HBAR has recently experienced a significant upward momentum, rising 27% over the past 24 hours to a four-month high.

This surge has brought Altcoin’s market capitalization to $10.74 billion, surpassing Bitcoin’s cash, attracting investors’ attention. The rally shows strong demand, but raises concerns about potential profits.

HBAR inflow signal risk

The Chaikin Money Flow (CMF) indicator shows a rapid influx into HBAR, indicating positive market sentiment. However, when CMF approaches the 0.20 threshold, it suggests that Altcoin may be approaching the terms of the acquisition. This could lead to a price reversal if the HBAR rally is cooled and the pullback is triggered.

As HBAR rises further, investors’ attention becomes more relevant. It is often corrected as the market approaches an overheated level, increasing the likelihood of a price drop. If the CMF exceeds the 0.20 mark, you can make sure the rally is running the course and get profitable and reduce in the short term.

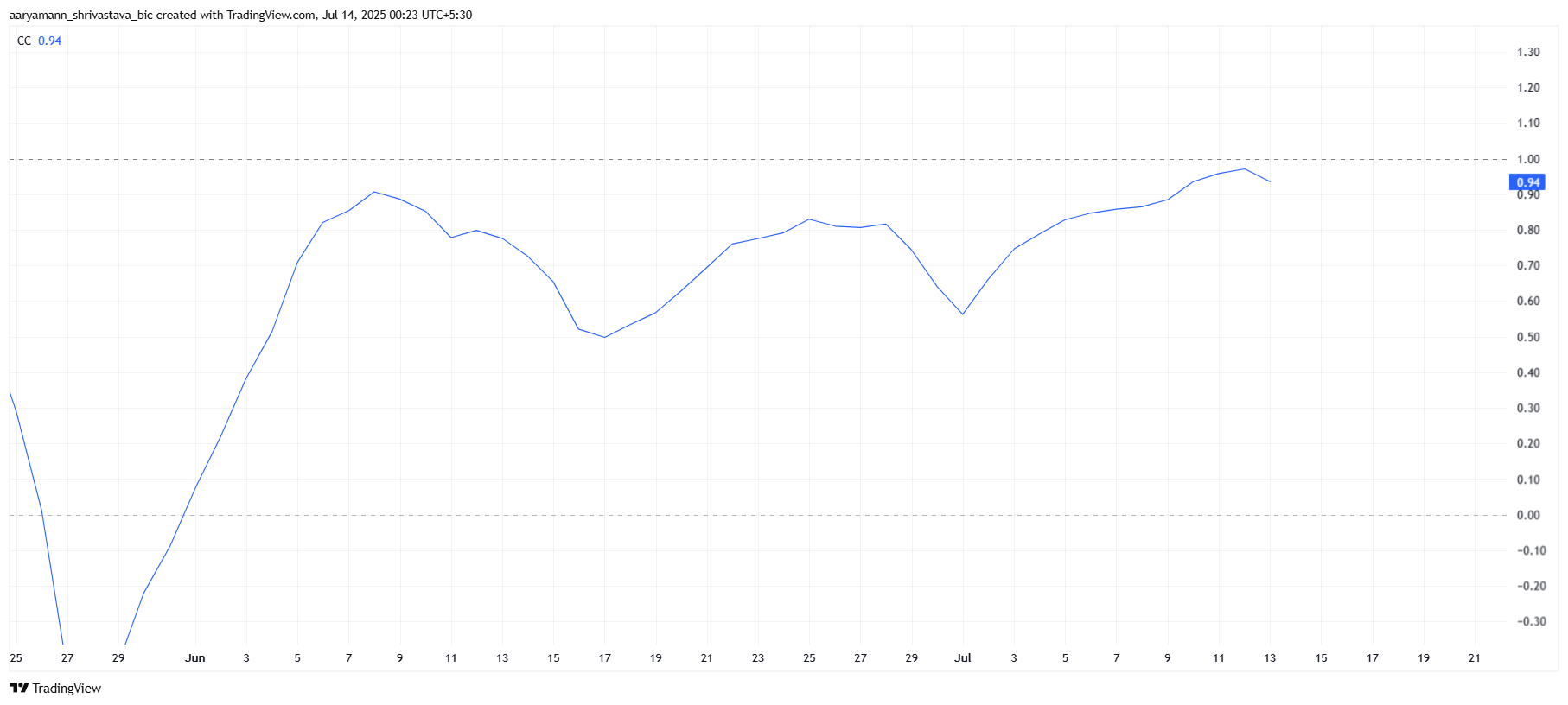

The correlation between HBAR and Bitcoin sitting at a strong 0.94 supports the idea that HBAR can avoid sharp corrections. Bitcoin is approaching $120,000, approaching the new all-time high (ATH). As Bitcoin strengthens, it lifts other cryptocurrencies, including HBAR, to share market sentiment and investor behavior.

This correlation protects HBAR from potential price drops despite the terms of the acquisition. The rise of Bitcoin will help to maintain HBAR’s current momentum and will encourage continued interest and investment in Altcoin.

Can HBAR prices continue to rise?

At the time of writing, HBAR is trading at $0.250 for $0.250. A 27% rise over the last 24 hours has pushed HBAR to four months’ heights, and AltCoin is poised to continue on an upward trajectory if it can break this resistance level.

To maintain the current bullish momentum, HBAR needs to secure a level of $0.250 in support. This confirms the recent price action and gives AltCoin a pass that reaches $0.267. Bitcoin’s continued strength could play a key role in pushing HBAR beyond this critical level.

However, if your HBAR fails to violate $0.250 or experience a serious sale, Altcoin could return to $0.220, which could be even lower, potentially at $0.188. This invalidates bullish papers, suggesting a reversal of Altcoin’s recent surge.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.