Despite recent volatility, well-known analysts have argued that the technical setup of XRP is not yet bearish. They highlight certain price levels that are important to confirm trends.

A technical evaluation of XRP’s recent five-day charts adds context to these analyst views.

Analysts are cautiously optimistic about XRP prices

XRP prices have fallen almost 7% in the past week amid rising geopolitical tensions, particularly amidst the rise in US airstrikes at Iranian facilities. Altcoin has stabilized around $2.06 after falling from about $2.20 to a low of nearly $1.90.

Veteran trader Peter Brandt highlighted the potential head and shoulder (H&S) patterns on XRP’s charts. This is traditionally a bear metric that indicates a reversal from bull to bear ow if the main support level is broken.

But Brandt emphasizes his attention to premature bearish conclusions. He explicitly points out the importance of XRP maintaining support above $1.80.

To see bearish scenarios, you need a decisive end of each week, below that critical level.

Meanwhile, analyst Egrag Crypto has used multiple technical indicators to provide a detailed bullish perspective.

Gaussian channels are volatility indicators used to identify trend strength and potential inversions. Currently, closing approximately $1.75 within this channel boundary will weaken momentum and indicate possible downward pressure.

Egrag emphasizes the importance of XRP beyond this boundary to maintain bullish strength.

Additionally, the 21-week EMA serves as the key moving average that traders use to identify macro trends.

Above the $2.33 EMA level means strong bullish momentum.

Additionally, $2.65 above resistance confirms a robust, long-term bullish trend.

Egrag also applies Elliott Wave analysis, a technical approach to identifying recurring patterns of market prices (waves) to predict potential targets.

Using the Elliott Wave ratio, if Altcoin successfully completes the expected fifth wave, the Analyst Project XRP could reach $9-$10.

Short-term technical analysis supports attention

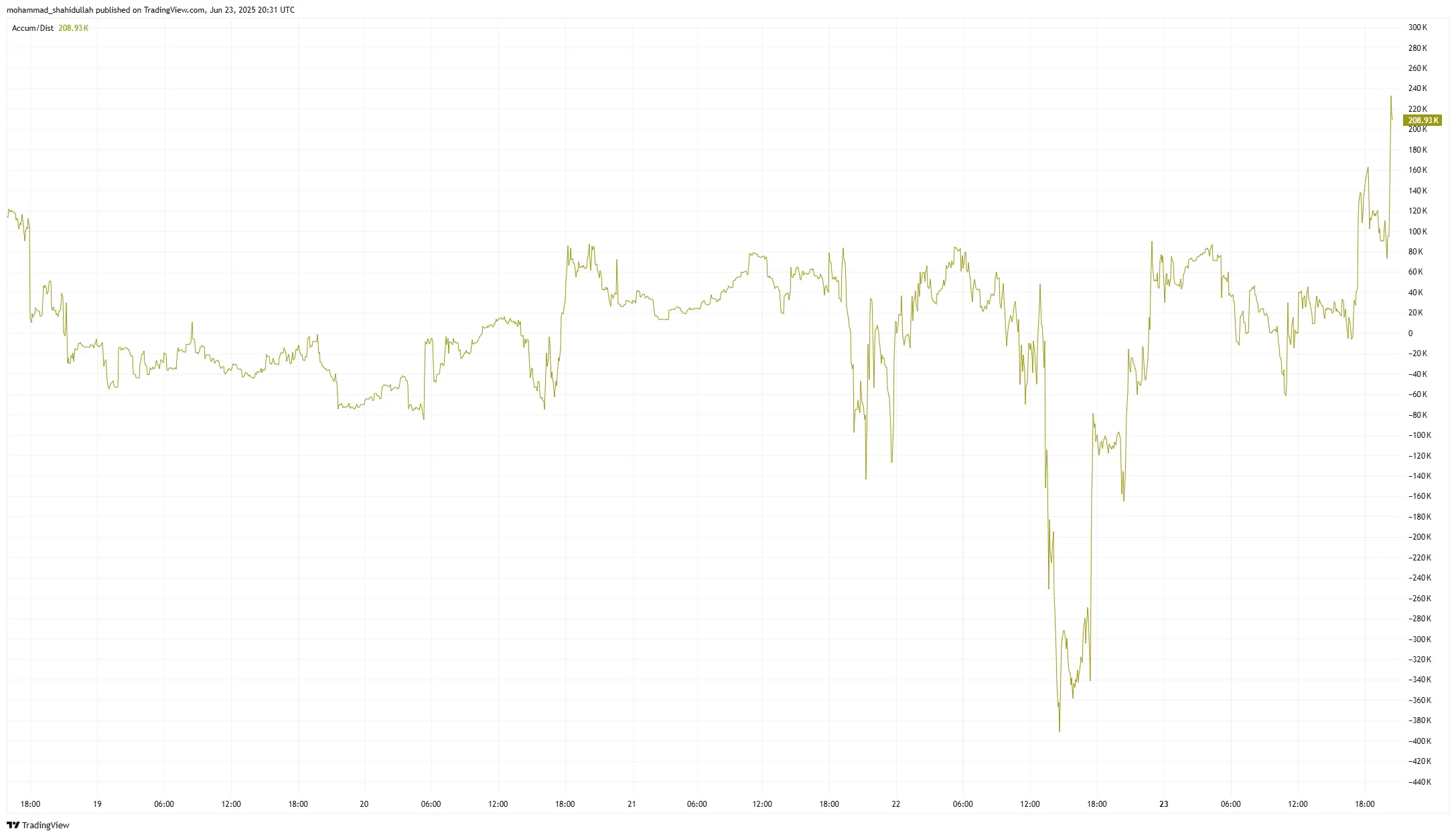

XRP faced significant sales pressure as it was confirmed by a sharp drop in price to $1.90 and a noticeable abolishment of the Accumulation/Distribution (A/D) line.

