Bitcoin returned to $105,900 after the Israeli-Iran ceasefire on Tuesday. However, sudden panic and FUD from the new Bitcoin Zilla are becoming increasingly fierce for the biggest cryptocurrency.

Cryptoquant highlights the major realised losses from the new whales as key drivers. These investors are actively selling Bitcoin under pressure, amplifying the market slump.

How the new whales drive the recent price of Bitcoin

Bitcoin has been fluctuating widely since mid-June. June began at nearly $107,000, rising above $110,000 and below $100,000.

Between June 14 and June 22, whales recognized approximately $228 million in Bitcoin losses, according to Cryptocant analyst Ja Maartunn. A major spike occurred on June 17th, resulting in a loss of $95 million per day.

Most of these losses were registered from new whales, but only $8.2 million from older whale investors.

Another notable spike appeared on June 22, totaling $51 million, and was split more evenly between new and old whales.

New whales, which have recently entered at a higher price, appear to be prone to panic sales amid geopolitical tensions. Their rapid exits will strengthen price fluctuations and strengthen resistance, especially at critical levels of nearly $111,000.

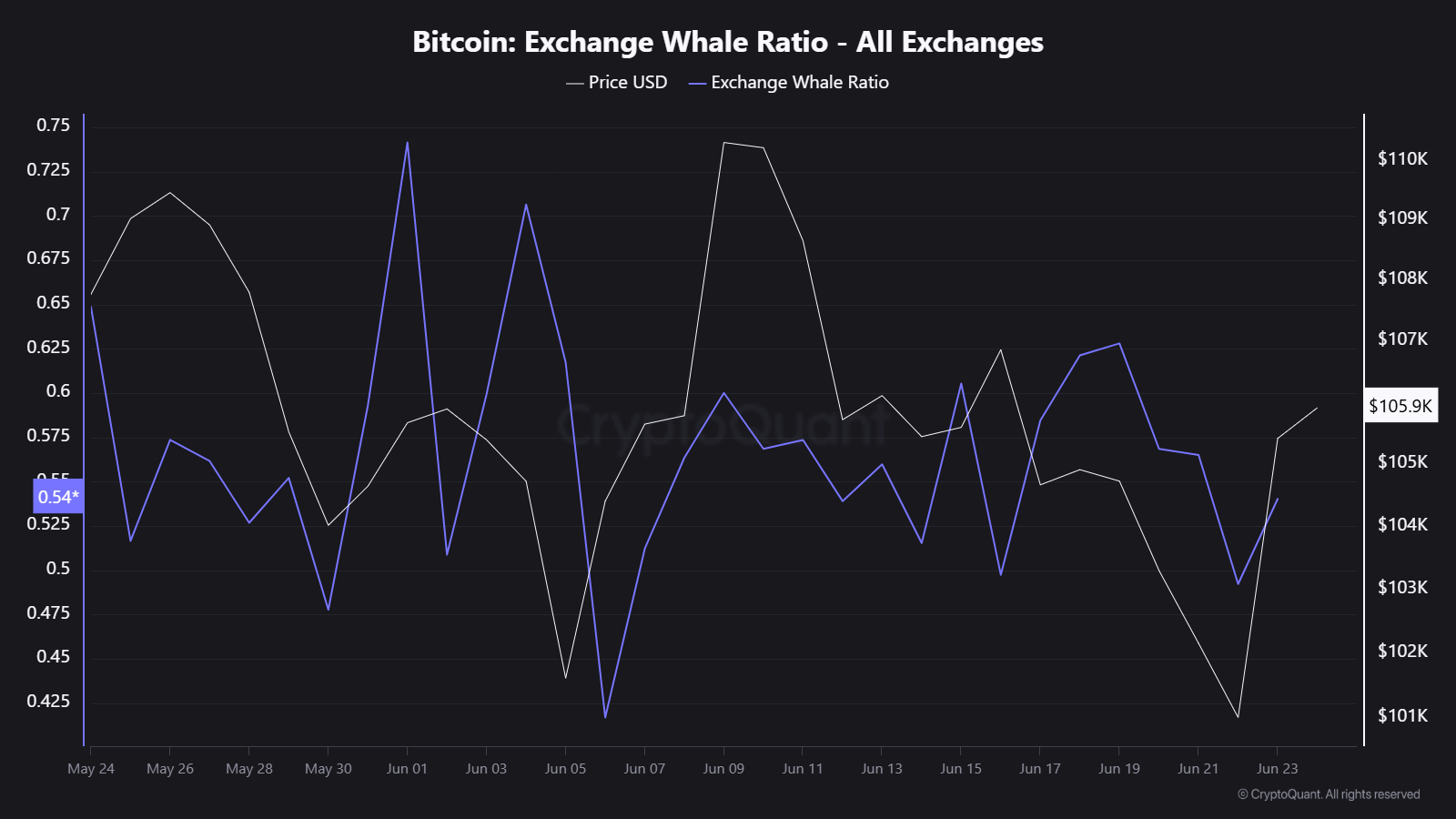

Exchange whale ratio indicates sales pressure

To further support this trend, Cryptoquant’s Exchange Chhale ratio remained rising until much of June.

This indicator is a measure of whales’ activity in exchange. A high ratio indicates that whales are actively depositing Bitcoin in exchange, usually ahead of sales.

Data shows that this ratio is rising mainly around Bitcoin’s attempts to exceed $110,000. The whales appeared to be preparing sales orders at this level, limiting their potential upward momentum.

As Bitcoin fell below $102,000, the ratio temporarily fell, climbing again when the price rebounded to $105,900.

This activity suggests that whales will continuously manage risks and create sales pressure and market uncertainty.

Geopolitical uncertainty amplifies whales’ anxiety

Recent geopolitical events, including the Israeli-Iran war and the announcement of a ceasefire afterwards, have heightened market tensions.

New whale investors are particularly sensitive and respond quickly to negative headlines.

Such rapid sales will cause even more volatility. Leveraged traders face margin calls, amplifying price drops and hampering sustained upward momentum.

Analysts say whales must be easy to sell to maintain breakouts above the major $111,000 level. The reduced losses and reduced exchange inflows demonstrate improved market confidence.

Disclaimer

In compliance with Trust Project guidelines, Beincrypto is committed to reporting without bias and transparent. This news article is intended to provide accurate and timely information. However, we recommend that readers independently verify the facts and consult with experts before making decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.