Grupo Murano, a Mexico-based $1 billion real estate company, is pioneering a bold strategy to integrate Bitcoin into its business. CEO Elías Sacal claims that Bitcoin is “demonetizing” the real estate industry. By shifting from a traditional, wealthy model to a Bitcoin-centric Treasury, publicly traded companies aim to optimize their finances and leverage potential valuations of Bitcoin, offering a model for businesses navigating volatile interest rates and currencies.

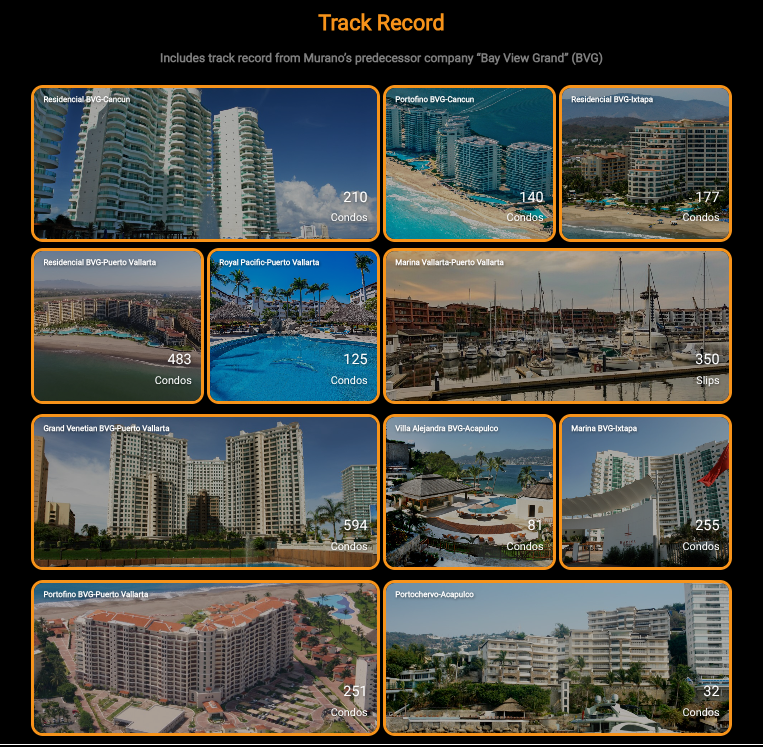

In an exclusive interview with Sacal’s Bitcoin Show, a 30-year real estate development veteran outlining Grupo Murano’s vision, Sacal. The company, which manages hotels under brands such as Hyatt and Mondrian in cities like Cancun and Mexico City, plans to convert assets to Bitcoin through refinancing and sales leasebacks. This approach reduces balance sheet debt and equity while maintaining operational management. “We believe Bitcoin will appreciate more in place of buildings waiting for a small thank you,” Sakull said, predicting a 300% price increase within five years.

Sacal’s strategy is addressing the real estate industry’s reliance on debt financing, which is disrupted by rising interest rates. “The real estate must be independent of the percentage of inflation in tomato or Walmart,” he noted, highlighting Bitcoin’s stability for transactions such as procuring materials globally and accepting hotel payments. By eliminating intermediaries such as hedge funds and portfolio managers, Bitcoin reduces costs from fees and exchange rates. Sacal said that while the $100 payments often shrink to $85 after the fee, Bitcoin makes these payments more efficient.

Grupo Murano educates employees, investors and guest stakeholders on Bitcoin’s profits. The company plans to deploy Bitcoin ATMs to its properties, completing a partnership with major payment platforms to enable seamless transactions, particularly for guests at American-oriented hotels in Cancun and Mexico City. This is in line with Murano’s ambitious goal of building a $10 billion Bitcoin Treasury within five years, inspired by a $100 billion valuation of the strategy acquired by employing Bitcoin. Murano is also considering accepting Bitcoin payments across its portfolio and is exploring opportunities to hold Bitcoin conferences there.

The company’s focus remains in the margin high margin development project, allocating 20-30% of its business to real estate and 70-80% to Bitcoin Holdings. Sacal has rejected other cryptocurrencies and calls Bitcoin “champions like F1 and NFL.” He sees pioneering Latin America like El Salvador as a fertile basis for Bitcoin adoption, despite political risks remaining. Bitcoin has been able to unify the local economy and reduce its dependence on tourism and remittances.

For Bitcoin Magazine audiences, Grupo Murano’s pivot highlights the potential of Bitcoin to transform capital-intensive industries. Murano offers a playbook for businesses seeking resilience to economic volatility by prioritizing development over ownership and leveraging Bitcoin’s appreciation. As Sacal states, “In the end, real estate will be controlled globally by Bitcoin trading,” indicating a shift towards a more stable, decentralized future.

Bitcoin for Corporation is an initiative owned by BTC Inc., the parent company of Bitcoin Magazine. BTC Inc. operates a variety of subsidiaries focused on the digital asset industry and has business relationships with the group Murano.

Source: https://bitcoinmagazine.com/news/grupo-muranos-1b-bitcoin-bet-real-estate