The A/D line measures cumulative buying and selling pressure, and the decline indicates an increase in price trading volume, reflecting the activity of strong sellers.

Once the XRP price reached support of nearly $1.90, the A/D line stabilized, starting a modest climb during the rebound, and updating buyer activities.

Nevertheless, this accumulation during rebound suggests that attention remains as it has not yet completely neutralized its previous distribution.

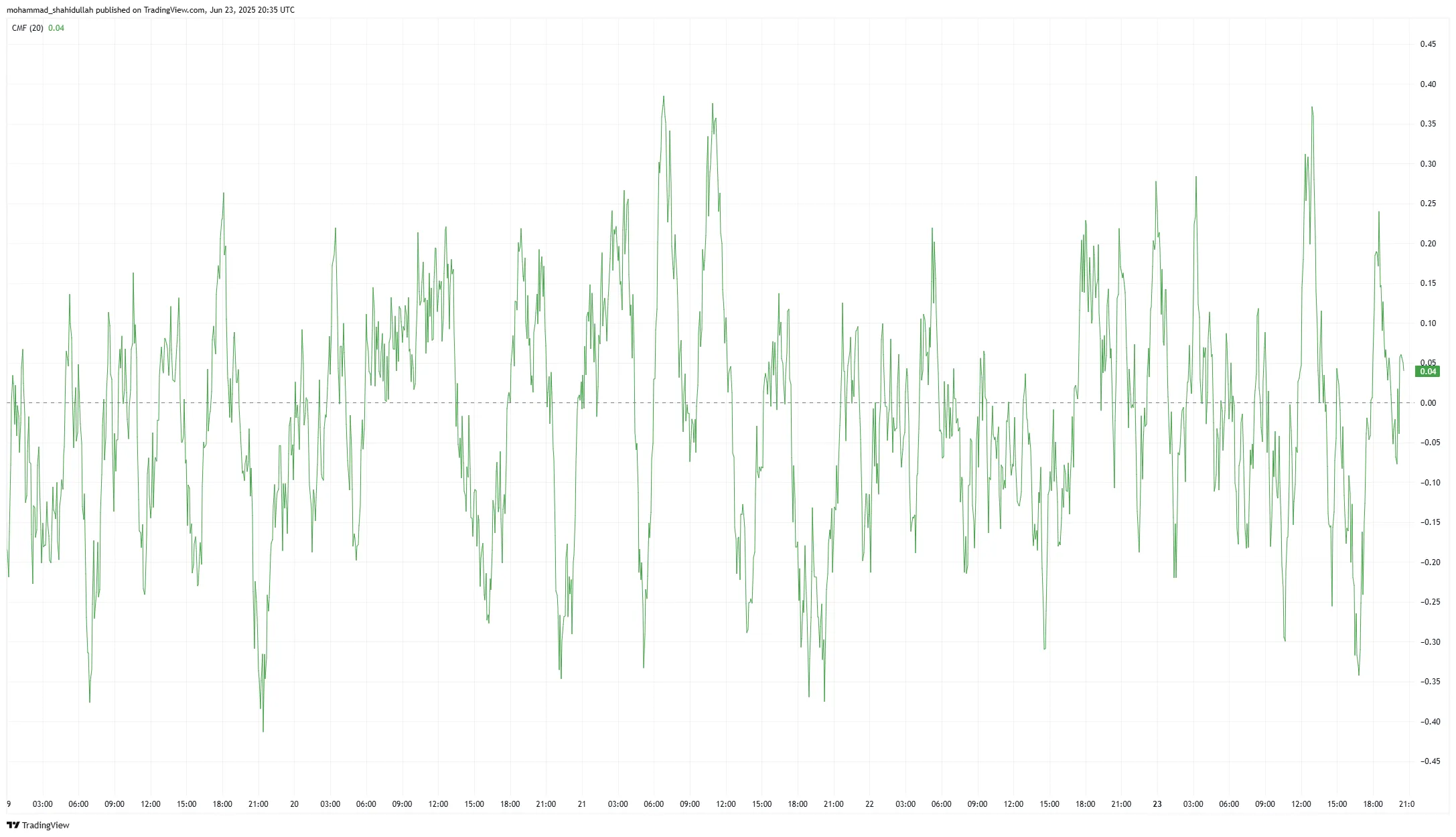

Meanwhile, the Chaikin Money Flow (CMF) is an indicator of the strength of money coming and going to assets, and it became negative during the sale, confirming a strong leak.

The CMF has improved slightly during XRP rebound, but it has not yet entered the aggressive territory until weak, indicating that buyers remain tentative.

Integration and critical levels for monitoring XRP

These technical indicators suggest that XRP is currently in a careful integration state. While support at nearly $1.90 has proven strong, the limited improvements in CMF indicate ongoing market uncertainty.

Overall, this analysis is consistent with analysts’ views that key support remains around $1.75 to $1.80. Only the decisive end of each week below these support tests the bearish outlook.

Traders need to closely monitor the interaction between the critical support and resistance levels of XRP.

Specifically, confirmed breakouts above $2.33 and above $2.65 indicate bullish continuation, while a critical violation of support between $1.75 and $1.80 indicates an increased risk of bearishness.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.