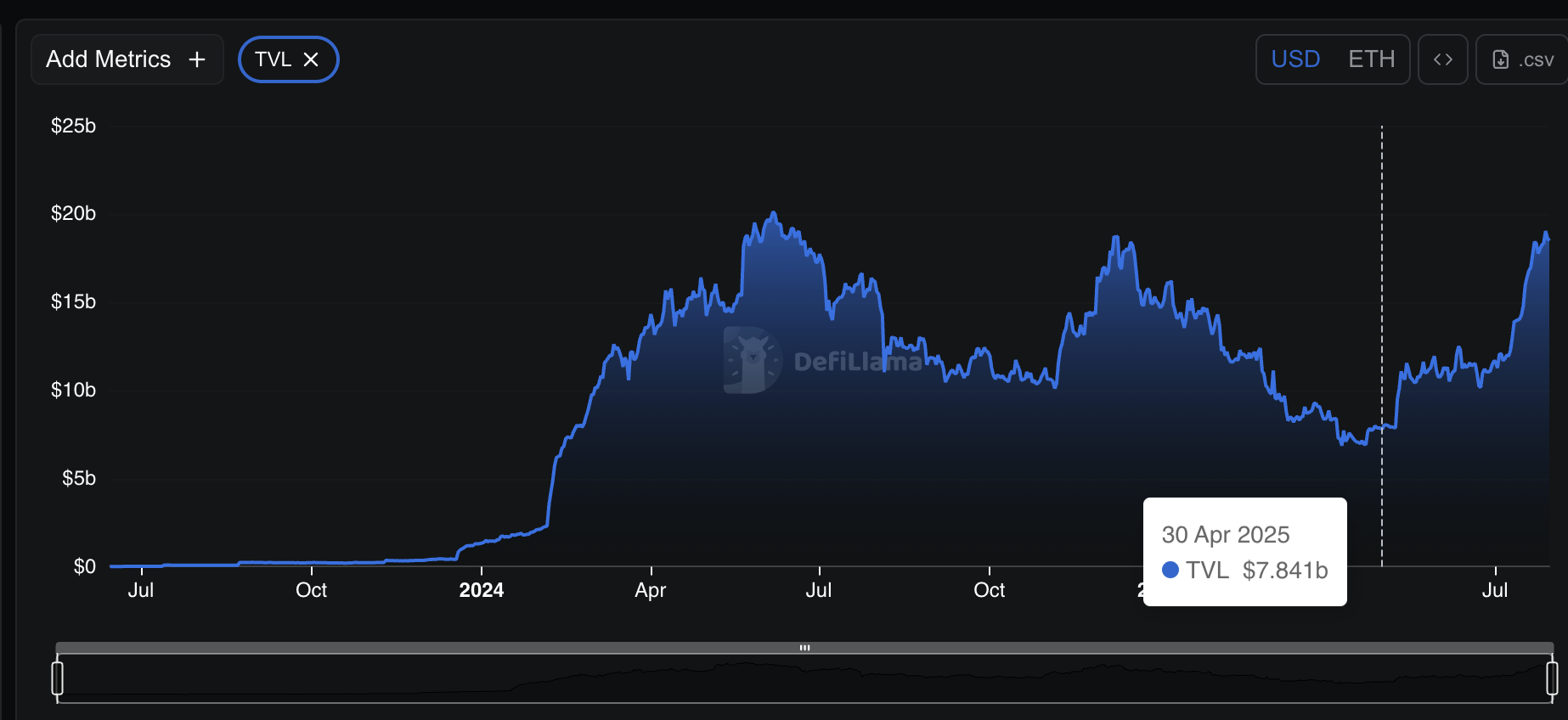

Eigenlayer’s total Defi TVL spiked 120% from around $8 billion to $18.34 billion as capital was revolved into this new yield layer.

Eigenlayer is a protocol that allows for the rebuild of ETH to ensure additional services above the Ethereum base chain, adding another yield layer to the owner.

