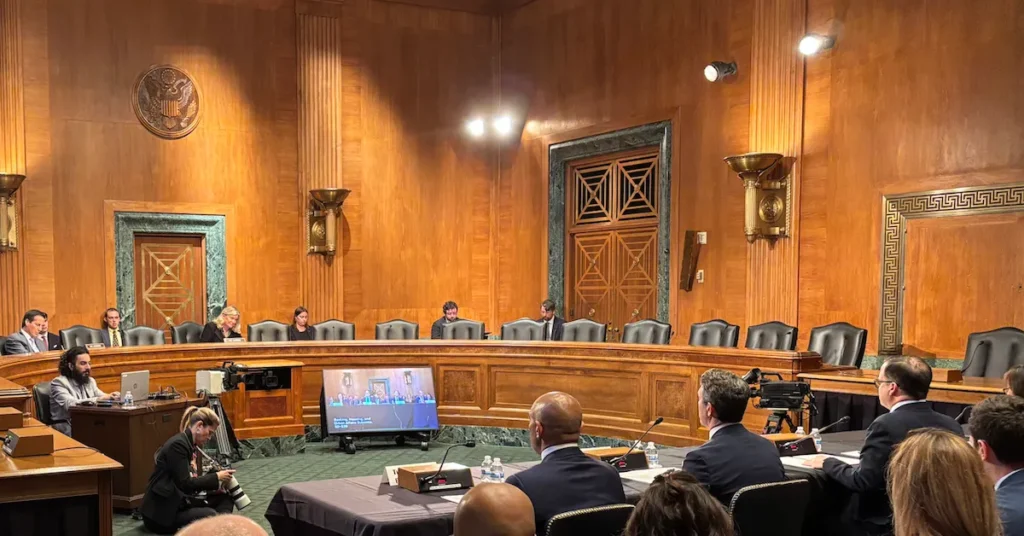

Today, the US Senate Bank’s Subcommittee on Digital Assets held a hearing titled “Exploring a Bipartisan Legislative Framework for the Digital Asset Market Structure.”

(Spoiler alert: The word “bitcoin” never appeared in the hearing. That being said, Bitcoin is subject to some of the cryptographic regulations discussed at the hearing. Therefore, it is important to understand what you were told as a Bitcoin enthusiast.)

The hearing came after Senators Cynthia Ramis (R-WY), Tom Tillis (R-NC), Bill Hagerty (R-TN) and Senate Bank Speaker Tim Scott (R-SC) issued the principles of digital asset market structure this morning. (See the complete list of principles here.)

Senator Ramis began it by moderating the event and touching on some of the aforementioned principles, adding that the United States is taking part in the 21st century now that the Senate has voted for a genius act.

Senators were joined by a panel of witnesses including Senators Bill Hagerty (R-TN), Bernie Moreno (R-OH), Angela of Brooks (D-MD), Dave McCormack (R-PA), and a panel of witnesses:

Sarahammer of Ryan Vanglack, Executive Director of the University of Pennsylvania Wharton University, General Counsel at Multicoin Capital, Board Member of the Blockchain Association, and Vice President of Legal Affairs at Coinbase, is the honorary Vice President of Law at Rostin Behnham, and the Member of the Occupational Artisan Committee for Occupational Sales (CFTC).

Fighting illegal activities in the crypto space

In the first round from Senator Ramis, both Behnam and Hammer highlighted the importance of fighting illegal activities involving digital assets through clear money laundering and counter-terrorism funding rules, but neither of them detailed what this would look like.

When Senator Ramis asked Hammer which countries should the US be aware of when it comes to regulating Crypto’s anti-terrorist funding, Hammer cited Singapore.

Before stepping down from the topic of fighting illegal cryptographic activity, Behnam argued that it would give more space to offensive stakeholders for operations to wait for Congress to pass laws of comprehensive market structure.

“Bad actors are drawn to unregulated areas,” says Behnam.

Consumer protection for crypto investors

Senator Hagerty, a leading sponsor of the Senate recently passed Genius Act, praised the bipartisan efforts in the legislative process on digital assets, hinting at the notion that colleagues want to maintain momentum.

And on the bipartisan topic, the Senator, a Democrat senator present at the hearing, seemed optimistic about the possibility of code, but was also concerned about setting up a proper guardrail for investors.

She asked Behnam which consumer protection factors are essential to Crypto investors.

Behnam cited “bankruptcy protection” as the most important component of consumer protection.

“Customer assets must be completely separated, so there is no doubt that the assets will be returned to the customer in the event of bankruptcy,” Behnam said.

Prices that failed to legislate US cryptography

Heading into the second half of the hearing, Senator Moreno asked panelists how long the US must pass crypto regulations and what the price is for not doing so.

Xethalis responded by saying, “We must act now.”

He argued that initial costs could potentially allow other jurisdictions to establish more troubling rules for crypto. He cited the European enactment rules for internet commerce decades ago as a precedent for this.

Xethalis argued that the second cost is economical. He said the US is behind in both 5G development and silicon chip manufacturing, stressing that he doesn’t want the same to happen with cryptography.

Bipartisan appeal

Senator Ramis closed the hearing by pleading with the senators and panelists to engage in discussions between the parties and work across the aisles, as he did with Senator Gillibrand.

She noted that because President Trump’s family is involved in the industry, some Democrats are reluctant to engage in the legislative process around the code, adding that code is greater than the president’s family involvement and Democrats should acknowledge this.

Source: https://bitcoinmagazine.com/news/panelists-at-senate-banking-hearing-on-crypto-market-structure-call-for-regulation-asap