The Spot Bitcoin ETF won just $1 billion last week, showing continued investor interest despite the cooling trend.

The figure remains significant, but reflects a 29% drop from the $1.39 billion recorded last week. This suggests moderation of institutional appetite for BTC exposure.

ETF demand will cool down as Bitcoin stalls

Between June 16 and June 20, Bitcoin-backed funds saw net inflows of $1.02 billion, down nearly 30% from the $1.39 billion recorded last week.

This pullback of this influx came amidst BTC’s inactive performance and struggling to stabilize at the $103,000 price range for the week of reviews. This trend underscores the short-term uncertainty in the market as geopolitical tensions in the Middle East continue to weaken investors’ sentiment.

Last week, BlackRock’s Spot BTC ETF IBIT recorded the highest net outflow of all BTC ETFs, with $1.23 billion participating in the fund, bringing total historic net inflow to $51 billion.

Bitcoin slides below $103,000

Today, major coins have extended the decline and are below the psychological $103,000 price mark. BTC, which has dropped by 1% in the past day, is currently replacing its phones for $101,000.

The price decline is accompanied by a 37% increase in the daily trading volume of coins, reflecting the pressure on sellers in the market. A lower asset prices show strong sales pressure while trading volumes increase.

However, the persistent positive funding rate of BTC across the derivatives market suggests fundamental bullish sentiment among futures traders. Currently, this is 0.002%, indicating a long position preference, even amid the reduced price performance of the coin.

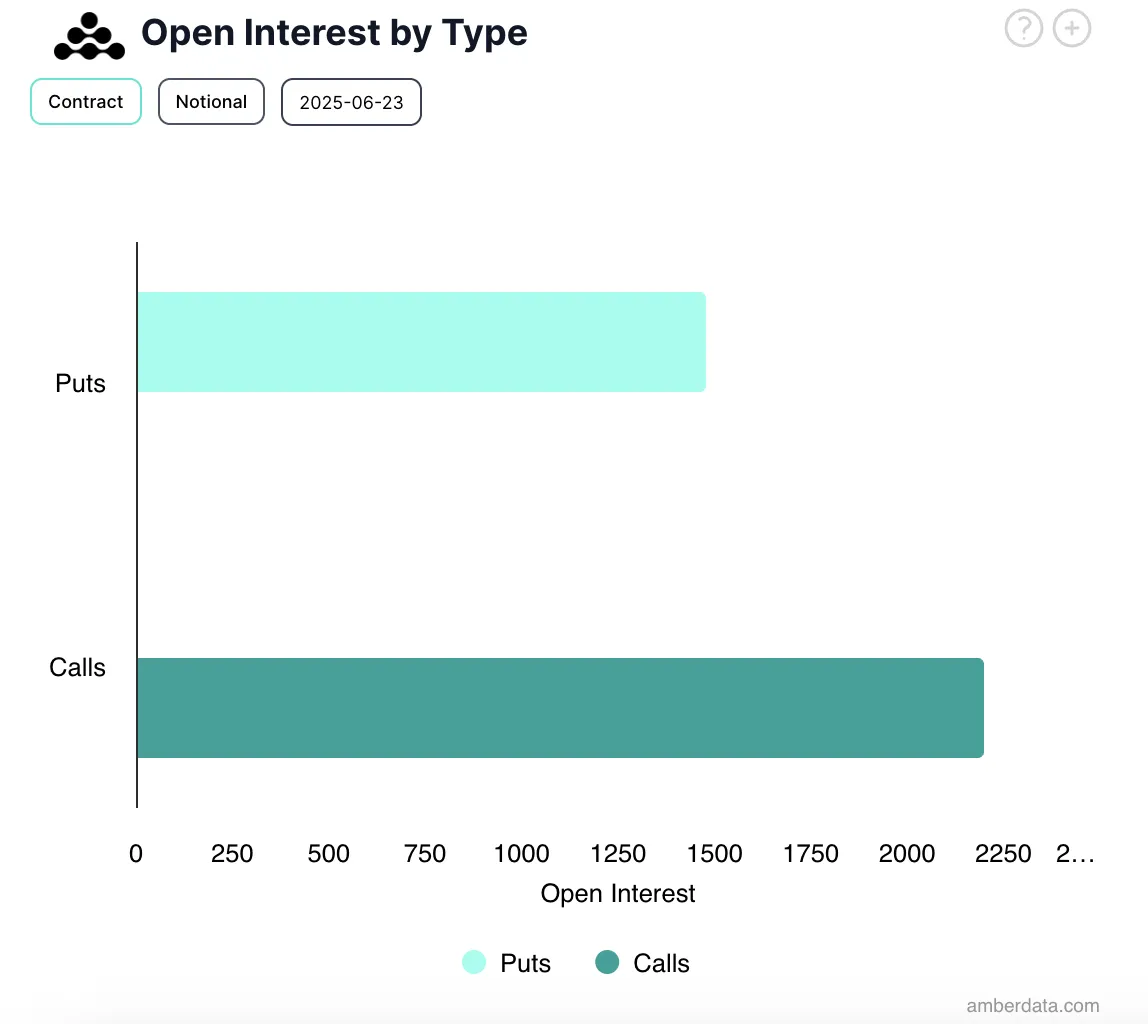

Furthermore, today the options market is in high demand for call contracts. This shows that many traders are positioned for potential benefits.

This strengthens a broader risk-on mood, suggesting that cautious optimism continues to dominate the sentiment of the near-term derivatives market.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.