The US Bureau of Labor Statistics (BLS) released the Consumer Price Index (CPI), indicating that inflation rose in June. Crypto Markets responded in the aftermath amid growing influence of US economic signals on Bitcoin (BTC).

The focus will shift to the waves of Federal Reserve (Fed) speakers on today’s schedule. Their statement is expected to provide a window into policy outlook ahead of the FOMC meeting on July 30th.

Inflation rose to 2.7% in June, US CPI Print Show

According to BLS, inflation rose 2.7% per year in June, exceeding economists’ expectations ahead of data printing.

Prior to CPI Printing, the consensus was hoping that headlines would rise by 0.3% per month (MOM) and accelerate to 2.6% year-on-year (Yoy).

“It’s been five months since I last saw it exceeded my expectations,” analyst Quinten pointed out.

Mark an extension of US CPI inflation reading shows consumer prices rose 2.4% per year.

Therefore, headline CPI inflation continues to increase for the second consecutive timeanalysts hope that the Fed will continue to suspend.

“In just two months, US CPI inflation has risen from 2.3% to 2.7%. Critics denounce tariffs and praisers denounce the basic effect.

Shortly after, Bitcoin prices recorded a modest surge, trading at $117,138 at the time of this writing.

Prior to the price of CPI, the market began relaxing, with Bitcoin sliding from a height of $123,000. BTC slipped into the $116,900 range in time that led to CPI prints.

The otherwise muted response could be attributed to already priced traders and investors of this impact amid last month’s call for and expectations for an increase.

The same sentiment was reflected among Altcoins, with advanced projects flashing red in the cryptography bubble.

Meanwhile, analysts say geopolitical tensions between Israel and Iran may have contributed to US inflation in June. This comes as the perceived impact on crude oil prices after Iran constrained the Strait of Hormuz.

“We expect it to be higher than last month due to oil prices. The big question is whether it’s even higher than expected. Bescent’s recent comments seem to foresee and decorate more numbers.

Experts blame Trump’s tariffs, but will the Fed cut interest rates?

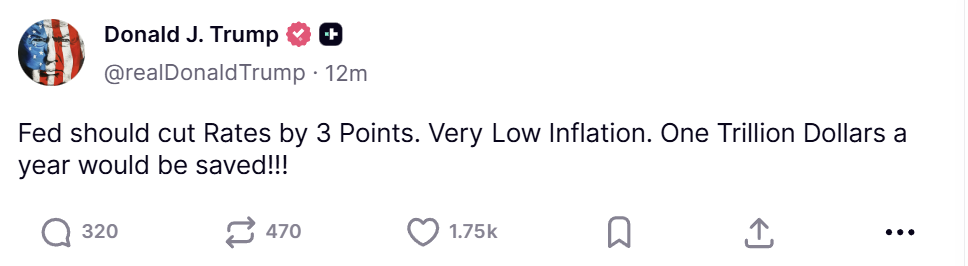

Donald Trump once again used today’s CPI data to urge the Fed to cut interest rates by at least three points. The US president continues to voice rate cuts by calling current inflation rates “very low.”

