Despite Bitcoin (BTC), which has shown strengths during US sessions, traders and investors should expect some volatility early in the European session on Friday amid expectations for the expiration date of the options.

However, the impact may be short-lived given the market will quickly adapt to the new trading environment.

What Traders Should Know About Today’s Options Expiry Date

Deribit data shows that over $5.03 billion in Bitcoin and Ethereum (ETH) options have expired today. For Bitcoin, the expected expiry option is $4.3 billion, with a full 36,970 yen.

With a Put-to-Call ratio of 1.06, the maximum pain level for today’s expired Bitcoin options is $108,000.

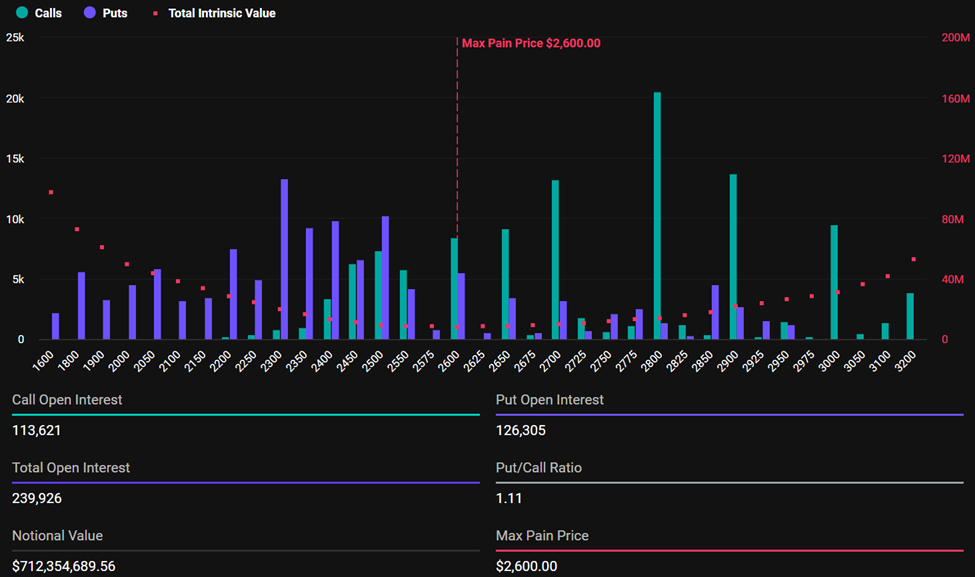

For their Ethereum counterparts, the expected value for today’s expired ETH options is $712.35 million, with a total interest of 239,926.

Like Bitcoin, today’s expired Ethereum options have a put-to-call ratio of more than 1. At the time of writing there is delivery data indicating 1.11. On the other hand, the maximum pain level, or strike price, is $2,600.

In particular, today’s expired Bitcoin and Ethereum options are significantly higher than last week. On July 4, Beincrypto reported an expired option of approximately $3.6 billion, highlighting the 27,384 BTC and 237,274 ETH contracts, with concept values of $2,980 million and $610 million, respectively.

However, the main similarity between the options that expired this week and the options seen last week is that they both display put-to-call ratios (PCRs) above 1.

PCRs above 1 indicate that more put (sell) options are traded than call (purchase) options, suggesting bearish market sentiment.

A 1.06 Bitcoin PCR and a 1.11 Ethereum PCR suggest a balanced bet for traders between sales and purchase orders. This balanced outlook is because investors speculate whether the market will decline in the event of a sale or hedge the portfolio.

Highly leveraged trading activities – extreme risk taking

Beware of the analysts at Greeks.Live. Most activities focus on news events rather than price analysis. However, they also highlight high-leverage trading activities and extreme risk-taking.

“Traders discussing a 500x leverage position that appears to be a ‘suicide’ from the current market level. Despite the extreme risks described as interested, new positions are open.

In particular, a 500x high leverage transaction amplifies both profits and losses. Meanwhile, Bitcoin and Ethereum were well above their respective maximum pain levels.

At the time of this writing, Bitcoin was on sale for $116,823 after establishing a new all-time high (ATH). Meanwhile, Ethereum was trading at $2,970 after a nearly 7% rise in the last 24 hours.

The biggest problem is the key metrics in crypto options trading. This represents price levels where most option contracts are worthless and expired. This scenario will inflict the greatest financial loss or “pain” to the traders who hold these options.

The concept is important as it often affects market behavior. According to the maximum pain theory, the price of an asset tends to be drawn to this level as an option close to its expiration date.

As an option close to 8:00 UTC on Delibit, Bitcoin and Ethereum prices could drop towards these levels. However, this does not necessarily mean it will fall to $108,000 for BTC and $2,600 for ETH.

The market usually stabilizes immediately after the trader adapts to the new price environment. Today’s massive expiration dates allow traders and investors to expect similar results, which could impact market trends over the weekend.

The $5 billion Bitcoin and Ethereum options are expired today. What traders should expect was first to appear in beincrypto.