Bitcoin (BTC) prices are ready for the next all-time high (ATH). This is a show of strength that has encouraged the Bloomberg Terminal, a staple food to coordinate its professional services.

The appeal of crypto, Bitcoin in particular, continues to grow, with institutional investors just like retail.

The optics at the facility will change, but is hyper-bitcoin next?

The Bloomberg Terminal has adjusted its scale and is now showing millions of Bitcoin. As of Thursday, one Bitcoin was quoted at 0.112 million or $112,000.

Bloomberg Terminal is a premium financial software platform that provides professionals with real-time market data, analytics software and trading capabilities.

Adjustments to the Bloomberg display represent more than a decision on the user interface (UI). This reflects a world that adapts to Bitcoin’s role as a valuable macro asset.

It also shows a subtle and powerful signal to change financial optics around the world’s largest digital assets.

Analysts say it could strengthen BTC’s “cheap” or speculative anymore, marking a turning point in mainstream perception. Rather, it is a rare and valuable digital property.

“The Bloomberg Terminal displays BTC to millions. This is more than just a UI update. It’s a change of mindset. Traditional finance is finally embracing what we know for a long time. The future of money is digital, and Bitcoin has led the way.”

This interface change coincides with Bitcoin climbing and a new all-time high of $112,000 to $118,000 within a 24-hour window.

At the time of this writing, Bitcoin has grown nearly 7% in the last 24 hours, trading at $118,535. At Bloomberg Terminal, this means about 0.118 million per BTC.

The move triggered up to $1.25 billion in record liquidation, sparking speculation that the current cycle could enter the hyperbolic phase.

Meanwhile, this priced gathering comes amid a surge in chain activity and a renewed interest in institutions. I recall some of the boldest predictions ever for where Bitcoin prices could be heading next.

Bold Bitcoin forecasts will be stacked after 2025

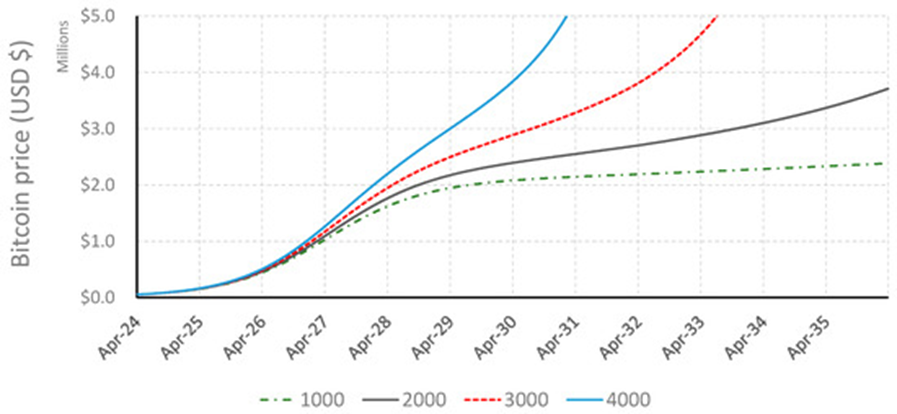

Academic research published by MDPI earlier this year suggested that Bitcoin could reach $1 million by early 2027 and $5 million by 2031.

However, this depends on how quickly the coin is withdrawn from the liquid supply. This model predicts the transition from adoption-driven growth to supply-driven hyperbolic price action.

“At the highest level of withdrawal, the price could reach 2m by the second half of 2027,” read the excerpt from the paper.

This study adds to the mountain of market sentiment that favors offensive benefits. Max Keizer had repeated many years of calls for $220,000 by the end of 2025.

Meanwhile, Standard Chartered expects BTC to reach $135,000 in the third quarter (Q3) and reach $200,000 by the fourth quarter.

“My official Bitcoin forecast is the second quarter of $120,000, ending $200,000, ending 2025 and ending $500,000 for 2028.

Elsewhere, Bitmex co-founder and former CEO Arthur Hayes is even more bullish, predicting $250,000 by 2025.

However, as reported by Beincrypto, Haye’s target goals are conditioned on the Federal Reserve (Fed).

“If my analysis of the interactions between the Fed, Treasury and the banking system is correct, Bitcoin reached its local low of $76,500 last month. This time it will start to rise to $250,000 per year end,” read the excerpt from his blog.

Analysts and economists are increasingly debating quantitative easing scenarios as balloons for US debt levels.

