Solana (Sol) experienced a strong gathering, pushing prices to months’ highs, temporarily surpassing $200.

However, despite recent success, Solana faces significant challenges from investors. This issue is attributed to an increase in profit-raising emotions that could lead to price reversals.

Solana’s profits accumulate

Solana’s Net Unrealized Profit/Loss (NUPL) indicator shows that profits have reached a five-month high. This indicates that many investors are profiting and raise concerns about the possibility of a sale. Historically, when profits rise sharply into the optimism zone, it causes a wave of profits.

Characterized by rising profits, this investor sentiment could weigh heavily on Solana’s price action. Solana’s recent profits could soon evaporate if these profitable actions take hold due to potentially increased sales pressures on the horizon.

About Token TA and Market Updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

Solana’s technical indicators also show caution. Currently, the relative strength index (RSI) is in an excess zone above 70. This suggests Solana’s principle of potential modification. This is because price pullbacks have historically continued at such levels. RSI’s previous foray into this acquisition zone led to price adjustments, and this time may not be an exception.

While the terms of the acquisition show potential declines, it is also worth noting that the market can remain in over-acquired territory for a long period of time during a bullish trend. The key to Solana is whether investor sentiment shifts to attention, or whether the broader market situation continues to support further profits.

Can Sol Price secure $200 in support?

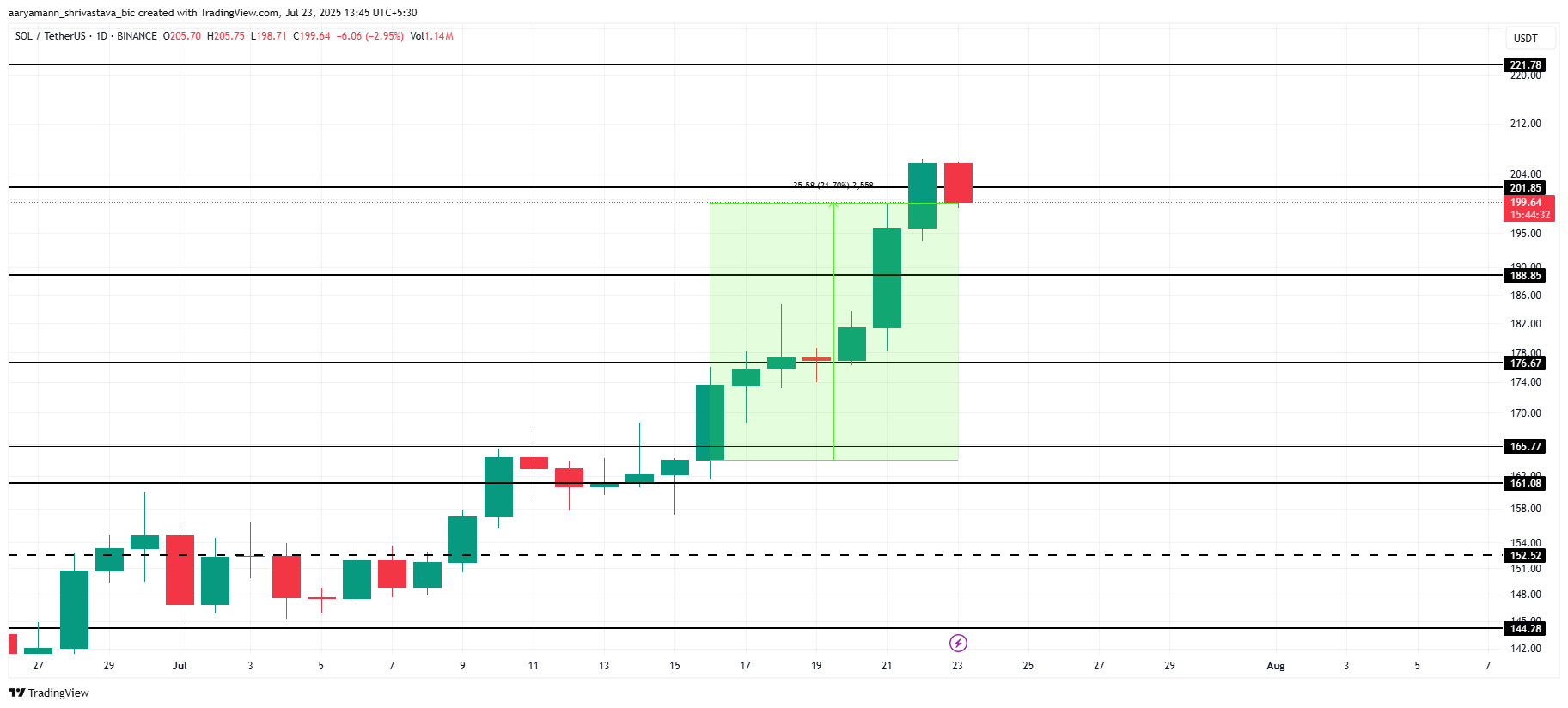

Solana prices have risen 21% in the past week and are currently trading at $199. Despite violating the $200 mark, Solana was unable to maintain this level, marking a five-month high. Altcoin is currently facing resistance and potential reversals due to factors listed above, such as investor profit acquisition and acquisition terms.

If these factors apply, Solana’s price could drop to a support level of $188 or down to $176. Moves below these levels could erase a significant portion of recent profits and shift altcoins to a bearish trend.

However, if investor trust continues to increase and the market continues to show signs of bullishness, Solana can stabilize over $200. Securing this level as support could bring the price back to $221, potentially disabling the bearish outlook.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.