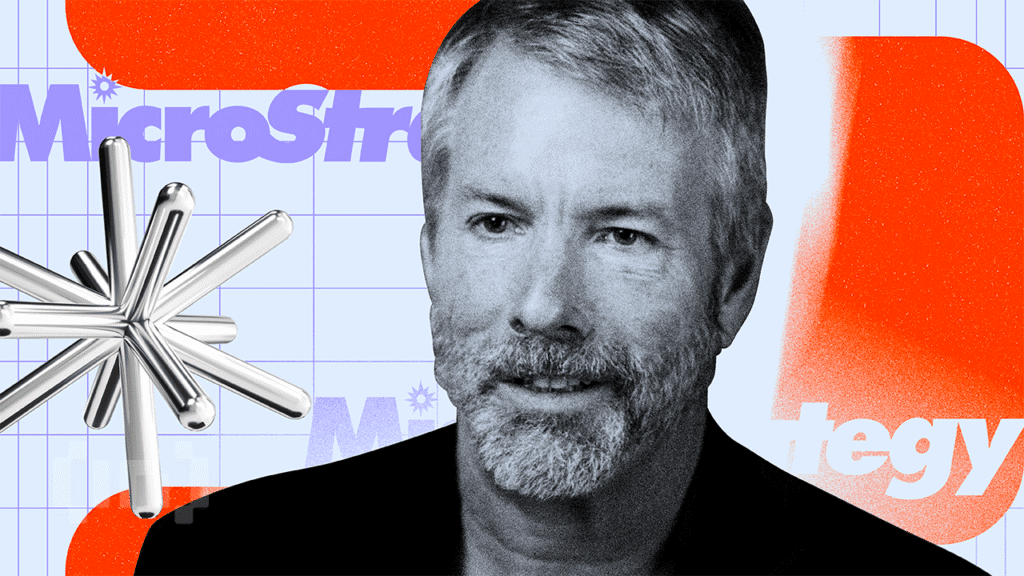

Michael Saylor, co-founder of Strategy (formerly MicroStrategy), has dropped another inexplicable hint that his company could soon add more Bitcoin to its already large holdings.

In a June 22nd post on X, Saylor shared a chart of Bitcoin’s performances, pairing it with the phrase “There’s nothing to stop this orange.”

Saylor predicts that Bitcoin could reach $21 million in 20 years

This social media post follows the well-known pattern of Saylor’s inexplicable signal just before his company file with the US Securities and Exchange Commission (SEC) to purchase additional Bitcoin.

Over the past few weeks, the Strategic Bitcoin position has grown aggressively following several strategic acquisitions.

This means that the company holds approximately 592,100 BTC, valued at over $60 billion. Strategy’s BTC reserve accounts for approximately 2.8% of the total Bitcoin supply, making it the world’s largest asset holder.

Meanwhile, Saylor’s confidence in Bitcoin shows no signs of decline despite the substantial retention of his company. Bitcoin Bull recently predicted that the top crypto could reach a price of $21 million within the next 21 years.

“$21 million over 21 years,” Saylor said in X.

Despite his bullish tone, Saylor’s approach has attracted criticism.

Jim Chanos, a well-known investor best known for his bearish appeals to companies like Enron, has publicly challenged Saylor’s claims about the company’s use of debt.

In a video clip shared online, Saylor defended the strategy by saying that the company’s debts were “convertible”, “unsecured” and “unreliable.” Bitcoin Bull also suggested that the value of the top crypto could fall by 90% without affecting his company’s repayment obligations.

However, Chanos strongly opposed this view, saying that the strategy is liable if the debt is not converted fairly by maturity.

“Of course, if the converted debt is not converted fairly, it’s only natural. How does he not know this?” the investor asked.

His criticism means that Saylor may be exaggerating the security of the company’s debts.

Chanos’ view is no surprise given that his company has recently taken the extraordinary stance of betting on strategy for a long time on Bitcoin.

This double position underscores the growing view among several investors that while Bitcoin may flourish, Saylor’s aggressive corporate strategy could take hidden risks.

Disclaimer

In compliance with Trust Project guidelines, Beincrypto is committed to reporting without bias and transparent. This news article is intended to provide accurate and timely information. However, we recommend that readers independently verify the facts and consult with experts before making decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.