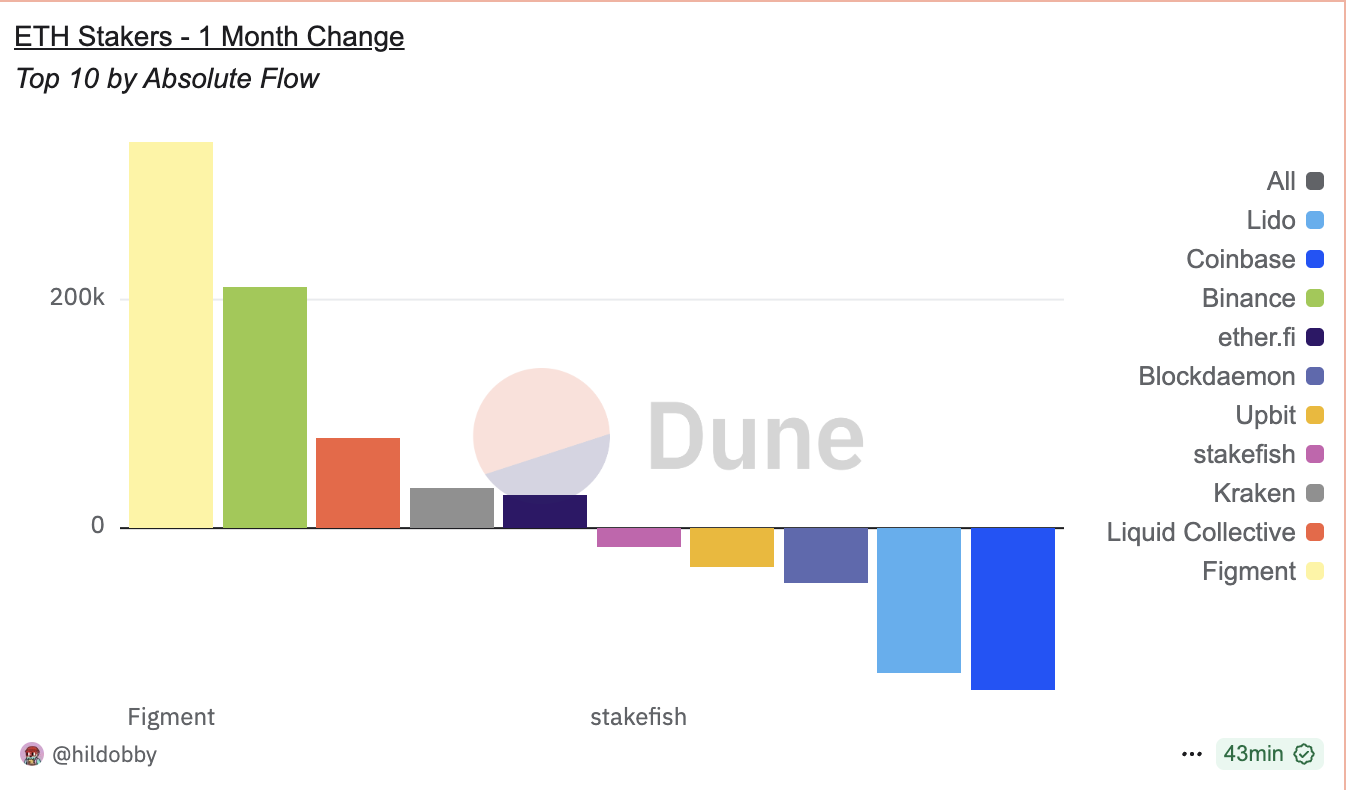

Even the Figment has led to a fresh influx of 250,000 ETH last month, indicating a growing institutional appetite. Figment is a well-known institutional staking provider that helps large investors and funds delegate ETH to Balters without managing their infrastructure.

Etherfi, the leading liquid redevelopment platform, commands 6.5% of ETH on all piles, comparable to intensive giants like Binance and Coinbase. Therefore, large-scale CEX influx is not necessarily so bad. Individuals may even seek opportunities to staking and produce yields rather than exert selling pressure.

As an Ethereum gathering, synthetic yields get hot

Ethereum’s price surges have not only attracted spot buyers. It has supercharged activities on synthetic yield platforms like Ecena. These platforms create “synthetic dollars” backed by ETH. This bets again to get more yields.

They deposit Ethereum with ETH holders, or deposit it in Mint USDE, a synthetic dollar asset where you can bet more on tiered yields, or place stakes. As more traders try to amplify returns, the flow to USDE is accelerating rapidly.