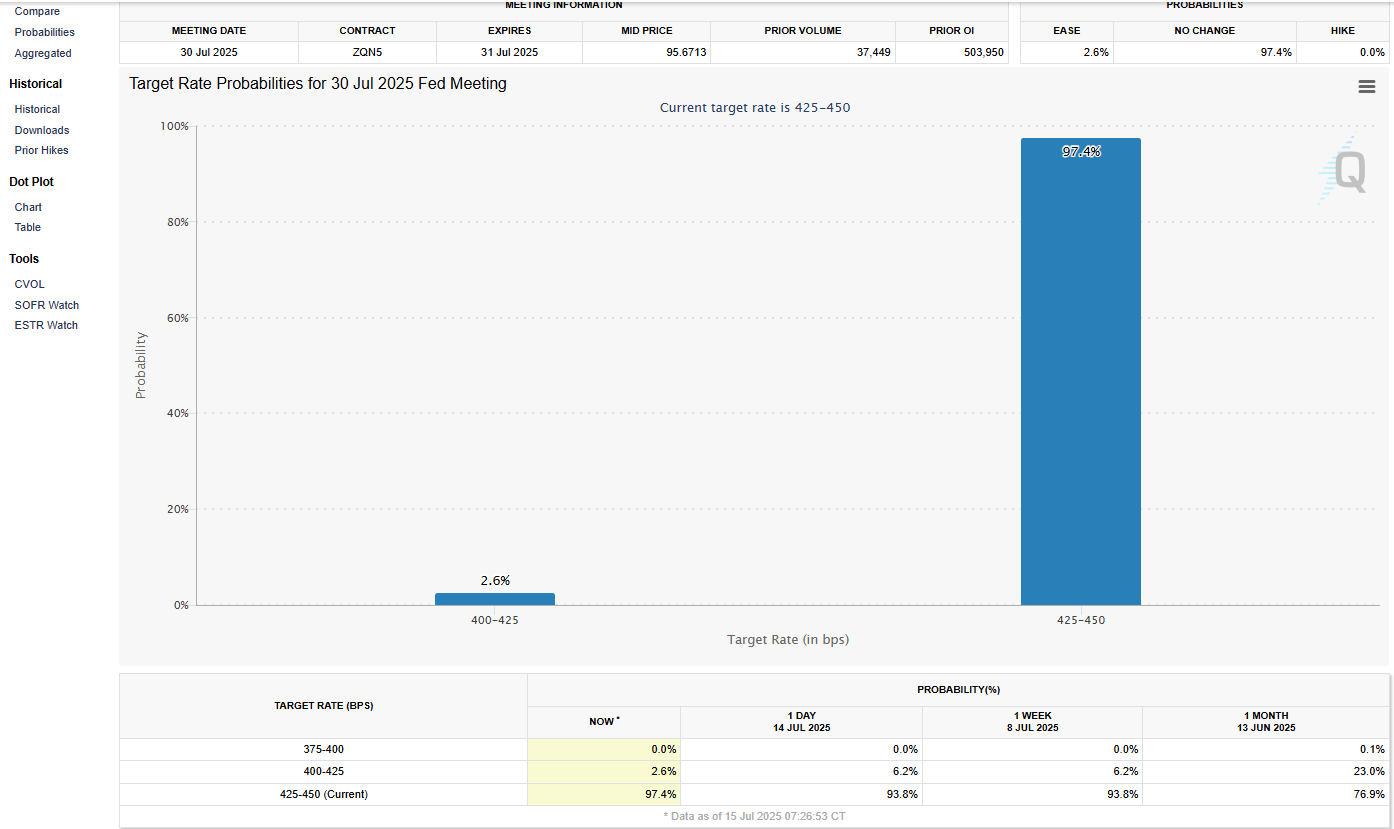

Before the June CPI print, the CME FedWatch tool showed interest bettors predicting that the Fed would not change interest rates between 4.25% and 4.50%.

This has since been changed, and the FEDWATCH tool shows the 97.4% chance that the Fed will still continue to pause interest rates.

The next FOMC meeting is scheduled for more than two weeks on July 30th.

Economists saw it coming and attributed the rise of US inflation to Trump’s trade policy.

Like Fed Chairman Jerome Powell, private sector forecasters expected high inflation over the summer.

“We expect to see some higher readings over the summer,” Powell said at a July 1 meeting.

Companies have run out of options after trying to protect their customers from tariffs for a while. Previously, some people went to the point where they had to replenish their inventory in advance, while others actively absorbed some of the higher costs at the expense of lower margins.

They can no longer do so, and consumers can now take the brunt of the brunt.

“You’re still in an environment where companies use a wide range of strategies to mitigate the impact of their jobs,” Bloomberg reported, citing Gregory Daco, chief economist at Ey-Parthenon.

In hindsight, minutes from the Federal Reserve June policy meeting released last weekhighlights the outlook for rising inflation.

As reported by Beincrypto, authorities have been split on the potential impact of tariffs on US inflation, as well as on monetary policy courses.

Nevertheless, the next CPI print is always the most important thing in the last CPI print, and today’s reading of inflation is no exception.

Disclaimer

In compliance with Trust Project guidelines, Beincrypto is committed to reporting without bias and transparent. This news article is intended to provide accurate and timely information. However, we recommend that readers independently verify the facts and consult with experts before making decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.