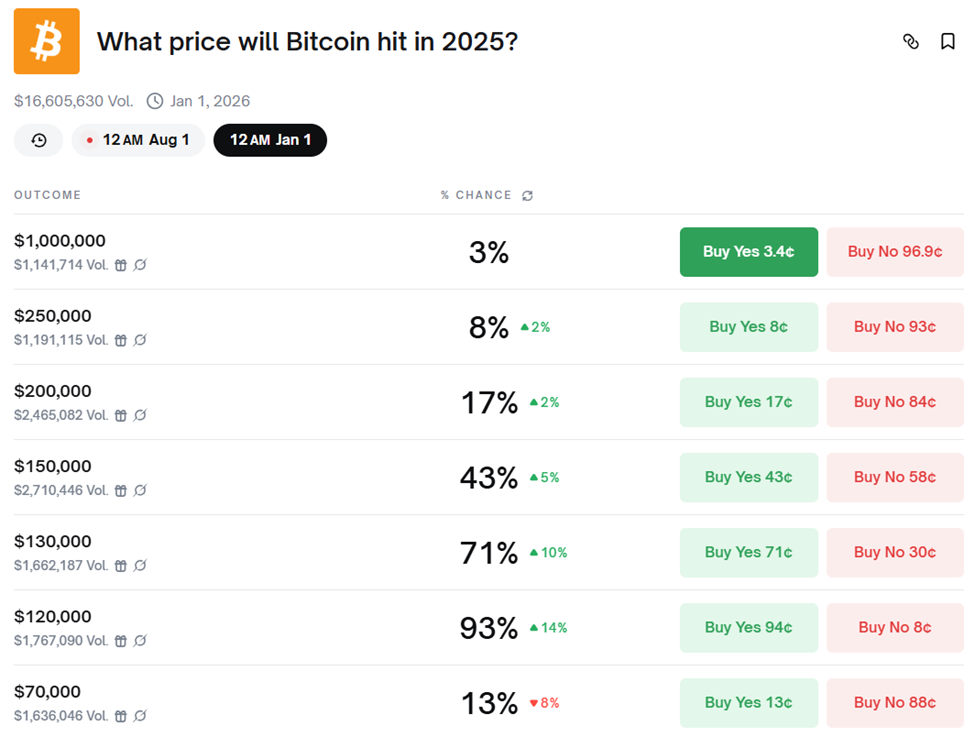

Meanwhile, the retail forecast market is also aligned, with polymer bettors currently being seen as the most likely result of 2025 at $120,000.

This suggests that there is room for the rally to run, but resistance can be close.

Does on-chain activity show healthy growth?

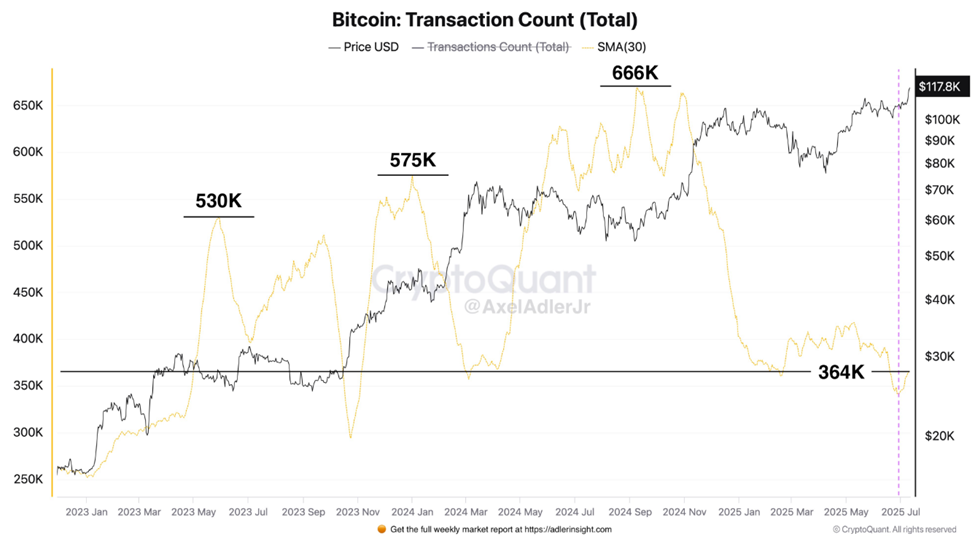

Network activity is also green. Bitcoin’s average daily trading has skyrocketed from 340,000 to 364,000 over the past two days, representing a 24,000 or 7% jump.

The rise is still below the 2023-2024 peak range (530,000-666,000), but shows an increase in engagement, according to Axel Adler, an on-chain analyst at Cryptoquant.

According to Adler, this points to the owners not actively selling to gatherings to book profits. This, he says, will enhance technical and basic support for higher prices.

“Essentially, holders are responding gently to current growth and there are no indications of aggressive coins sold in the market. This will enhance both basic and technical bullish signals,” analysts on the chain wrote.

The current price remains shy at $120,000, but the conversation has already turned to a seven-figure rating.

Bloomberg Display may feel cosmetic, but in the cycle where the story moves through the marketInstitutional hands are also involvedit could now be the psychological bridge necessary to normalize what sounds like a hopium.

The Bloomberg post shows millions of bitcoins as price forecasts were $1 million++ first appeared on beincrypto.