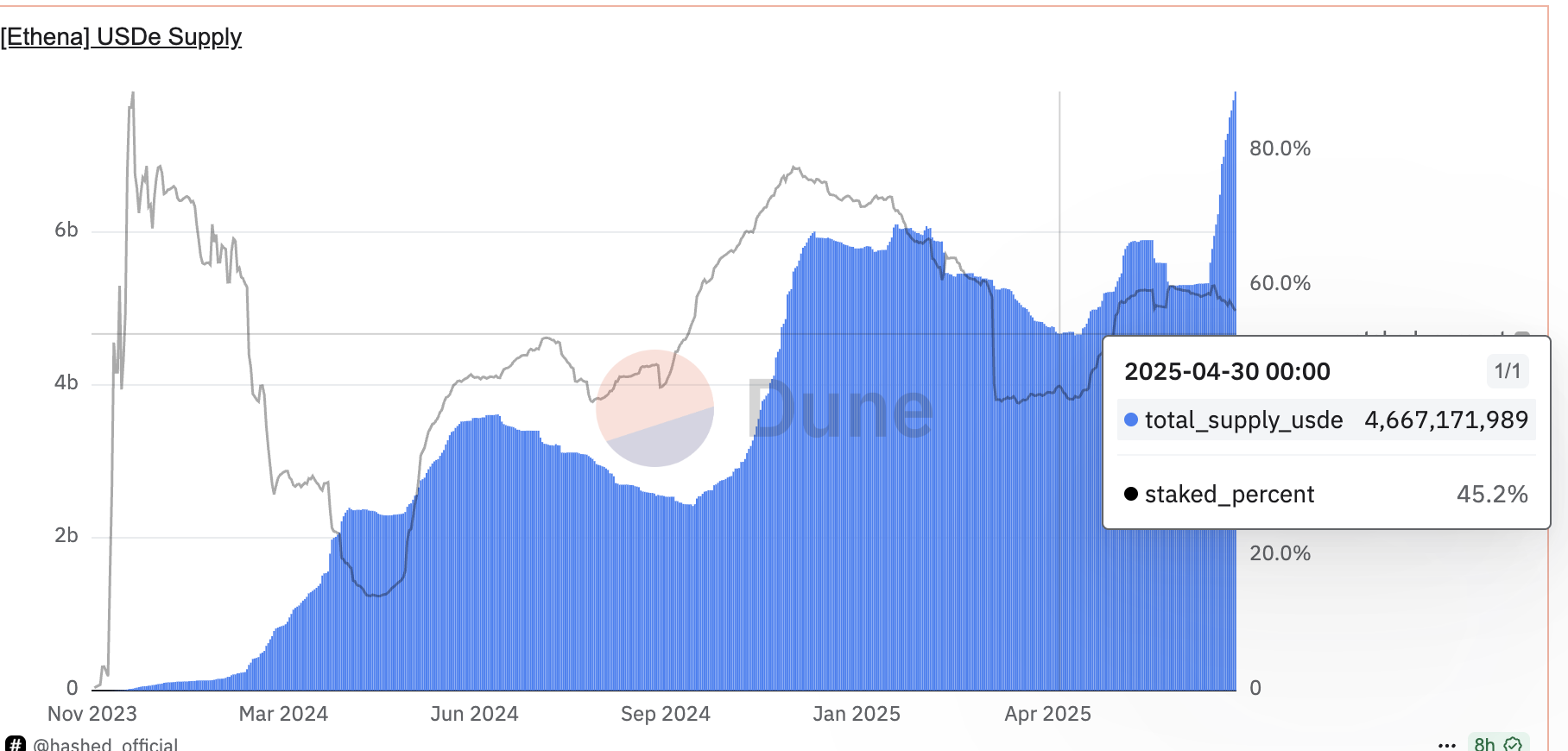

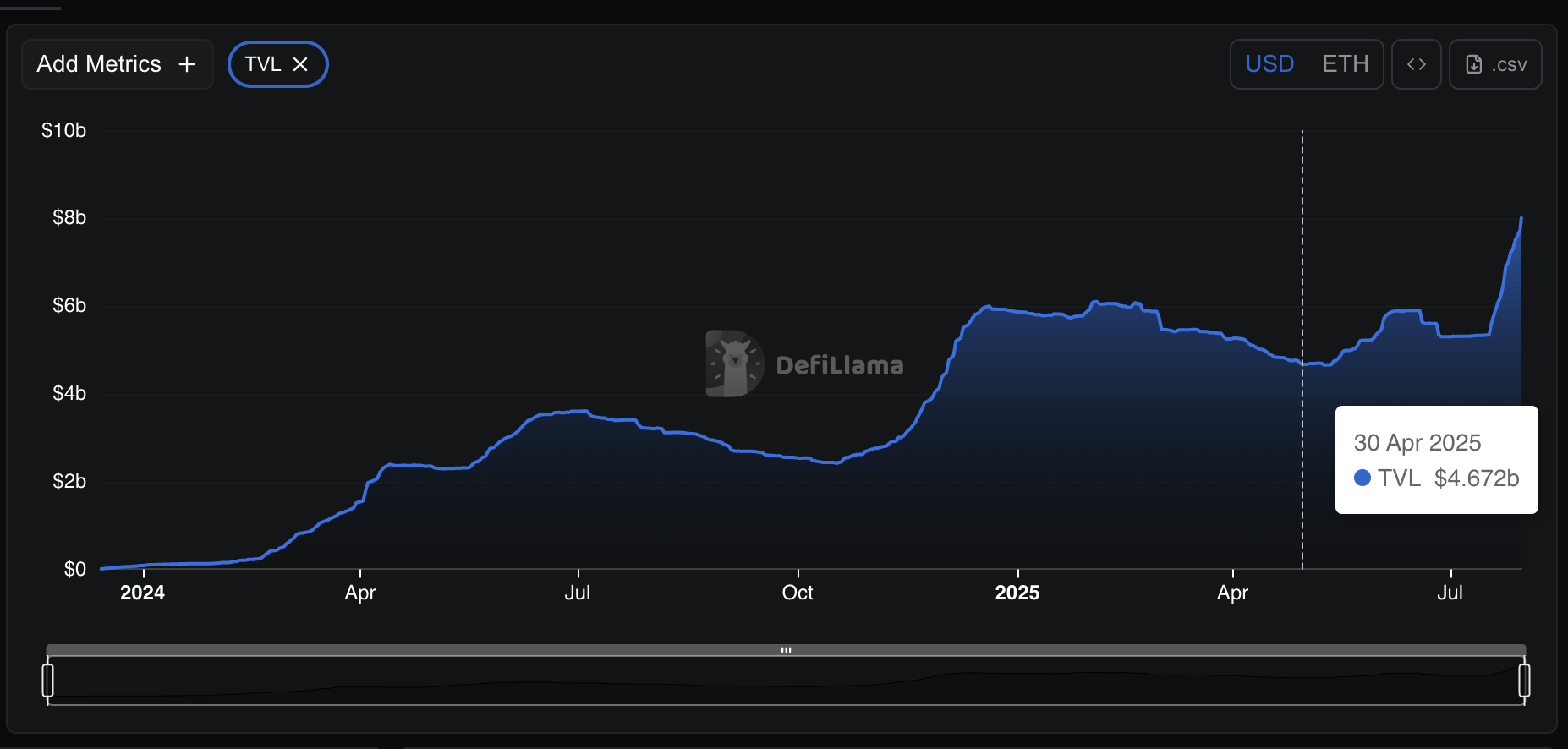

Total USDE supply has increased nearly 80% since April 30th, reaching approximately 4.666 billion to over 8.03 billion. In addition to that, the USDE stake percentage has risen from around 45% to 56.3%, increasing confidence in getting additional returns from these stable derivatives. Ethena’s own TVL (locked total) rose to $8.1 billion, reflecting strong capital inflows.

