Bitcoin prices hit a record high in July for a row, but two key indicators suggest that the rally is US-led.

The growing differences between US and South Korea’s trading activities raise questions about global participation and market risk.

Coinbase Premium Surge with US Bitcoin ETF inflow

The Coinbase Premium Index, which tracks the price difference between Coinbase (USD) and Binance (USDT), rose sharply during July.

This premium reached 0.08%, indicating strong US purchase pressure.

Coinbase serves US institutional and retail investors. The rise in premiums often reflects an aggressive accumulation by American whales, ETF providers, or businesses.

This coincides with the recent recent influx into US Spot Bitcoin ETFs, which exceeded $14.8 billion, pushing BTC to $123,000, near its all-time high.

These moves confirm that US agencies are leading the current cycle and are supported by favorable regulations and capital access.

The Bitcoin market in Korea is talking about something else

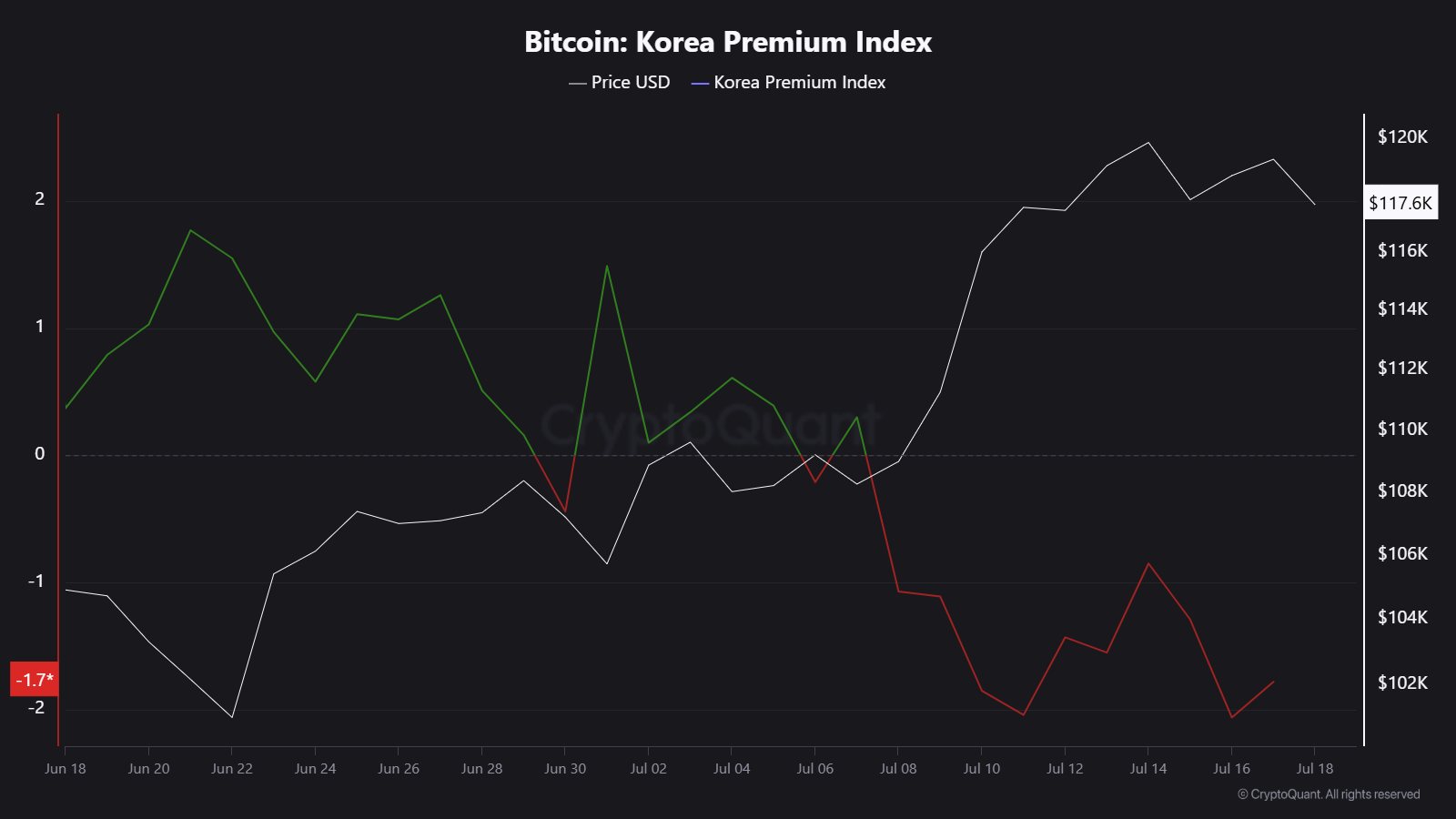

In contrast, the Korean Premium Index, often referred to as “Kimchi Premium,” is below zero.

This index tracks the price difference between Korean exchanges (Upbit, Bithumb, etc.) and Bitcoin on global platforms.

As of mid-July, insurance premiums remained at about -1.7%, with Bitcoin trading being cheaper in South Korea. Negative South Korean premiums suggest that South Korea’s retail demand is weak and few new investors will enter the market.

In previous Bull Run (2017, 2021), South Korea was driven by a speculative retail frenzy, often seeing premiums above +10%. That dynamic is not today.

Why is this divergence important?

The premium index split has revealed that Bitcoin’s current Bull Run is globally unbalanced. It is concentrated in the US and has limited retail enthusiasm from one of Asia’s most active markets.

Historically, widespread retail participation has maintained and expanded bull markets. Without it, the assembly would be too best of the best, and there is a risk that it will depend solely on institutional flow.

This could also affect the momentum of Altcoin, which often relies on Korean exchange liquidity and retail-driven narratives.

Overall, if US demand remains strong, Coinbase Premium should remain positive. However, if South Korea immerses while it remains negative, it could indicate a silence of momentum.

A positive flip around South Korea’s premium could suggest a re-entry for retail and fuel the next leg after Bitcoin rise.

Until then, Bitcoin pricing measures could remain US-centric, led by ETFs, businesses and wealth managers, rather than global retail investors.

Disclaimer

In compliance with Trust Project guidelines, Beincrypto is committed to reporting without bias and transparent. This news article is intended to provide accurate and timely information. However, we recommend that readers independently verify the facts and consult with experts before making decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.