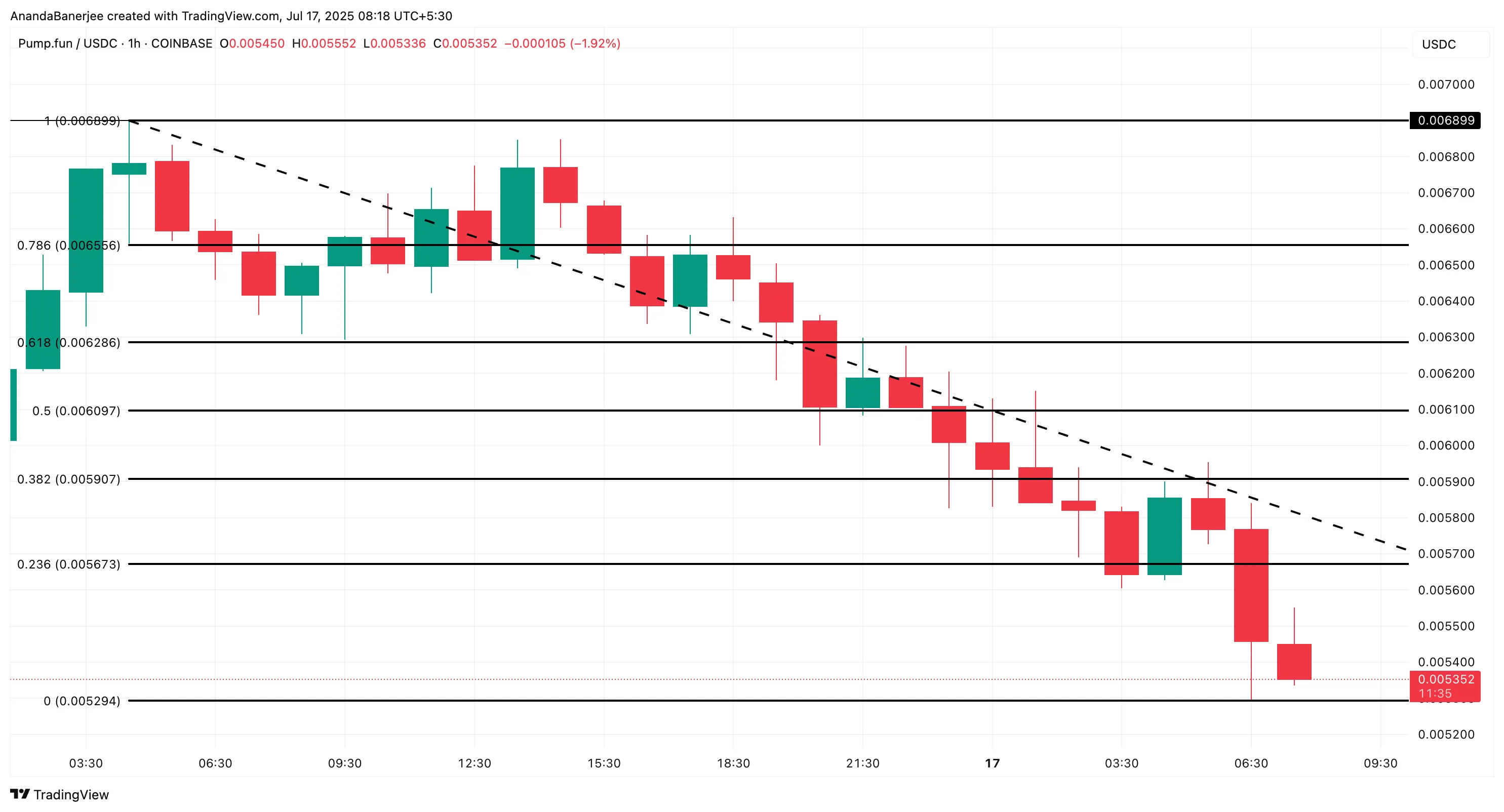

Pump, the native token of Pump.Fun, shows signs of fatigue after a dramatic breakout. The token surged to a local high of $0.006899 on July 16, attracting market attention on Solana’s meme coin wave.

However, within hours, the pump price collapsed to a low of $0.005,294, showing a sharp drop of 23.2%. The sudden revision comes even from large profits from early owners, and the signs suggest even more negative side pressure, unless key levels are recovered.

Smart Money begins dumping as realised profits surge

The latest on-chain data reveals aggressive profit-taking rounds from top holders. PNL data shows that profits of more than $107 million are realized on the top 10 wallets alone, and the leaderboard shows that traders are fully cashing out.

Wallet CXSZ84UI booked $1.79 million, while the other eight people chased more than $1.5 million with realized profits. In particular, over 95% of the top wallets hold 0% of the initial position, informing you of the total exit.

Meanwhile, smart money wallets tagged for high wins have seen a 34.5% decline in holdings and are currently sitting at 3.17 billion tokens, down from over 4.3 billion people that day. The wallet balance of the pump whale also slips by 3.63%, suggesting that it is not just a large player looking. They are actively selling.

This means that pump buybacks aren’t outweighing the pressure of sustained selling. Fees spent on buying back are either cancelled by making profits from whales or even dropping large stakes.

Conversely, the unrealized pump profit leaderboard reveals a dangerous setup. The wallet still holds nearly $10 million in paper profits. For example, the Wallet 9MKY1K8S shows an unrealized profit of $1.38 million, which is held 100%. Or maybe it’s a stagnant reason why pump prices are deeper.

Supertrends are bearish and match the behavior of the whale exit

The Super Trend Indicator is red on the 1 hour chart. This is a sign that the short-term trend has shaking the bearish. This is alongside what we already see from our big wallet holders. After getting on the rally, the whale begins to pull out, and its exit appears to be cutting prices.

When major players stop buying and trend indicators also flip, it is often possible that more downsides will be ahead.

For those unfamiliar, supertrends are indicators of trend following that respond to both price and volatility. When prices fall below a certain range, the line flips from green to red, indicating a shift from bullish to bearish momentum.

Pump prices risk breakdowns below major support

The price chart tells a clearer story. Fibonacci’s retracement level was taken to swinglow at $0.00689 from the local highs at $0.00529. At the time of writing, the pump price is trading at around $0.00535, bringing it dangerously close below the Fibonacci base (0.0 level).

The key level has already been violated. 0.382 retracement at $0.00590 and 0.236 level at $0.236 were not retained as support. If $0.00529 breaks, you run the risk of cascading your sell-off, especially since there are still so many wallets in the realm of unrealized profits.

The bearish paper currently serves as the strongest resistance/support, unless the Bulls can regain the 0.618 Fibonacci level for $0.00628. The clean break above will inform buyer re-entry and may set up a re-test of $0.00689.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.