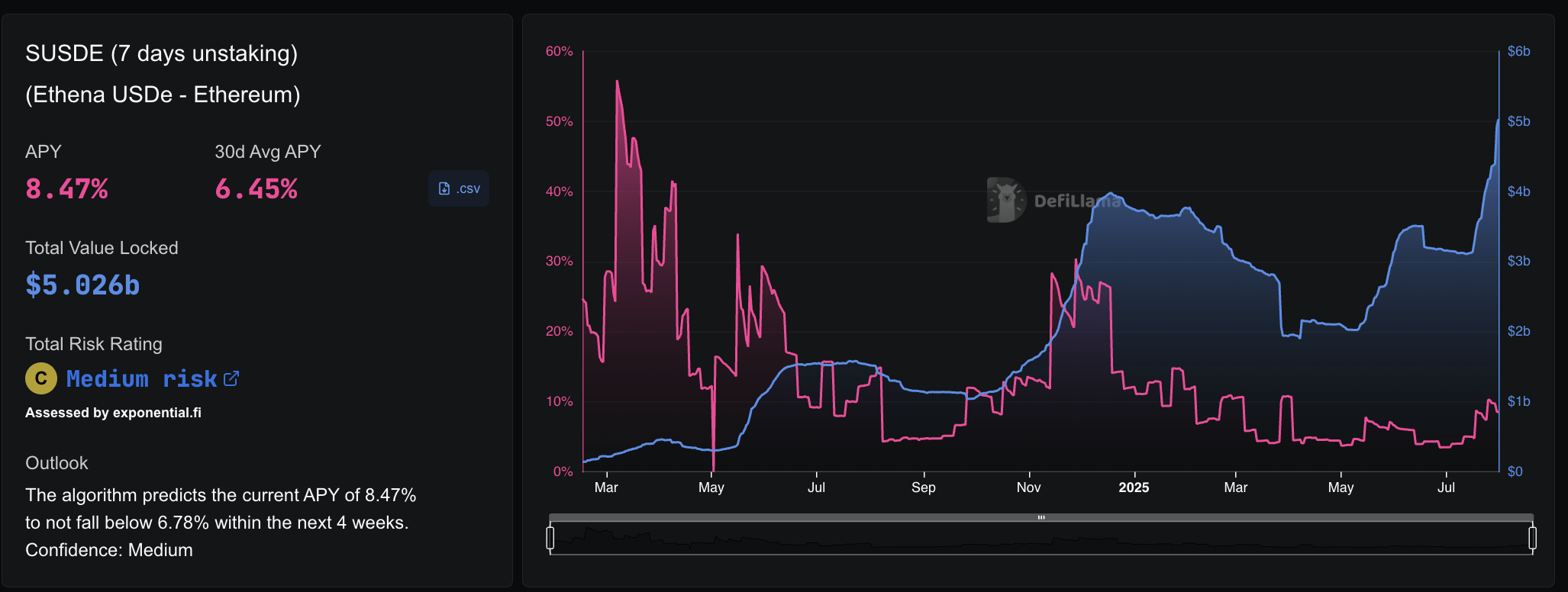

The current yield is around 8.47% per year, so users can layer the return: In addition to the base ETH staking yield, staking USDE to earn additional income in addition to the USDE mint reward.

This multi-stack strategy becomes more attractive during the bullish Ethereum cycle. This is because it promotes reliability and collateral growth across the synthetic yield hub due to its high prices.

Fundraising rate agriculture – Payment is made while ETH is gathering

While many traders view liquidation maps as a battle between bulls and bears, farming for funding rates draws a different picture.

In Bitget’s Eth-USDT permanent market, open interest has been leaning very long, with a cumulative long leverage of $5.95 billion, stacked with 10x ($6.55 million) and 25x ($1787 million) exposures. At first glance, the $2.86 billion shorts look like a bearish bet. In reality, many of these positions do not predict price declines. They are there to collect fundraising payments from duplicate longs.

In a lasting future, we are eager to pay the money for shorts when buying pressure and outweighing sales. And, like ETH’s recent run to $3,900, during a strong rally, traders accumulate for a long time with high leverage, and funding rates skyrocket.

Smart money goes on the other side and opens low-risk shorts to get a stable yield from this imbalance. Shorts don’t have to “win the bet” on the price, as leverage is mainly concentrated on the long side. As long as long demand is overheated, they are paid.

This hidden yield play has become a staple for major players across the trending market, turning market happiness into a passive revenue stream.

Lending and Liquidity Pools – Low-risk Erdplay

Not all of this Ethereum Rally smart money chases high leverage or speculative mint. Some flow quietly into a pool of lending and liquidity that offers more stable and low-risk returns.

Liquidity pools are a collection of tokens locked into smart contracts that drive transactions and earn liquidity provider fees.

Platforms like Morpho Aave V2 look at deposits despite a moderate yield of 1.2-1.9% per year, despite being rated as “B”.

Other pools containing liquid Dex Dex USDC-ETH and UNISWAP ENS-ETH exhibit high yields of 27-50% despite high risk exposure. This variety of eslinked lending options highlights how to balance safer Aave-style lending, where safer Aave-style lending and more risky, higher-return pools are revitalized as Ethereum price rally attracts fresh liquidity.

Just as Ethereum gathers, the yields are: Where does Smart Money flow? It first appeared in Beincrypto.